In Adams County these claims rose from 11 as of March 14 to 390 with a total of 1 284 claims filed in this four-week span from March 14 to April 11. Auglaize County tied for the sixth-lowest rate in the state with Geauga and Madison counties.

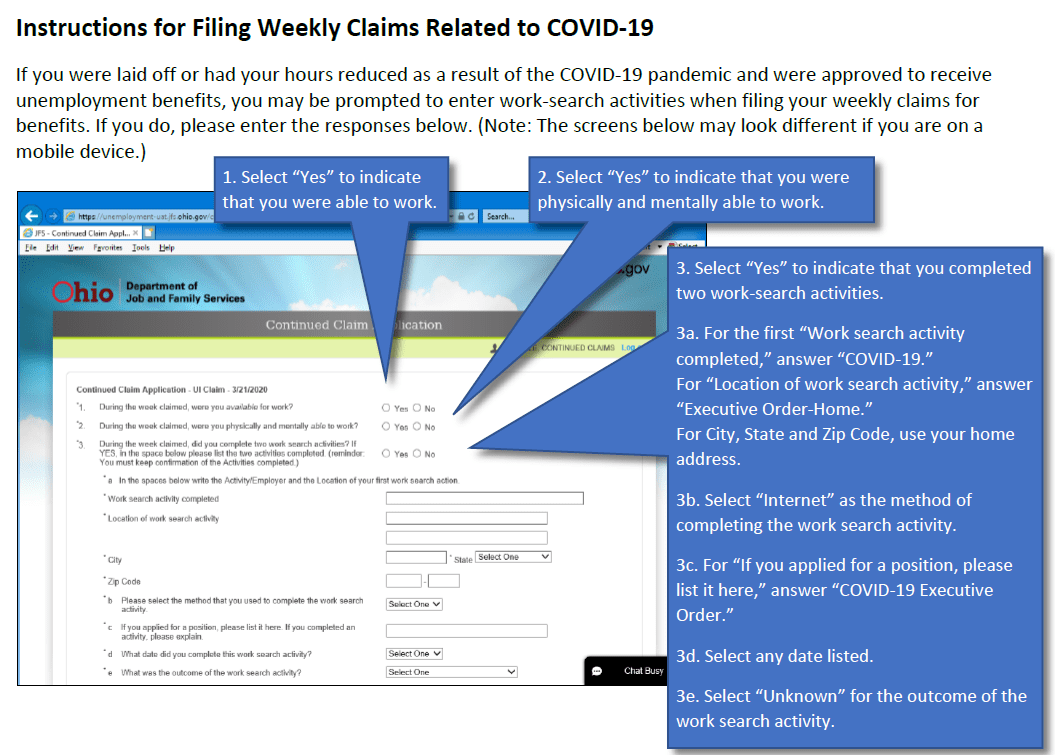

Unemployment went up from 47 to 5 in Clark County and 4 to 42 in Champaign County between September and October according to data recently released by the Ohio Department of Job and Family.

Ohio unemployment numbers by county. The comparable unemployment rate for Ohio was 35 in November. Mercer County had the third-lowest rate in Ohio at. The counties with the.

While Ohio unemployment claims remain in the thousands it is still lower than the peak earlier this year. In data tabulated by Policy Matters Ohio Adams Clinton Logan and Union Counties reported their highest initial unemployment compensation claims in the week ending April 11. 1-877-OHIOJOB 644-6562 or TTY.

The November unemployment rates in adjacent counties were. Office of Unemployment Insurance Operations is 877-644-6562. Data Series Back Data June 2021 July 2021 Aug 2021 Sept 2021 Oct 2021 Nov 2021.

33 Percent Monthly. Box 182404 Columbus Ohio 43218-2404If you report your liability at thesourcejfsohiogov you will receive a determination immediately. County Road 25A Troy Ohio 45373 Hours Monday 700 AM to 600 PM Tuesday thru Friday 800 AM to 500 PM OhioMeansJobs Miami County is proud to offer priority of service to US.

File by phone at. The main phone number for the Ohio Department of Job and Family Services. Military Veterans and eligible spouses.

WARREN Augusts jobless rates in Trumbull and Mahoning counties were stagnant ending a descent toward single-digit pre-pandemic numbers and remain among the worst in Ohio in an area. Office of Unemployment Insurance Operations website. The number of unemployed has decreased by 235000 in the past 12 months from 536000.

Reporting their unemployment tax liability as soon as there are one or more employees in covered employmentThis may be done at thesourcejfsohiogov or by completing the JFS 20100 Report to Determine Liability and mailing it to PO. Applying for Unemployment Benefits. Unemployment Rate in Warren County OH OHWARR5URN Unemployment Rate in Warren County OH.

The number of workers unemployed in Ohio in July was 301000 up from 291000 in June. Ohios unemployment number for June is 109 with just over 35000 initial jobless claims last week according to the Ohio Department of Job and Family Services. Find contact information for local unemployment offices in Ohio on the UI Delivery Locations page of the Ohio Department of Job and Family Services.

This is lower than the long term average of 663. Ohio Unemployment Rate is at 480 compared to 510 last month and 560 last year. Office of Workforce Development Ohio Department of Job and Family Services 4020 East Fifth Avenue Columbus OH 43219.

50 Percent Monthly. All media inquiries should be directed to the Ohio Department of Job and Family Services Office of Communications at 614 466-6650. Since 2005 the unemployment rate in Ohio has ranged from 34 in October 2000 to 173 in April 2020.

15 rows Richmond Heights Unemployment Office. - Your name address telephone number and e-mail address - Your social security number. Unemployment Rate in Seneca County OH OHSENE0URN Unemployment Rate in Seneca County OH.

The current unemployment rate for Ohio is 63 for June 2021. Seven counties and did not change in three counties. Putnam County has the.

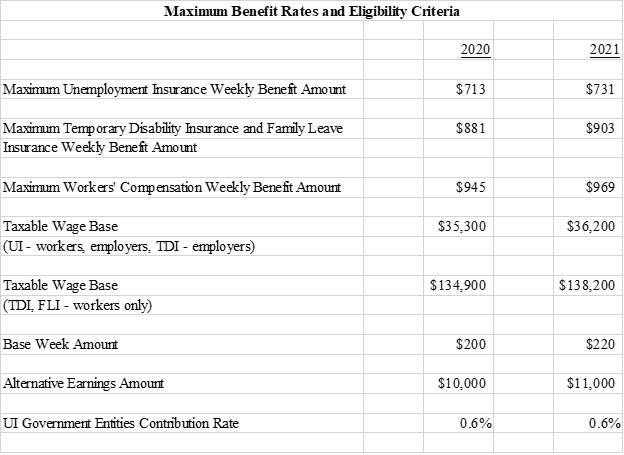

See table on next page Eight counties had unemployment rates at or below 25 in November. Unemployment rate for July was 54 down from 59 in June and down from 102 in July 2020. To reach your local unemployment office in Ohio by phone use the following numbers.

You can also call or visit your local county office for help with benefits. The lowest rate in Ohio is 20. File online at httpunemploymentohiogov.

The total number of initial claims over the past 17-weeks is just under 15 million which is more than the. Number of persons in thousands seasonally adjusted. You will need the following to complete your new claim.

The July unemployment rate for Ohio decreased from 93 in July 2020. According to the Ohio Department Job and Family Services Allen County has the highest unemployment rate in our area but also saw the biggest fall going from 61 in September to 42 in October. 2 In percent seasonally adjusted.

See how other local areas compare by using our Unemployment Compare tool.

/cloudfront-us-east-1.images.arcpublishing.com/gray/TENASPTC3NH4DA5RLTPNADTUFY.png)