If you were employed for at least 20 weeks during the first four of the last five calendar quarters. An executive order issued by Governor DeWine expands flexibility for Ohioans to receive unemployment benefits during Ohios emergency declaration period.

Benefit Changes Redeterminations Requirements Affected By Coronavirus The Center For Community Solutions

For that former Ohio Attorney General Marc Dann weighed in.

Ohio unemployment if you have covid. If they were employed for at least 20 weeks during the first four of the last five calendar quarters. In Ohio 111055 unemployment claims were filed between March 15-18 2020. That VC is recorded and can be accessed on demand for a county to review.

Find COVID-19 Vaccine Locations With Vaccinesgov. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. The coronavirus COVID-19 state of emergency has created uncertainty regarding unemployment loss of benefits and other assistance programs.

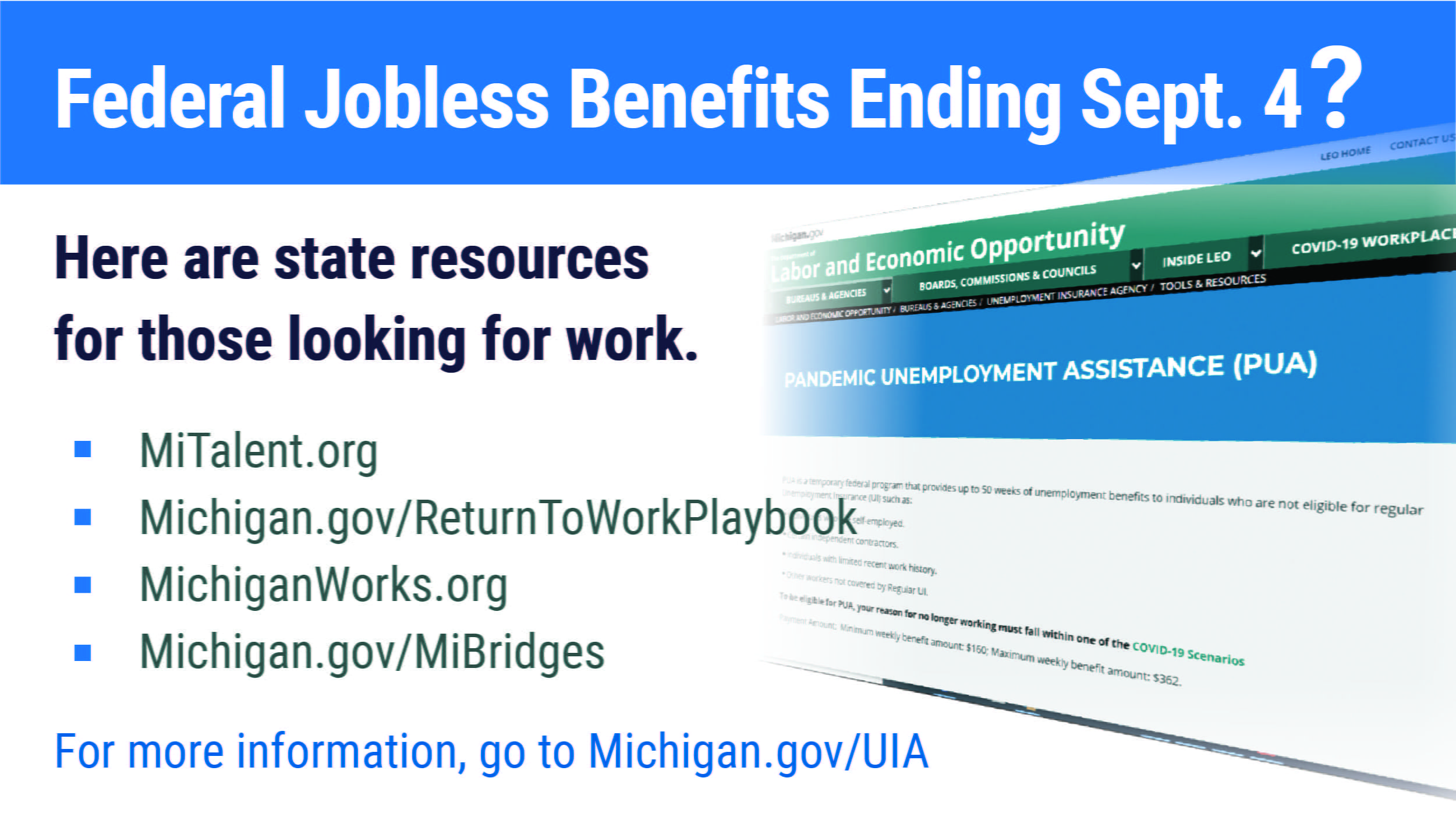

If you earned an average weekly wage of at least 280 during that time you were employed. You have been advised by. COVID-19 extended unemployment benefits from the federal government have ended.

COVID-19 Unemployment Benefits. It is always more difficult to get unemployment benefits when you quit your job and that is not likely to change due to COVID-19. If you have trouble accessing the recorded VC please reach out to TANF-FSTAjfsohiogov.

If you have 1 to 2 dependents and have weekly wages of over 1074 the maximum benefit amount you may earn is 537. New PUA applications will continue to be accepted through Wednesday October 6 2021 but only for weeks of unemployment prior to September 4. Your employees may be eligible for unemployment benefits only if they are partially or totally unemployed due to no fault of their own.

Employers and employees in every field are implementing new and innovative ways to operate under the threat of COVID-19. But you may still qualify for unemployment benefits from your state. Ohioans who are unemployed as a result of the COVID-19 pandemic but dont qualify for regular unemployment benefits can apply for Pandemic Unemployment Assistance PUA a new program that covers additional categories of workers and is authorized by the federal Coronavirus Aid Relief and Economic Security CARES Act.

So we can verify that no in Ohio you cannot get unemployment if you quit or were fired for not getting a COVID-19 vaccine and your employer required it as part of company policy. Record numbers of Americans have filed for unemployment benefits since the pandemic began. Vaccinesgov makes it easy.

Ohio Department of Job and Family Services. If you do not have any dependents and have weekly wages of over 886 during the base period the maximum you can earn is 443. Generally communicable diseases like COVID -19 are not workers compensation claims beca use people are exposed in a variety of ways and few jobs have a hazard or risk of getting the diseases in a greater degree or a different manner than the general public.

The coronavirus pandemic and unprecedented public health measures implemented in most states have had a massive impact on the United States economy. Covid-19 infections are ballooning and sick Americans who miss work due to the virus may wonder if they qualify for unemployment benefits. I am on a paid andor approved leave of absence from my job.

Youll also find ways to weather the storm of unemployment and the business disruptions that coronavirus disease brings. If they earned an average weekly wage of at least 280 during the time they were employed. It depends on how you contract it and the nature of your occupation.

However under Department of Labor guidelines you may still qualify if. And if you are able available and actively seeking work. How Have Unemployment Benefits Changed.

Not in most states because if youre dismissed for refusing the COVID vaccine that would be considered being fired. I was fired and it was my fault. If you are unemployed you will likely want to know what.

Due to the Federal American Rescue Plan Act of 2021 signed into law on March 11 2021 the IRS is allowing certain taxpayers to deduct. Here we explain what public health orders mean for you the way you do your work and your future. Individuals in this situation must call the PUA Call Center at 1-833-604-0774 for assistance.

Unemployment benefits will be available for eligible individuals who are requested by a medical professional local health authority or employer to be isolated or quarantined as a consequence of COVID-19. Contact your states unemployment insurance program for the most up-to-date information. I am still working.

And if they are able available and actively seeking work. You may be eligible for unemployment benefits only if you are partially or totally unemployed due to no fault of your own. Out an additional notification later today.

Here are some resources and information that could be beneficial for family members direct support professionals DSPs and agency providers. 168 funds be appropriated for regional economic. Heres the maximum unemployment benefits amount you can earn in Ohio.

There were more than 1. If you are considering quitting your job because you are fearful of contracting COVID-19 you will probably not be eligible for unemployment benefits. If youre fired for cause then youre not entitled to unemployment.

Do any of these statements apply to you. You or a family member have been infected by COVID-19 and cannot work. Can you collect unemployment if youre fired for refusing the COVID-19 vaccine.

Our teams have discussed in our monthly video conference VC. You may also be eligible to collect unemployment benefits if you fall into one of these categories. Eligibility Were you laid off.

The Coronavirus Aid Relief and Economic Security Act that was signed into law March 27 contains three unemployment insurance stimulus programs directed towards individuals who find themselves partially or totally unemployed due to COVID-19. I am on strike from my employer. Ohio like all other states is facing an unprecedented rise in unemployment claims as a result of the COVID-19 pandemic.