_____ Quarter ___________ - ___________ ___ ___ ______ ___ ___ ___ ___ Quarter ___________ - ______________ ___ ______ ___ ___ ___ ___ Quarter ___________ - ___________ ___ ___ ______ ___ ___ ___ ___ Quarter ___________ - ___________ ___ ___ ______ ___ ___ ___ ___ Quarter ___________ - ___________. There is a weekly benefit calculator available online at the NYgov website.

The more money that you made in your base period the larger the amount that you will recieve every week for unemployment.

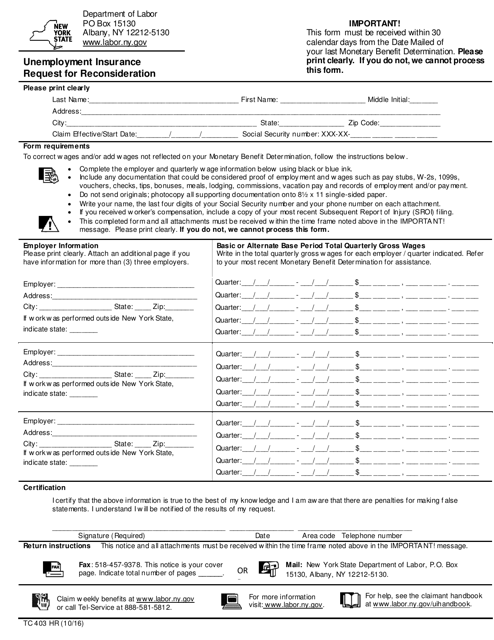

Nys unemployment alternate base period. Requirements during one of your base periods basic first 4 of the previous 5 quarter years or alternate last 4 of the previous 5 quarter years. If work was performed outside New York State indicate state. The standard base period is the earliest four of these five quarters.

Extended Base Period A longer timeframe for considering income for unemployment. Request the alternate base period within 10 days of the date of the monetary benefits determination sent to you by the DOL. For those who are unable to meet the earnings requirements below in the regular base period New York recognizes an alternate base period.

By choosing the alternate base period which includes the most recently completed quarter you may bring your benefit rate up. If you qualify using the Alternate base period that base period will be used to establish your claim. The alternate base period is the persons last four completed quarters before filing for unemployment.

They must have worked and been paid wages for work in at least two calendar quarters in the base. The Department of Labor must receive your completed form within 10 days from the Date Mailed on the Monetary Determination. 1999 Fourth Quarter October December 1999 Completed Lag Quarter January March 2000 Filing Quarter April June 2000 Worked Began October 13 1999 Filed June 23 2000.

In order to receive unemployment benefits in New York you must have been employed for paid work for at least 2 calendar quarters during your Base Period a Base Period is one year or 4 calendar quarters. See the How Your Weekly Unemployment Insurance Benefit. Complete the steps below using black or blue ink.

To calculate your WBA divide your base period quarter with the highest wages by 25 and round to the nearest dollar. The alternate base period encompasses the last four completed calendar quarters before claimants file for unemployment. How to calculate unemployment benefits in New York.

New York Unemployment Base Period. If you wish to use the Alternate Base Period to increase your w eekly benefit rate. This alternate period considers more recent employment.

Estimated Weekly Benefit Rate using Alternate Base Period. ALL earnings in those base periods can be used for an application after July 2nd. Now if I want to use my alternate base period the most recent quarter instead of the high quarter do I still have to meet the threshold of the other quarters being 15X that of my alternate base quarter.

My hours were reduced am I eligible for regular UI. Once wages are used they cannot be included in a future claim. You must have worked and been paid wages in jobs covered by Unemployment Insurance in at least two calendar quarters You must have been paid at least 2600 in one calendar quarter.

This alternate period takes more recent employment into account. New York recognizes an alternate base period for those who cant meet the earnings requirements below in the regular base period. Claimants who qualify under the basic base period may request that their benefits be calculated using the alternate base period if they believe it would result in a higher compensation rate.

Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period whichever is less. The Alternative Base Period for unemployment benefits is the last four completed calendar quarters preceding the starting date of the claim. Additional information such as most recent quarterly earnings proof of wages earned in the form of pay stubs and verification of earned wages may be asked for in case of the Alternate Base Period.

The first is to use the four most recently completed calendar quarters as the base period. Even filers who qualify using the regular base period can ask. Basic base period is the first four of the last five completedcalendar quarters prior to the calendar quarter in which the claim is effective.

Earnings in only 2 or 3 base period or alternative base period quarters the benefit rate will be calculated as follows. Fill out the Request for Alternate Base Period form. Hello I understand that to qualify for unemployment your base quarter earnings must be 15X that of your high quarter earnings.

How is a benefit rate calculated. New York offers two other alternative base periods to an employee who does not meet the wage requirements based on the standard base period. This is only available to applicants that receive workers compensation and.

Include any documentation that could be considered proof of employment and wages such as pay. In some cases the Basic Base Period may be extended back up to two calendar quarters. If high quarter is 4000 benefit rate is 126 of the average of the two highest quarters.

The alternate base period is the last four completed quarters before the person files for unemployment. Complete the steps below using black or blue ink. Traditional Base Period Alternative Base Period First Quarter January - March 1999 Second Quarter April June 1999 Third Quarter July Sept.

Alternate Base Period The four financial quarters directly before you submit forms to apply for unemployment in NY. If you wish to use the Alternate Base Period to increase your eekly w benefit rate. Just be aware that if you opt to use the Alternate Base Period to calculate your weekly benefit rate it could affect your ability to qualify for a future unemployment claim.

Even filers who qualify using the regular base period can. The alternatebase period is the last four completedcalendar quarters prior to the calendar quarter in which the claim is effective. Your alternate base period now is April 1 2016-March 31 2017.

If you apply July 2nd or later your alternate base period will be July 1 2016-June 30 2017. If you qualify under the Basic base period but you think using the Alternate base period would result in a higher benefit rate you may apply within 10 days from the date of the initial monetary notice to have your rate recalculated using the Alternate base period. Most eligibility requirements for unemployment in New York are met in the base period.

Your base period is the period of time that you worked prior to losing your job in which you establish the amount of money that you will receive in unemployment. Include any documentation that could be considered proof of employment and wages such as pay stubs W -2s. There is a deadline for us to consider you for the Alternate Base Period.

The Ultimate Guide For Unemployment Benefits In Ny Freedomcare

Esdwagov Calculate Your Benefit

Form Tc403 Hr Download Printable Pdf Or Fill Online Unemployment Insurance Request For Reconsideration New York Templateroller

Base Period For Filing Unemployment Benefits Fileunemployment Org

Esdwagov Calculate Your Benefit

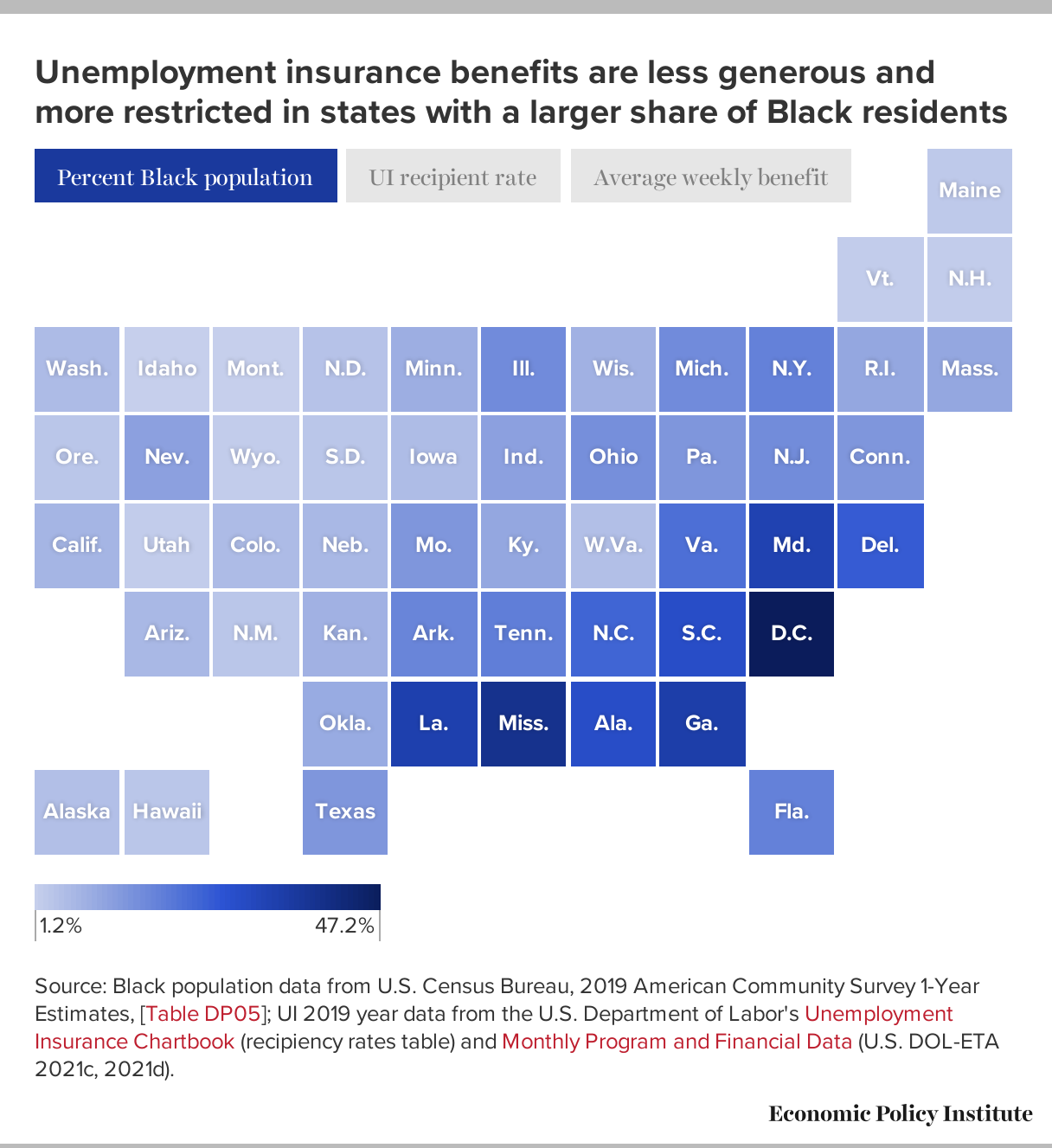

Section 3 Eligibility Update Ui Eligibility To Match The Modern Workforce And Guarantee Benefits To Everyone Looking For Work But Still Jobless Through No Fault Of Their Own Economic Policy Institute

Base Period For Filing Unemployment Benefits Fileunemployment Org

Base Period For Filing Unemployment Benefits Fileunemployment Org

The Ultimate Guide For Unemployment Benefits In Ny Freedomcare

No comments:

Post a Comment