Employers can use ERIC to register for new employer account numbers get web access for new and existing accounts file quarterly reports make payments and manage their accounts. Electronic Signature Solutions by SignNow.

Career Planning Based On Possible Labor Shortage Data Career Lessons Career Planning Job

The individual your company designates as the account administrator must register.

Ohio unemployment employer registration. Welcome to the Employer Resource Information Center ERIC. JFS - Ohio Unemployment Compensation - TPA Contact Registration Step 1 of 3. Employer Resource Information Center.

This Quick Tips and Step-by-Step Guide can help expedite the claims process for unemployed workers. The Employer Resource Information Center ERIC is a self-service unemployment compensation tax system. Employer Registration Step 1.

Agent Uploading Ohio Quarterly Unemployment Files pdf. Employers can use ERIC to. Please email all WARNs and related inquiries to rapdrespjfsohiogov.

In order to qualify for unemployment in Ohio you must have lost your job through no fault of your own. Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of taxes and other transactions including sales and use tax employer withholding commercial activity tax unclaimed funds and unemployment compensation tax. You can apply for unemployment benefits by calling the ODJFS helpline or online via the ODJFS benefits portal and you should do so as soon as you become unemployed.

Register for new employer account numbers. The individual who initially registers your employer account will assume the. Report it by calling toll-free.

If ODJFS has been notified that your company is authorized to act on behalf of one or more employers for matters pertaining to Unemployment Compensation Benefits your company may access the accounts of those employers online. Register with the Employment Security Commission. Welcome to Ohios Unemployment Insurance Program.

Register for online access to ERIC or OBG ERIC Employer Resource Information Center - jfsohiogov OBG Ohio Business Gateway - wwwohiobusinessgatewayohiogov Download the Quarterly Wage Reporting Tool QWRT QWRT is an offline tool designed to help employers and third-party administrators TPAs manage employee data and file. Division of Tax Operations Integrity Assurance Ohio Unemployment Compensation Guide Civil Rights Posters Correct Quarterly Tax Reports Contact Unemployment - Compliance Phone Numbers Employee vs. Employers who have paid wages in covered employment must register for an employer account.

Click here for step-by-step videos FAQs and more. Everyone except workers that remain attached to an employers payroll have to. Get web access for new and existing accounts.

Suspect Fraud or Ineligibility. How to get online access to The SOURCE. Report it by calling toll-free.

Logging in to The SOURCE for the first time. Report Suspected Fraud or Ineligibility. JFS 20233 Employers Guide to Wage Report and Payment File Specifications.

Employer Identification Enter your UI account number Plant number Federal Tax ID and the ten-digit Registration Code that was mailed to you. Employer Credentialing and Agent Credentialing. Below you can find out how Ohio unemployment benefits and eligibility work and how to claim them.

To register for a UI employer ID and receive an immediate notification regarding your obligation visit thesourcejfsohiogov. Employer Contact Registration Step 1 of 3 Employer Information. How to Obtain an Employer Account Number To register with ODJFS for an Unemployment Compensation tax account employers should complete a Report to Determine Liability JFS-20100 online at the Employer Resource Information Center Eric at ericohiogov or employers can register their business by mailing the JFS-20100 form to.

Personal Information Enter your name and phone number. Independent Contractor Failure to File and Pay Find Info about Tax Rates Mass Layoff Procedures for Employers Portable Media Reporting Prepare for an Audit Request. Report COVID-19 Work Refusals.

ERIC is a self-service unemployment compensation tax system. Ad signNow Allows You to Edit Fill and Sign any Documents on any Device. Enter 000 if no plant location exists Federal Tax ID FEIN Registration Code.

After the registration is complete you will receive an Employer Identification Number EIN and can begin to file wage reports and maintain your account via the online system. The SOURCE or the State of Ohio Unemployment Resource for Claimants and Employers is Ohios internet-based unemployment tax system. It can take 3 weeks or longer to receive.

How Do I Claim Unemployment Benefits in Ohio.

More Ohioans Are Discovering They Ve Been Targeted By Unemployment Scammers Thanks To Unexpected Letters Cleveland Com

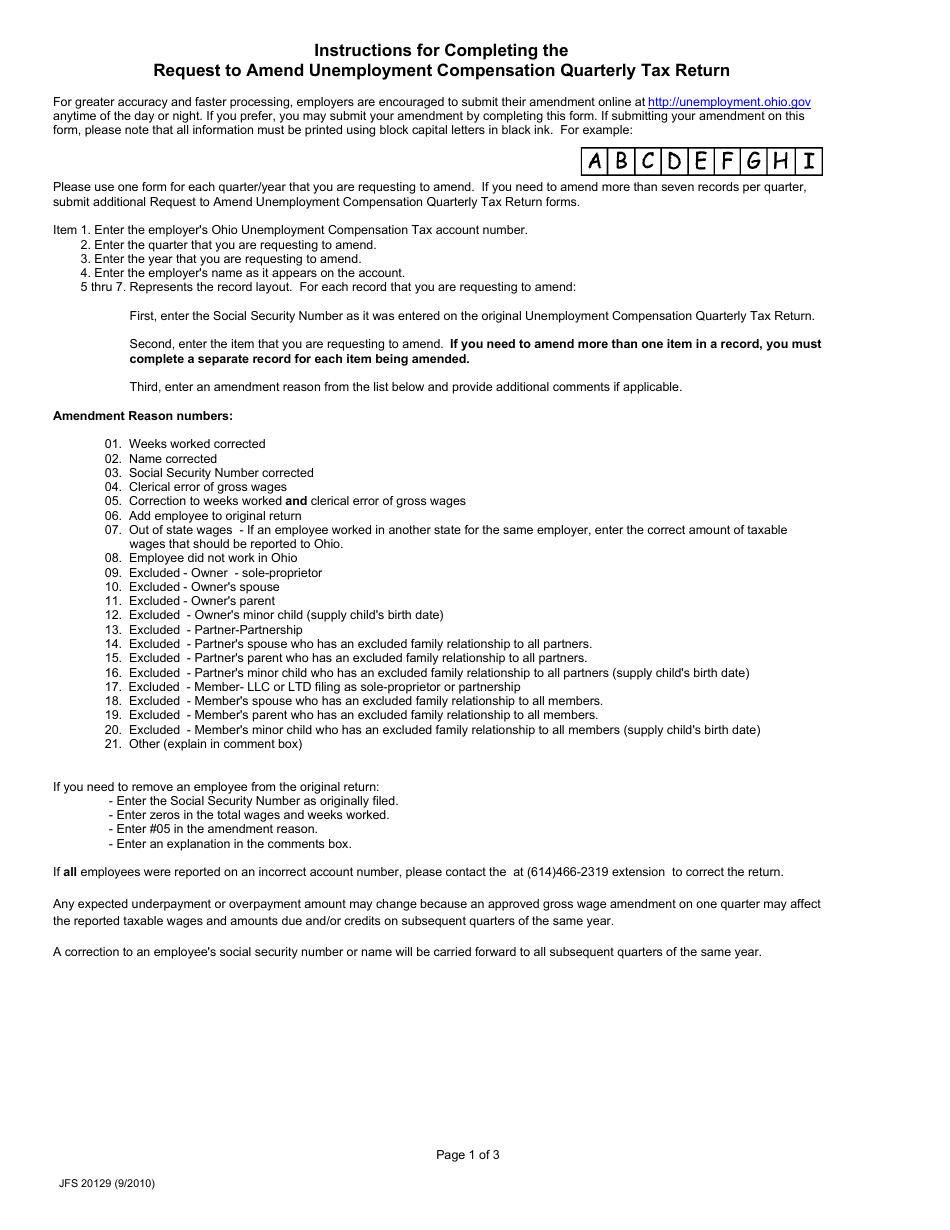

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

How Non Profits Can Avoid Paying State Unemployment Tax

Ohio Unemployment Login Problems Ohio Unemployment Ohio Gov

Free 7 Sample Unemployment Tax Forms In Pdf

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Unemployment Insurance Ohio Gov Official Website Of The State Of Ohio

Is There A Way To Find My Unemployment Id Number I

Wage Envelope 1940s Zine Design Graphic Design Typography Packaging Design

Free 7 Sample Unemployment Tax Forms In Pdf

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Is There A Way To Find My Unemployment Id Number I

No comments:

Post a Comment