The taxable wage base for calendar year 2000 and after is. 18 which incorporates recent federal tax changes into Ohio law effective immediately.

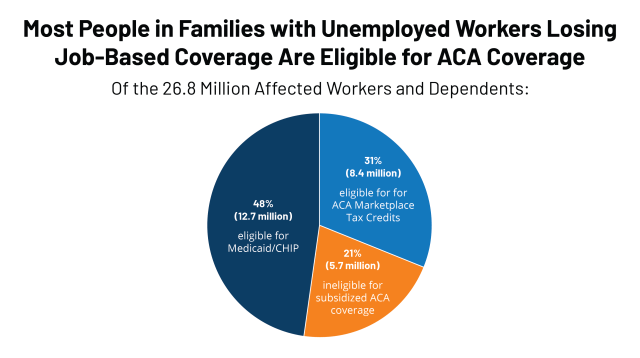

As Unemployment Skyrockets Kff Estimates More Than 20 Million People Losing Job Based Health Coverage Will Become Eligible For Aca Coverage Through Medicaid Or Marketplace Tax Credits Kff

Apply for Unemployment Now Employee 1099 Employee Employer.

Ohio unemployment tax rate. Ohio Unemployment Rates November 2021 November Unemployment Rates United States 39 Ohio 35 Not Seasonally Adjusted Ohio Department of Job and Family Services Mike DeWine Governor Jon Husted Lt. 58 2009 State Business Tax Climate Index. Unemployment tax rates for experienced employers are to range from 03 percent to 92 percent in 2019 compared with 03 percent to 9 percent for 2018.

Contribution Rates For 2011 2012 and 2013 the ranges of Ohio unemployment tax rates also know as contribution rates are as follows. Ohio unemployment tax rates are to increase for 2021 because a mutualized tax is to be in effect the state Department of Job and Family Services said Nov. Ohio Announcement Relating to 2022 Unemployment Tax Rates The Ohio Department of Jobs and Family Services DJFS has announced that unemployment tax rates for experienced employers will range from 03 to 97 in 2022 03 to 93 in 2021.

Payments for the first quarter of 2020 will be due April 30. The UI tax funds unemployment compensation programs for eligible employees. The sales and use tax rate for Paulding County 63 will decrease from 725 to 675 effective October 1 2021 Map of current sales tax rates.

Taxpayers with 25000 or less of non-business income are not subject to income tax for 2021. Because the Ohio Unemployment Trust Fund is below the minimum safe level MSL as of the. Ohio Individual Income Tax Rates.

On March 31 2021 Governor DeWine signed into law Sub. Questions Answered Every 9 Seconds. There are -628 days left until Tax Day on April 16th 2020.

Ad A Tax Advisor Will Answer You Now. Box 182404 Columbus Ohio 43218-2404If you report your liability at thesourcejfsohiogov you will receive a determination immediately. If your small business has employees working in Ohio youll need to pay Ohio unemployment insurance UI tax.

7031 Koll Center Pkwy Pleasanton CA 94566. Reporting their unemployment tax liability as soon as there are one or more employees in covered employmentThis may be done at thesourcejfsohiogov or by completing the JFS 20100 Report to Determine Liability and mailing it to PO. JFS-20106 Employers Representative Authorization for Taxes.

1 2022 total unemployment tax rates for experienced employers are to range from 08 to 75 for positive-rated employers and from 77 to 102 for negative-rated employers the department said on its website. The taxable wage base may change from year to year. Please note that as of 2016 taxable business income is taxed at a flat rate of 3.

The following are the Ohio individual income tax brackets for 2005 through 2021. Governor Matt Damschroder Director Office of Workforce Development - Bureau of Labor Market Information. 1 2019 Ohios unemployment-taxable wage base is to be 9500 unchanged from 2018 the state Department of Job and Family Services said Nov.

The tax brackets were adjusted per House Bill 110. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. Ohios unemployment tax rates are to generally are to increase for 2022 the Department of Job and Family Services said Dec.

Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. In Ohio state UI tax is just one of several taxes that employers must pay. Changes in how Unemployment Benefits are taxed for Tax Year 2020.

Also used by employers to authorize the Ohio Department of Job and Family. The increase is due to an inclusion of a mutualized flat tax rate of 05 which was added to bolster the state UI trust fund and pay the COVID-19 UI benefits charged to the mutualized account rather than individual employer accounts. The 2020 SUI taxable wage base reverts to 9000 down from 9500 for 2018 and 2019.

The Ohio 2021 SUI tax rates range from 08 to 98 up from the 2020 range of 03 to 94. To submit your quarterly tax report online please visit httpsthesourcejfsohiogov. Specifically federal tax changes related.

Taxable Wage Base The Taxable Wage Base is the amount of an employees wages upon which the employer is required to pay unemployment taxes each year. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes. 5 on its website.

In OH the average rate for counties and large municipalities weighted by total personal income within each jurisdiction is 182 weighted local rates are from Tax Foundation Background Paper No. Employers with questions can call 614 466-2319. 1 2021 the mutualized tax rate is to be 05 and is to be added to experienced employers unemployment tax rates the department said on its website.

Ohio Income Tax Update. Report it by calling toll-free. - The Finder This online tool can help determine the sales tax rate in effect for any address in Ohio.

6 Unemployment Insurance Tax 16 Untimely Reporting Assessments Forfeiture Assessed for untimely reporting Equal to 025 times the total remuneration reported Minimum of 50 and a maximum of 1000 per untimely quarter Interest Assessed on balances not paid by the due date including charges and forfeiture on the 1st of every month until the balance shown on the. 52 rows Generally states have a range of unemployment tax rates for. 2021 4 th Quarter Rate Change.

The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92. 2011 2012 2013 Lowest Experience Rate.

Increasing The Taxable Wage Base Unlocks The Door To Lasting Unemployment Insurance Reform

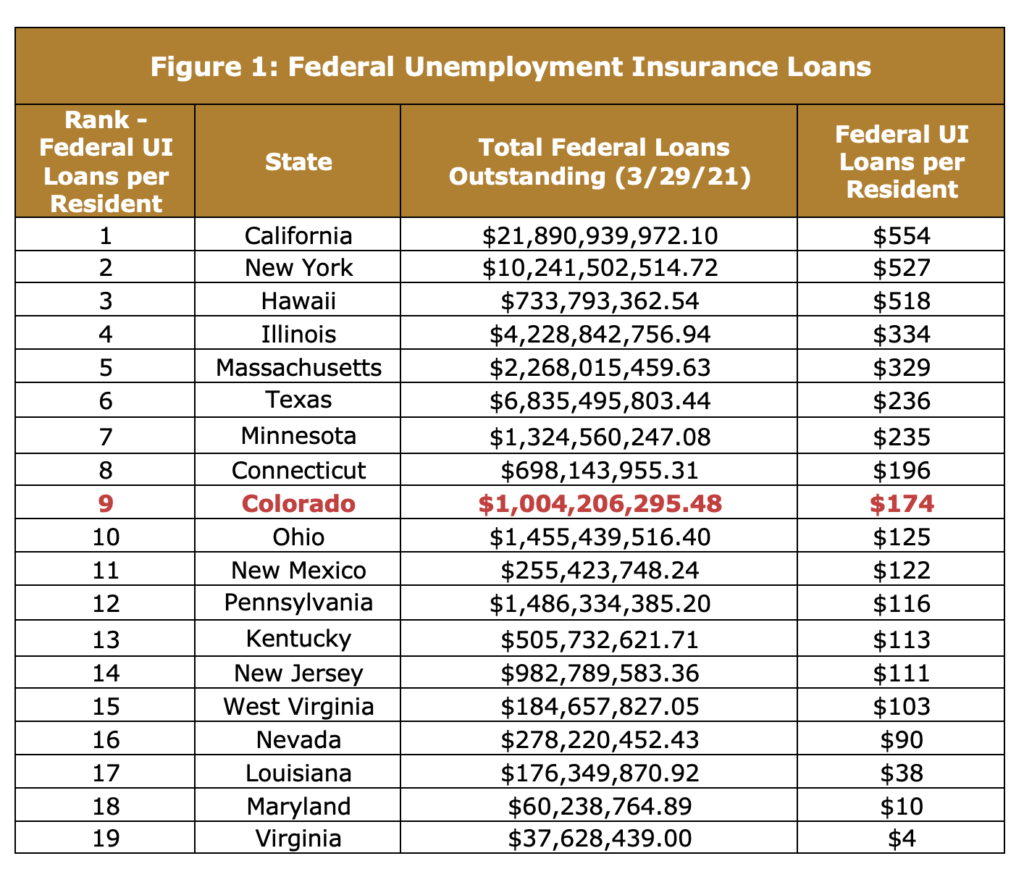

The State Of Colorado S Unemployment Insurance Trust Fund Common Sense Institute

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How Ohio Has Underfunded Unemployment Compensation

How Ohio Has Underfunded Unemployment Compensation

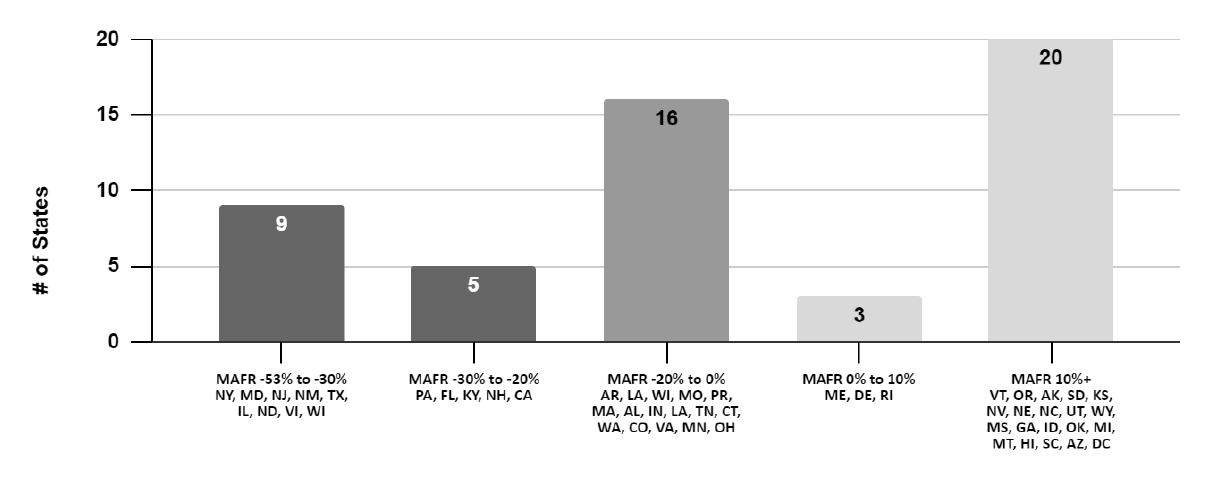

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Ohio Pays Off Federal Unemployment Loan Saving Employers From Unemployment Tax Increase Governor Mike Dewine

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

How Ohio Has Underfunded Unemployment Compensation

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Income School District Tax Department Of Taxation

No comments:

Post a Comment