Alabama Unemployment Benefits and. There are three specific requirements mandated by the Indiana unemployment department that impact whether or not you qualify for unemployment.

Filing An Unemployment Claim In Pennsylvania What To Do What You Need To Know Pennsylvania Capital Star

Applicants must meet the following three eligibility requirements in order to collect unemployment benefits in Pennsylvania.

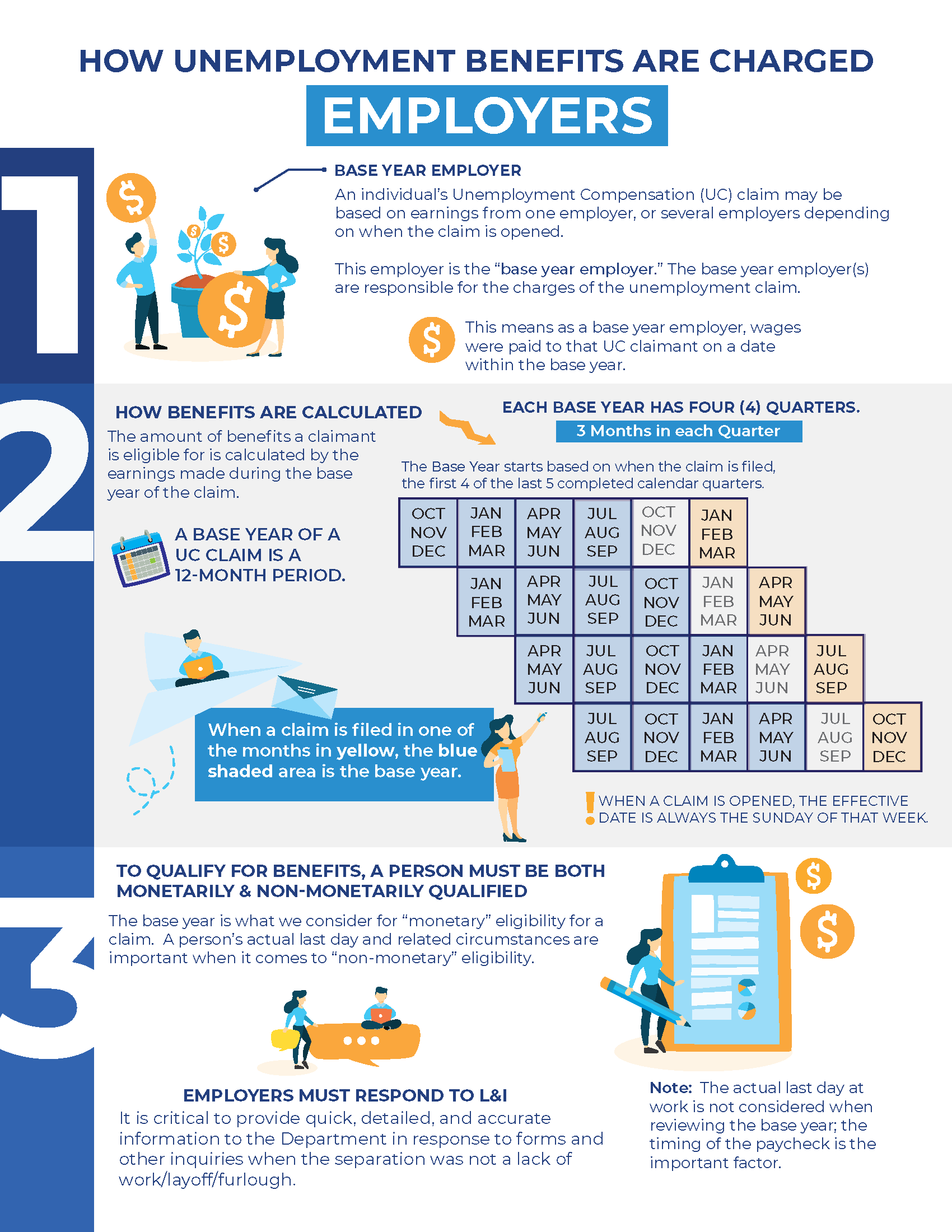

Pa unemployment qualifications. If you are laid off file the claim and let the unemployment agency decide. The qualifying formula for wages and employment used by Pennsylvania is 16 credit weeks and at least 20 BPW Base period wage out of HQ High quarter. Unemployment insurance or UI is a state-federal program designed to provide temporary income support for individuals who lose their job through no fault of their own.

Individuals who quit or leave due to a strike are usually ineligible for State compensation. You must have sufficient qualifying wages and a minimum of 18 credit weeks in your base year. In order to qualify for unemployment benefits you must be ready willing available and able to work.

A person must have lost employment involuntarily in order to be considered unemployed. Amount of Time Worked. If you are receiving benefits when an.

Typically unemployed workers can qualify for up to 26 weeks. Unemployment insurance benefits vary by state. Your past earnings must meet certain minimum thresholds.

The PA Department of Labor said Friday that unemployment numbers for February remained unchanged at 47 but they could not say how many Pennsylvanians filed for assistance since the COVID-19. Among them are the following. To qualify for unemployment benefits in Indiana you must meet several qualifications before being granted unemployment payments.

Credit weeks are seven-day periods when workers receive at least 50 in earned income. Following your application for benefits there are. You are able to work.

However the CARES Act also created the Pandemic Emergency Unemployment Compensation PEUC program to provide an extra 13 weeks of. Be a resident of Pennsylvania. Qualifications for unemployment benefits in Pennsylvania are set by the state Department of Labor and Industry.

You must have a qualifying separation. Weekly benefit amount ranges from 5 and 900 per week depending on your state income history and any additional income you have currently. Once you meet all the requirements and are determined eligible they use their own formula to decide how much per week you will collect.

The Department of Labor Industry will continue to provide important employment benefit updates as the situation evolves. Your eligibility is based on the information provided by you and your employer s after you file an application for UC benefits. Unemployment Eligibility Work Requirements.

Have worked and earned income in Pennsylvania. The Pennsylvania UC Law establishes various requirements for eligibility for UC benefits. You must not be disabled.

To make sure you qualify for benefits check out PA unemployment eligibility section. Other states may have slightly different necessities. Review the work requirements for initial and continued eligibility.

Harrisburg PA-Changes to unemployment compensation requirements have taken effect in Pennsylvania. You and your employer will be given an opportunity to provide information with regard to any eligibility issues that arise on your application for UC benefits. Any unemployed person may file a claim for UC benefits.

If you are not a resident of Pennsylvania but worked in Pennsylvania at your last job you should still have Pennsylvania unemployment eligibility. This is known as financial eligibility You will receive a Notice of Financial Determination Form UC-44F from the department that will state whether you are financially eligible and if you are the amount of benefits you may receive. PA residents who have become unemployed through no fault of their own must meet unemployment insurance eligibility requirements in order to.

The Pennsylvania Department of Labor and Industry assesses your application for eligibility. 1 Has within his base year been paid wages for employment as required by section 404c of this act. Exceptions to this rule are.

You must have enough wages and weeks of work in your employment history to qualify for UC. PA Unemployment Compensation Eligibility. The term Pandemic Unemployment Assistance PUA refers to a program that temporarily expanded unemployment insurance UI eligibility to people who wouldnt otherwise qualify.

Select your state to learn more about your eligibility the application process and how to submit your claim. In Pennsylvania the Department of Labor Industry handles unemployment benefits and determines eligibility on a case-by-case basis. You must be able to work.

INFORMATION FOR PENNSYLVANIA EMPLOYEES IMPACTED BY COVID-19. Section 801 - Qualifications Required to Secure Compensation Compensation shall be payable to any employe who is or becomes unemployed and who-- a Satisfies both of the following requirements. UI benefits are overseen by.

Pennsylvania employees must accrue at least 16 benefit weeks to receive unemployment compensation. Many people receive between 200 and 400 a week. In Pennsylvania you must have been employed for at least 16 weeks in the base year in order to get 16 weeks of joblessness.

This information may be gathered during a telephone interview or by a specially designed form to address the issue under review. In order to establish unemployment eligibility in Pennsylvania you have to. You must be unemployed through no fault of your.

If you are employed in Pennsylvania and are unable to work because of Coronavirus disease you may be eligible for Unemployment or Workers Compensation benefits. All unemployed workers are required to meet designated requirements in order to receive benefits. These credit weeks do not have to be consecutive but they must all occur within the state-designated base year.

Unemployment compensation UC is money paid to workers who have lost their jobs through no fault of their own. Starting this week all claimants for Unemployment Compensation UC Pandemic Emergency Unemployment Compensation PEUC and Pandemic Unemployment Assistance PUA apply for two jobs each week and search for one to continue their eligibility. This included self.

If you worked 18 weeks you can get 26 weeks of UC benefits. Most states pay unemployment benefits for a maximum of 26 weeks.

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania How Unemployment Payments Are Considered

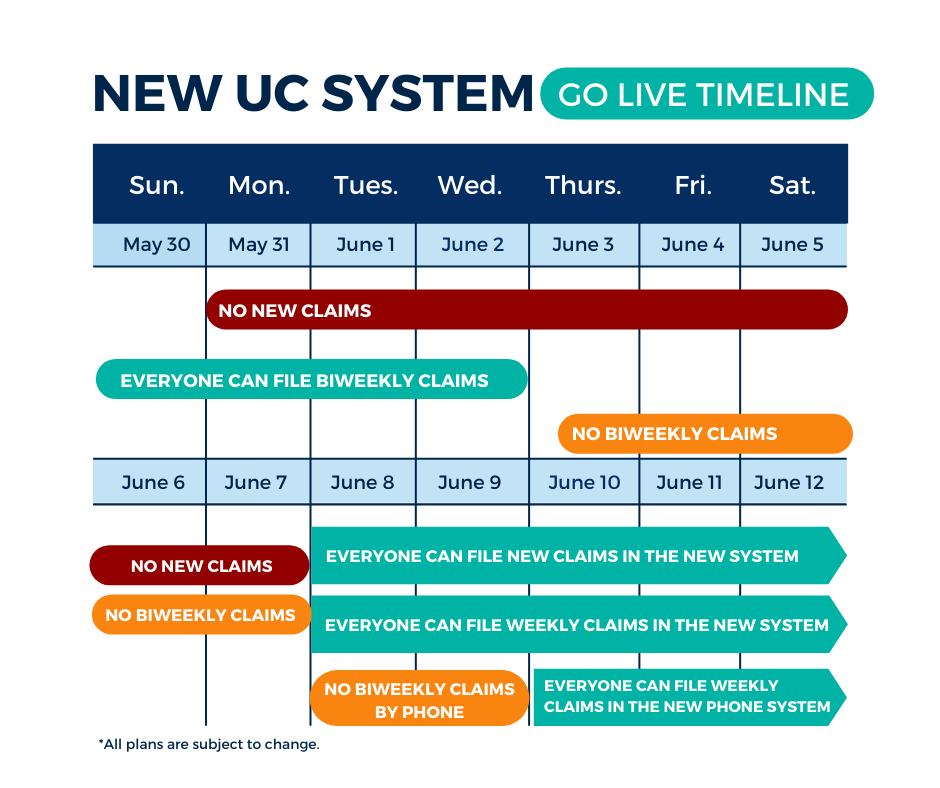

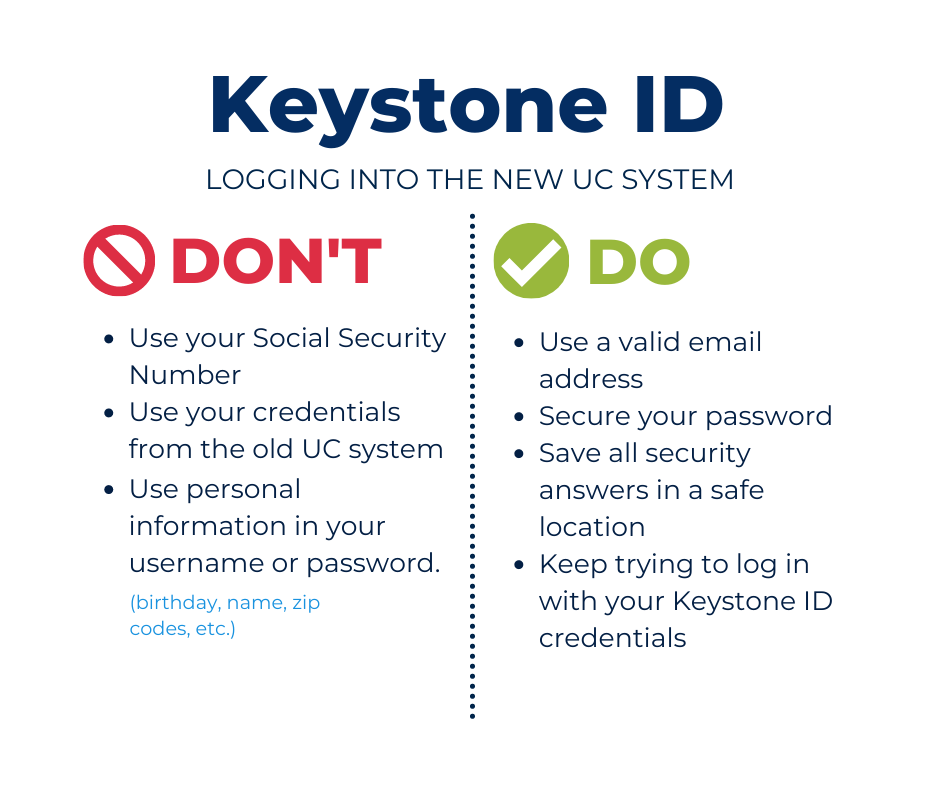

Offline Transition Information

Pa Unemployment Eligibility Swartz Swidler Employment Lawyers

Pennsylvania How Unemployment Payments Are Considered

Pa Officials Cause Confusion Over Unemployment Benefits Refusing To Return To Work Abc27

Extra 300 In Unemployment Payment Will Begin In Pa Connect Fm Local News Radio Dubois Pa

Unemployed Pennsylvanians Will Get An Extra 300 A Week

How To File An Unemployment Claim In Pa During The Coronavirus Outbreak Youtube

No comments:

Post a Comment