In order to start your unemployment CT unemployment requirements include the following. In order to claim Connecticut unemployment benefits you will have to show that you are willing to accept suitable employment and are actively seeking work.

What are the requirements to get unemployment in Connecticut.

Ct unemployment benefits requirements. While applying for unemployment you will need to attend a predetermined hearing in which your eligibility for unemployment will be assessed. The out-of-work employee must be available to work prepared to work and actively seeking work. Benefits will not begin until your Connecticut unemployment application is received and processed.

Your employer will also be notified of this hearing and will be able to either attend the hearing in person or submit a written statement. In order to receive unemployment insurance you must be fully or partially unemployed and. You must be unemployed through no fault of.

A work search requirement for unemployment benefits will begin again on May 30 the Connecticut Department of Labor announced Friday. Your past earnings must meet certain minimum thresholds. What are the requirements to get unemployment in Connecticut.

If you have become unemployed or partially unemployed you may file a UI claim. You have worked and earned a minimum amount of wages in work covered by unemployment tax during the past 18 months. MaximumMinimum Connecticut Unemployment Benefits.

The mandatory work search requirement was waived on March 19 2020 as part of Connecticuts public health response to the pandemic. Explanation of Connecticut and Other States Unemployment Compensation Eligibility Requirements Chargeability Rules and Employer Rights to Contest Claims 2000-R-0520 Receipt of Social Security and Eligibility for Unemployment Compensation 2000-R-0663. Unemployment Eligibility Work Requirements.

Wethersfield CT Connecticut Department of Labor Commissioner CTDOL Kurt Westby announced today that the work search requirement for unemployment benefits will begin again on May 30 2021. Claimants must make reasonable weekly work search. The waiver allowed claimants.

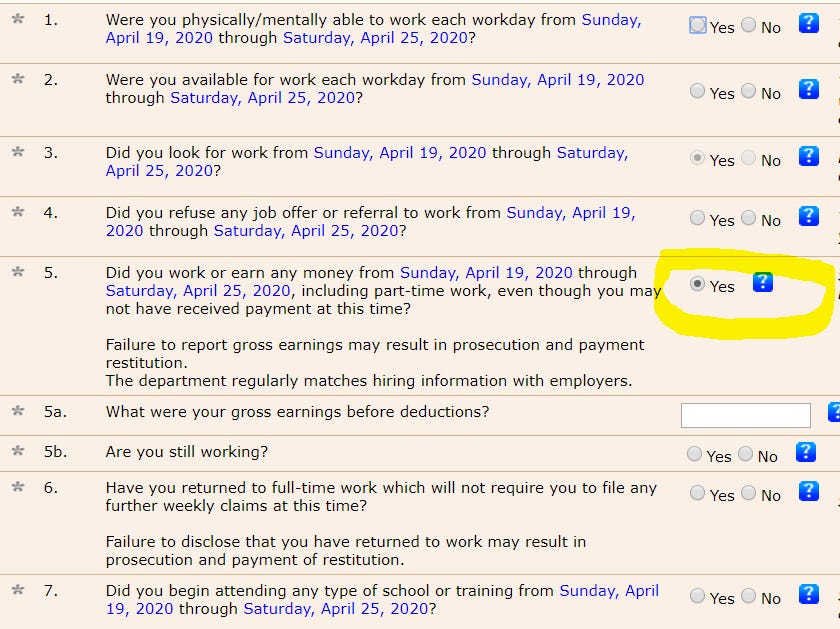

The Unemployment Insurance UI program pays benefits to workers who have lost their job and meet the programs eligibility requirements. While applying for unemployment you will need to attend a predetermined hearing in which your eligibility for unemployment will be assessed. Please check with the Connecticut Department of Labor for the latest facts and figures.

Enhanced and Extended Unemployment Benefits. File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Review the work requirements for initial and continued eligibility.

Your employer will also be notified of this hearing and will be able to either attend the hearing in person or submit a written statement. Extended unemployment benefits for workers who have used all state benefits as well. In order to qualify for unemployment benefits you must be ready willing available and able to work.

You must be able to work and are not disabled. A Guide to Your Rights Responsibilities When Claiming Unemployment Benefits in Connecticut Basic Eligibility Requirements. Many unemployed residents wish to know how to qualify for unemployment benefits in the state of Connecticut and what steps they can take to secure unemployment insurance.

Earnings history and whether you have collected benefits during the past year. You will also need to file your claims in a timely manner in order to receive your CT unemployment benefits on time and without interruption. You must be totally or partially unemployed.

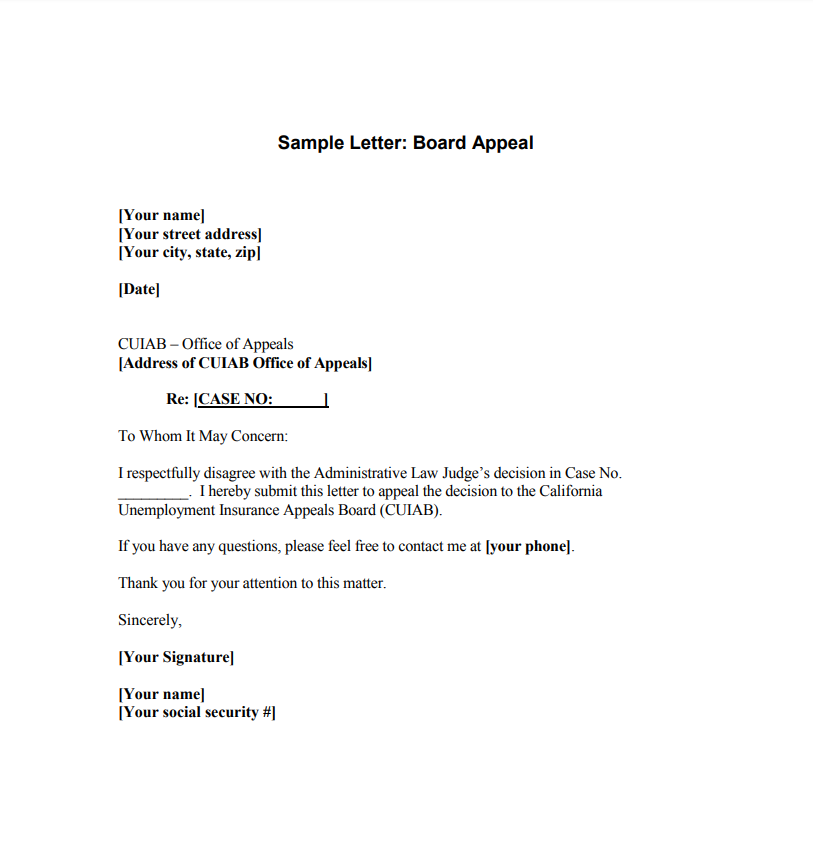

The Department of Labor spelled out what those efforts must entail. The amendments revise existing unemployment appeals procedures which were originally adopted in 1986 in order to align them with current practice and to align with information technology modernization efforts. Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter.

Check status of your weekly claim or manage your account. Connecticuts Department of Labor recently amended its regulations concerning proceedings on disputed matters pertaining to unemployment claims. You are totally unemployed.

People seeking unemployment will have to document their efforts to find a job. To collect unemployment insurance benefits in Connecticut you must meet all eligibility requirements. You must be monetarily eligible.

Connecticut requires that an unemployed worker be actively seeking work in order to get unemployment benefits. In order to receive unemployment benefits in Connecticut you must follow these rules. There are many factors that influence your eligibility for benefits.

You must meet the monetary requirement by having earned sufficient wages during your base period. In order to apply for Connecticut unemployment residents must meet specific requirements. You must be actively looking for a job and keeping a record of your.

After you have filed a claim you must continue to certify for benefits and meet eligibility. The unemployment compensation law states that most unemployed workers must make reasonable efforts to find employment each week. You must have lost your last job through no fault of your own.

What are the requirements for unemployment benefits in Connecticut. There is an unemployment insurance benefits application process that must be undergone as well in which the applicant may or may not be approved to receive benefits. If you lose your job it is recommended that you apply for Connecticutunemployment benefits within a week in order to maximize what you can be paid.

1232 AM EDT May 23 2021. Applicants must meet the following three eligibility requirements in order to collect unemployment benefits in Connecticut. Connecticut unemployment insurance benefits are available if you meet these criteria.

Depending on your vocation and industry you may qualify for unemployment if you have had your hours reduced. While unemployment can be a valuable resource for those who are between jobs it is important to be sure that you fall within. Anyone who is not ready to take a job or is not seeking a job will not get UI benefits.

You can receive benefits if you meet a series of legal eligibility requirements.