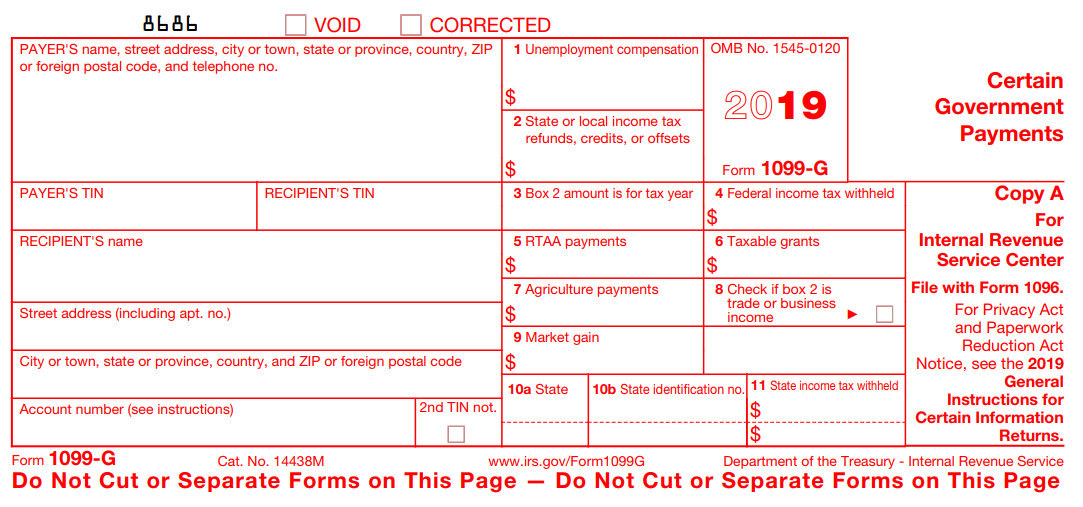

1099-G Form Certain Government Payments is a federal tax form filed by federal state or local government entities if they provide Reemployment Assistance benefit payments to eligible claimants. Postal Service will forward the Form 1099-G if a current forwarding order is on file.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

The 1099-G tax form includes the amount of benefits paid to you for any the following programs.

Unemployment 1099 g. Visit Ask EDD and select the Form 1099G category or call 1. Report the incorrect amount shown in box 1 of Forms 1099-G on your tax return. Unemployment benefits including Pandemic Unemployment Assistance Federal Pandemic Unemployment Compensation Pandemic Emergency Unemployment Compensation Mixed Earner Unemployment Compensation Lost Wages Assistance and Extended Benefits are.

In January TWC sends you the IRS Form 1099-G. The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to December 31. Every year we send a 1099-G to people who received unemployment benefits.

If your Form 1099-G is mailed to an address other than your current address the US. Income tax from your unemployment benefits at a tax rate of 10 percent before we send them to you. The 1099-G form is available as of January 2021.

Your unemployment payments are reported as income to the IRS. 31 of the year after you collected benefits. If you received unemployment your tax statement is called form 1099-G not form W-2.

More In Forms and Instructions. A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you including. This form shows the total amount of benefits paid in the previous calendar year.

How will unemployment compensation affect. Toyota Donates Winter Boots And Socks To Detroit Families 15000 To Salvation Army. On January 28 2021 the Arizona Department of Economic Security DES began mailing 1099-G tax forms to claimants who received unemployment benefits in the state of Arizona in 2020.

State or local income tax refunds credits or offsets. We do not issue Form 1099-G for pensions or unemployment or family leave insurancefamily leave during unemploymentdisability during unemployment. Enter the Social Security number that appears first on your New Jersey Gross Income Tax return and the tax year you wish to view.

Certain Government Payments Statement for Recipient. If you receive a Form 1099G but you did not file a claim for benefits or think that someone else filed a claim using your name address or Social Security number contact us to report fraud. About Form 1099-G Certain Government Payments.

Form 1099-G Statement for Recipients of Certain Government Payments is issued to any individual who received Maryland Unemployment Insurance benefits for the prior calendar year. Yes any unemployment compensation received during the year must be reported on your federal tax return. The Department of Unemployment Assistance DUA will mail you a copy of your 1099-G by Jan.

To reprint your 1099-G look under the I Want To heading in MiWAM and click on the blue 1099-G link. Withholding taxes is not required. The Form 1099-G reports the total taxable unemployment benefits paid to you from the.

If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns. Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB Federal Pandemic Unemployment Compensation FPUC and Lost Wages Assistance LWA. Combine the box 1 amounts from all Forms 1099-G and report the total as income on the UC line of your tax return.

UIA officials say any unemployment compensation must be reported on tax returns. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. Unemployment and family leave.

If you have received unemployment insurance payments last year you will need to report the total amount as found on your 1099-G on your federal taxes. If you received benefits in 2021 you will receive Form 1099-G Certain Government Payments as proof of income. Federal state or local governments file this form if they made payments of.

You will need this information when you file your tax return. The 1099-G is a tax form for Certain Government Payments. All individuals who received unemployment insurance UI benefits in 2020 will receive the 1099-G tax form.

Federal income tax withheld from unemployment benefits if any. If you received regular UC including PEUC EB TRA you will receive UC 1099-G. Shows the total unemployment compensation UC paid to you in the calendar year reported.

Click on the 1099-G letter for the 2021 tax year. If you received PUA you will receive PUA 1099-G. Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments.

Unemployment Insurance Agency I need a copy of my 1099-G where do I get that. The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year. How to Get 1099G Online - Department of Labor.

If you received unemployment compensation during the year you should receive Form 1099-G from the Office of Unemployment Compensation. Go to wwwirsgovidtheftunemployment for more information. ESD sends 1099-G forms for two main types of benefits.

Use your 1099-G Form to File your Taxes. How will I know how much unemployment compensation I received. Every January we send a 1099-G form to people who received unemployment benefits.

We also send this information to the IRS. The 1099-G reflects Maryland UI benefit payment amounts that. Form 1099-G Certain Government Payments is mailed in January to anyone who received an unemployment benefits payment during the previous calendar year.

If you received unemployment compensation during the year you should receive Form 1099-G from your states unemployment office. Reemployment trade adjustment assistance RTAA payments.

1099 G Tax Form Why It S Important

What To Do If You Can T Get Access To Your 1099g Tax Form Abc7 Southwest Florida

1099 G 2020 Public Documents 1099 Pro Wiki

1099 G Tax Information Ri Department Of Labor Training

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

Accessing Form 1099 For 2020 Unemployment Recipients

The Irs 1099 G Form What It Is And Who Receives

1099 G 2019 Public Documents 1099 Pro Wiki

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

1099 G Forms Available For Recipients Of Unemployment Insurance Benefits In 2020 Wrul Fm

Irs Courseware Link Learn Taxes

1099 Form Unemployment Benefits

No comments:

Post a Comment