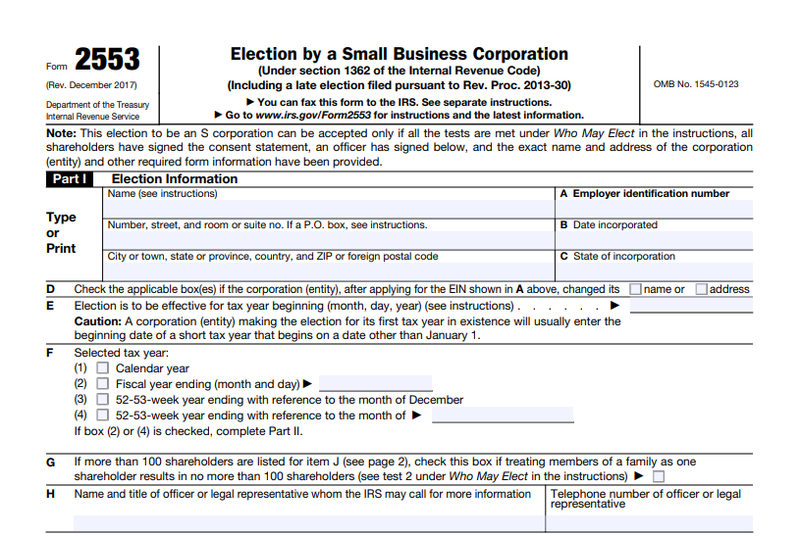

S-Corp Shareholders and Unemployment Insurance. The way that unemployment benefits work is that you need to be unemployed and fulfill some requirements to receive weekly payments.

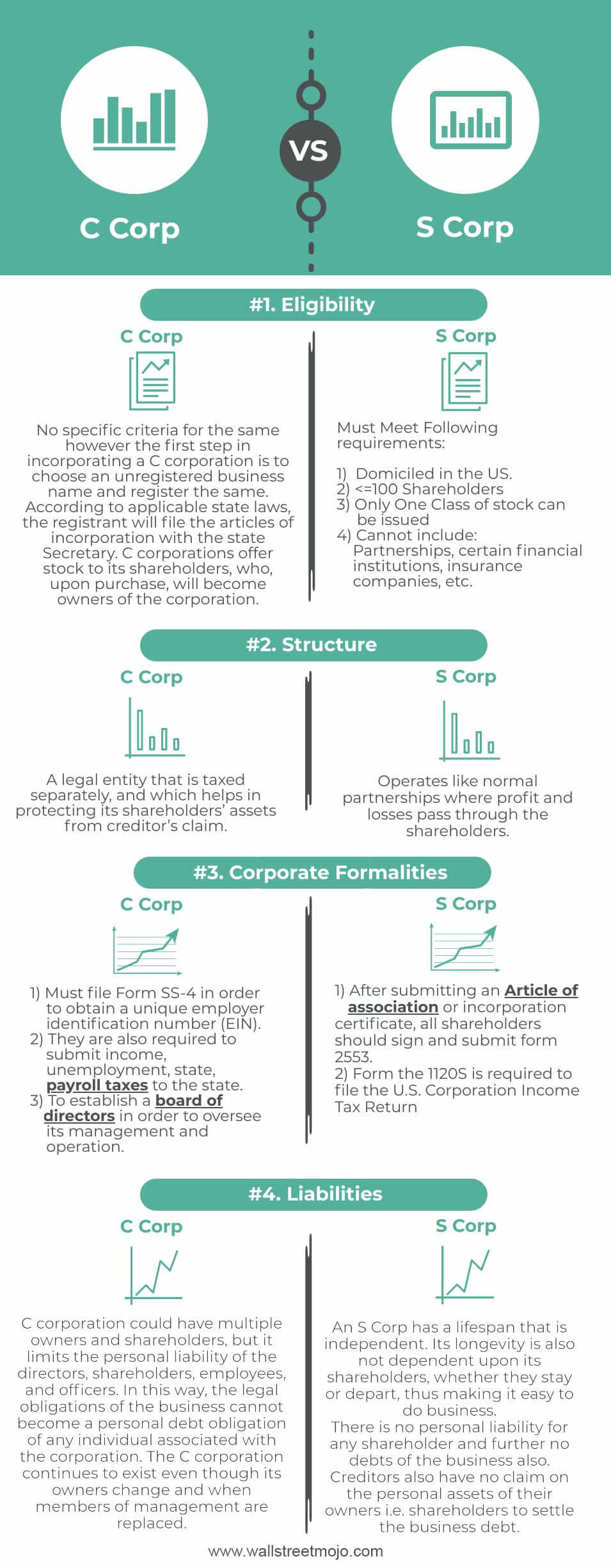

C Corporation Vs S Corporation Top 4 Differences Infographics

No as a current officer of a S-Corp cannot by virtue of the role as an officer in an S-Corp be considered unemployed.

Can an s corp officer collect unemployment. I own an S-Corp 5050 with my partner. Tax ETT unless your corporation is not subject to the Federal Unemployment Tax Act FUTA. Section 621a of the Unemployment Insurance Code provides that an employee includes any officer of a corporation.

Many corporation officers find it surprising that even though they are owners of a company they still may be subject to paying unemployment insurance UI premiums and taxes on the wages that they paid to themselves. The Corporation chooses to pay me as an Employee. As a self-employed individual you will not be eligible for traditional state unemployment insurance UI unless you paid yourself W-2 wages.

Unemployment benefits for corporate officers. How can I apply for unemployment benefits if I am an S Corp owner but Im not sure if my corporation paid unemployment tax. If you are an officer of a corporation or you own more than a 5 percent equitable or debt interest in the corporation and your unemployment claim is based on wages with the corporation you will not be considered unemployed during your term of office or ownership.

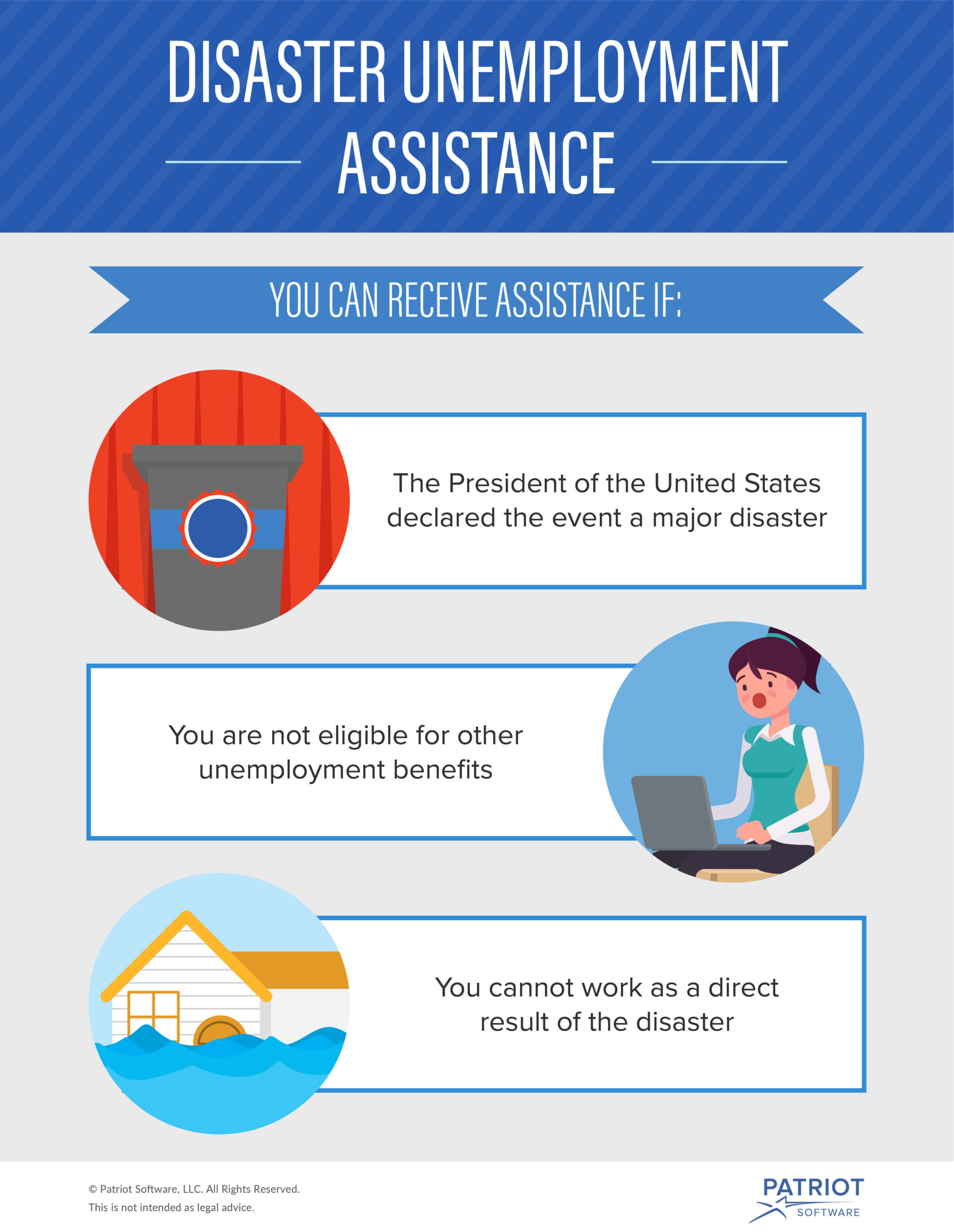

Total and Partial Unemployment TPU 110 Corporate or Union Officer A. There are possibly similar options if you work as an independent contractor and have lost your sole source of income as well. Starting the first quarter of 2014 corporate officers of for-profit corporations earning wages in Washington state are exempt from unemployment-insurance coverage unless the corporations voluntarily choose to insure its corporate officers and the Employment Security Department approves the request.

Under Section 402h of PAs unemployment Code if you are self-employed then then you are are ineligible for benefits. 100 owner-shareholders of an S-Corporation who do not take a salary LLC members who report self-employment income and. Yes S Corporation owners are eligible for unemployment insurance however depending on some crucial factors.

Courts have consistently held S corporation officersshareholders who provide more than minor services to their corporation and receive or are entitled to receive compensation are subject to federal employment taxes. To collect unemployment you will have to prove to the state that the S corporation is no longer viable and you are conducting a job search. The fact that an officer is also a shareholder does not change this requirement.

Unemployment Eligibility Since an S corporation officer is an employee as long as the officer meets the states requirements for unemployment benefits including earning sufficient wages and time serving at the position the officer should be able to qualify for unemployment compensation. Officer employees of corporations in Florida are required to pay unemployment tax on their compensation. Can you collect unemployment if you are an officer of a corporation in PA.

We pay a FUTA employer tax and are incorporatedbased in NYC. Such payments to the corporate officer are treated as wages. Information for corporate officers business owners.

Since an S corporation officer is an employee as long as the officer meets the states requirements for unemployment benefits including earning sufficient wages and time serving at the position the officer should be able to qualify for unemployment compensation. We are a production company and due to the covid-19 pandemic our business has. If you are an officer of a corporation or you own more than a 5 percent equitable or debt interest in the corporation and your unemployment claim is based on wages with the corporation you will not be considered unemployed during your term of office or ownershipYour claim will not be valid and you will not receive benefits.

As employee of my Calif S-Corp - I AM required as anyone else to pay into unemployment benefits when I received payment as employee. This is true for shareholders of an S corporation in particular as they are. This is a helpful service that supports people to afford food medicine and other basic needs while they are looking for a new job.

We are officers and the sole 2 employees of the company. Can an S Corp Owner Collect Unemployment. As the owner of a C-Corp or S-Corp that employees W-2 workers in the United States you have the option to file for unemployment if you have closed your business and are no longer receiving any form of compensation.

Yes we can still collect unemployment after starting S-Corp if we give ourselves a W-2 wage. However they have not been available to those individuals who are self-employed and do not collect a traditional paycheck. Can an officer of a corporation collect unemployment in Florida.

Exceptions At certain times the federal government allows entrepreneurs to collect unemployment while building their businesses. Section 622 of the Unemployment Insurance Code hereafter Code provides that an individual performing services in his or her capacity as a director of. Do I choose to pay myself.

Unemployment Eligibility Since an S corporation officer is an employee as long as the officer meets the states requirements for unemployment benefits including earning sufficient wages and time serving at the position the officer should be able to qualify for unemployment compensation. An individual who through ownership in stock and his position in the corporation exercises a substantial degree of control over its operation is considered a self-employed business person. Spouse If electing to be excluded must be both a corporate officer and shareholder IMPORTANT - PLEASE NOTE CAREFULLY The corporation must report your wages and pay contributions for Unemployment Insurance UI and Employment Training.

Unemployment insurance benefits have been a safety net for many individuals facing the loss of their job. Connect with me on Linkedin Aachri Tyagi to ask more questions. The IRS has officially stated that shareholders who work for S corporations even if the shareholder is the only owner or worker are considered employees for purposes of the Federal Unemployment Tax Act.

However I cannot find anything on the states website stating whether an officer employee is entitled to unemployment compensation when the business must temporarily lay them off for lack of work and revenue.

A Beginner S Guide To S Corp Health Insurance The Blueprint

Common Fringe Benefits Rules For 2 S Corp Shareholders And Changes Under The Cares Act

Can An S Corp Owner Collect Unemployment Quora

S Corp Vs Llc Everything You Need To Know The Blueprint

Can Llc Owners Collect Unemployment Benefits Inc Authority

Can An S Corp Owner Collect Unemployment Quora

S Corporation Shareholders And Taxes Nolo

Self Employed Unemployment Insurance Can Business Owners File

Can An Officer Of An S Corp In Ca Collect Unemployment In Ca Quora

Can An Officer Of An S Corp In Ca Collect Unemployment In Ca Quora

S Corporations Learn 15 Advantages Disadvantages Corporate Direct

C Corporation Vs S Corporation Top 4 Differences Infographics

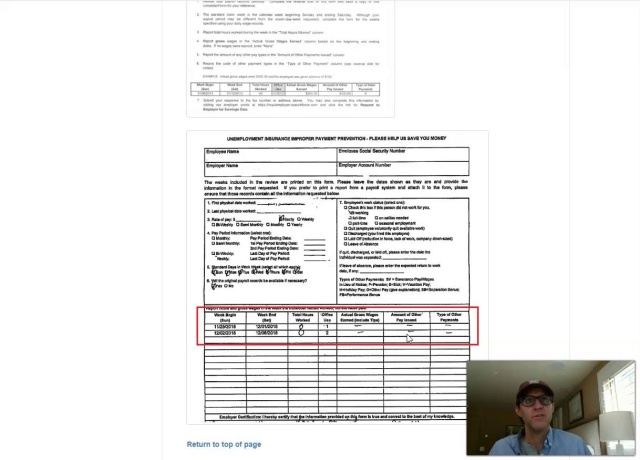

Ui Improper Payment Prevention Uib 144 Notice Asap Help Center

No comments:

Post a Comment