You can estimate what your benefits will be using this calculator. Your benefit amount is based on your earnings.

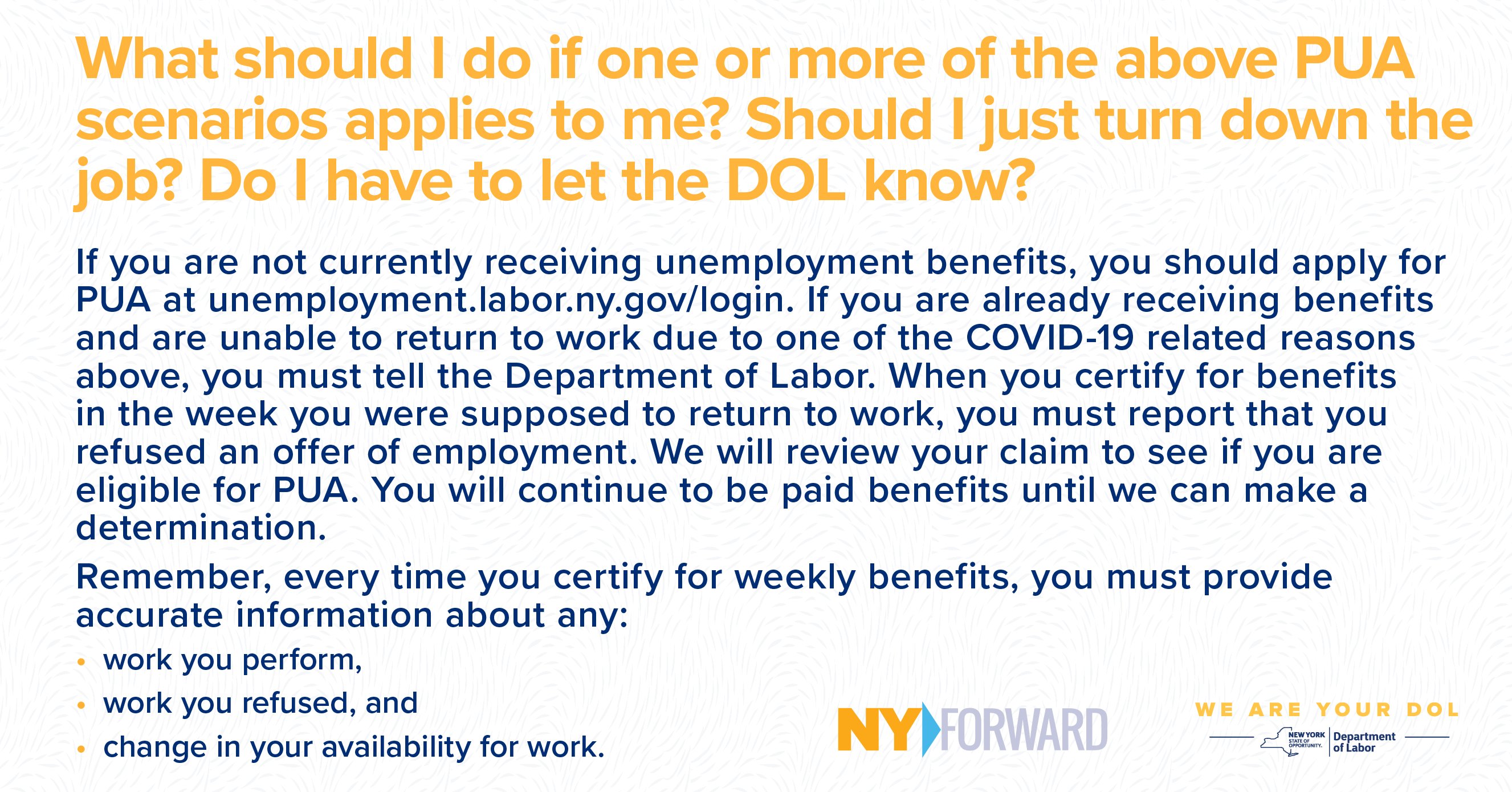

Nys Department Of Labor On Twitter Question Can I Turn Down A Job Offer And Continue Receiving Regular Unemployment Benefits Or Pua Because I M Afraid Of Catching Covid 19 See The Answer In

Who can file for unemployment in NY.

Unemployment ny 504. In New York the current maximum weekly benefit rate is 504. What is the max unemployment in NY 2019. The New York State Department of Labor NYSDOL determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 26 up to a maximum of 504 per week.

However if you receive more than 504 per week no matter how many days you worked during that week you cant receive unemployment benefits for that week. Minimum PUA Benefit Rate-In New York the Minimum PUA Benefit Rate is 182. For April 1 2020 -.

Also what is the maximum unemployment benefit in. Can I Work Part Time And Collect Unemployment Ny. The New york state Department of Labor NYSDOL determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 26 up to a maximum of 504 per week.

With this change your benefits will not be reduced for each day you engage in part-time work. To be eligible for benefits you must also have lost work through no fault of your own. And be actively looking for work.

The maximum benefit rate is 504 the same as the maximum benefit rate for regular unemployment insurance benefits. However how much you will get in benefits depends on your past wages. If however you are on regular UI and are self-employed the 504 limit does not apply to self-employed earnings.

Partial benefits are available to individuals who work fewer than 4 days per week and earn less than 504 during that week. What is the max for unemployment in New York. Your benefit amount is based on your earnings.

In fact What is the maximum unemployment benefit in NY for 2020. The maximum weekly benefit in New York is 504 people who make approximately 52000 will receive the maximum. If you work one day of the week your benefits will be only 300.

Beginning October 20 2021 through November 18 2021 DUA is available to New Yorkers in the following New York Counties Bronx Dutchess Kings Nassau Queens Richmond Rockland Suffolk and Westchester who 1 lost employment as a direct result of Hurricane Ida and 2 live or work in an impacted county. Under New York law you can receive unemployment benefits for 26 weeks. To estimate how much you are likely to receive if you file for unemployment you can follow our instructions using the New York Unemployment Benefits Calculator.

However the maximum weekly benefit in New York is 504. NY Unemployment Insurance program details. Also What is the maximum unemployment benefit in NY for 2020.

Receiving partial benefits extends the amount of time that you can collect unemployment. NYS DOLs new partial unemployment system uses an hours-based approach. What is the max normal unemployment benefit in New York.

The maximum weekly benefit in New York is 504 people who make approximately 52000 will receive the maximum. The maximum weekly benefit in New York is 504 people who make approximately 52000 will receive the maximum. Under the new rules claimants can work up to 7 days per week without losing full unemployment benefits for that week if they work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment.

Instead benefits will be reduced in. The maximum weekly benefit at 504 dollars is already low especially for those of us living in New York City so taxing on top of that is just cruel frankly said Freed the Executive Director of ExtendPUA an advocacy organization created. Disaster Unemployment Assistance.

FPUC 600300 Bonus All Or Nothing. For January 27 2020 - March 31 2020 the minimum benefit rate is 172. If this applies to you your benefit rate will be calculated as follows.

The typical weekly benefit amount for traditional unemployment benefits in New York is calculated based on recent employment earnings for a maximum of 504 per week. If you are on PUA then the 504 limit applies to self-employed earnings as well. Each day or partial day that you work causes your unemployment benefits rate to drop by 25.

Partial Unemployment-Prior to January 18 2021 you are considered partially unemployed and thereby eligible to collect benefits if you are working 3 days or less and earning 504 or less. For each day you work your. A benefit calculator is available on NYS DOLs website.

Unemployed individuals can receive between 104 to 504 per week up to a maximum of 26 full weeks of benefits in one year. The current maximum weekly unemployment benefit rate in New York state is 504. File an unemployment claim new york - Yahoo Search Results.

Amount and Duration of NYS Unemployment Benefits The New york State Department of Labor determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 26 up to a maximum of 504 per week. Any week that you earn over 504 you still lose that weeks benefits even if you worked 10 hours or less. Under the new rules you can work up to 7 days per week without losing full unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment.

That weekly benefit to jobless workers is worth about 1260 per hour which may have seemed like a lot before the coronavirus pandemic but now that employers are paying more amid a. The minimum PUA benefit rate is 50 of the average weekly benefit amount in New York. You can estimate what your benefits will be using this calculator.

Your benefit amount is based on your earnings. In the New York State unemployment insurance is available for all eligible unemployed individuals who have worked and earned enough wages in covered employment. 5 days ago unemploymentlabornygov.

How long Can You Collect Unemployment Benefits in New York. How much you will get in New York State unemployment benefits depends on your earnings. Those who make approximately 52000 per year can claim the maximum unemployment benefit of 504 per week.

Be ready willing and able to work. If you are living andor willing to look for work in the state of New York you may also file your claim by calling the Telephone Claims Center at 1-888-209-8124 during regular business hours. When she filed taxes for 2020 Freed discovered she owed New York State 1200 for income taxes on unemployment benefits.

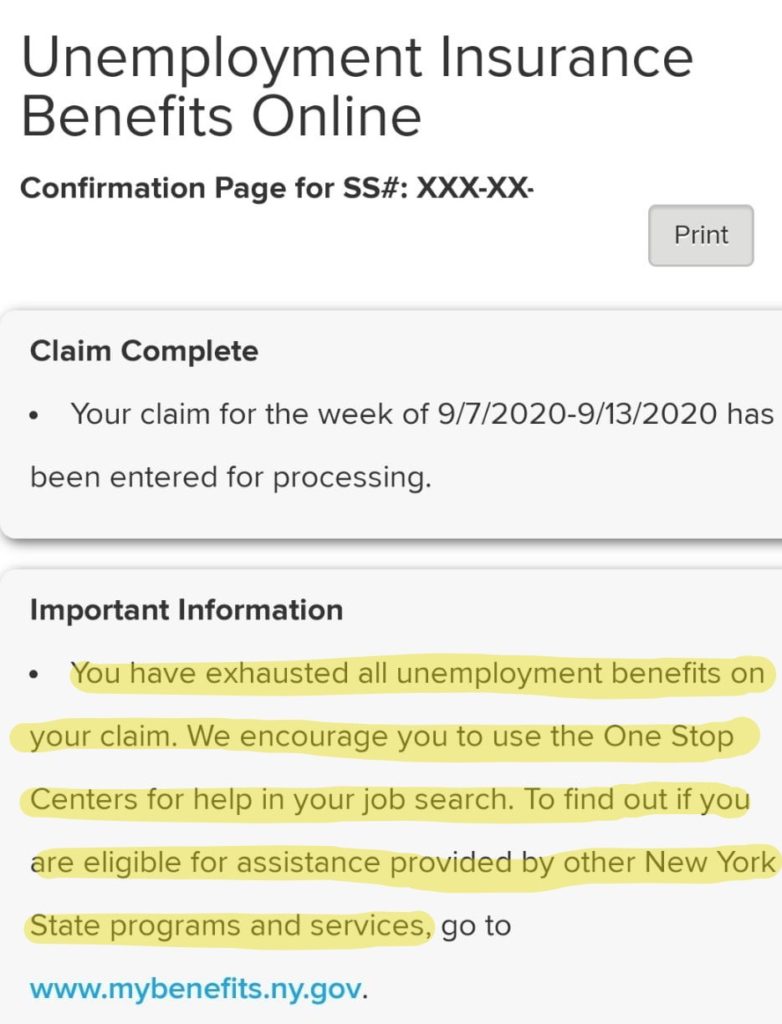

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Nys Department Of Labor On Twitter Question Can I Turn Down A Job Offer And Continue Receiving Regular Unemployment Benefits Or Pua Because I M Afraid Of Catching Covid 19 See The Answer In

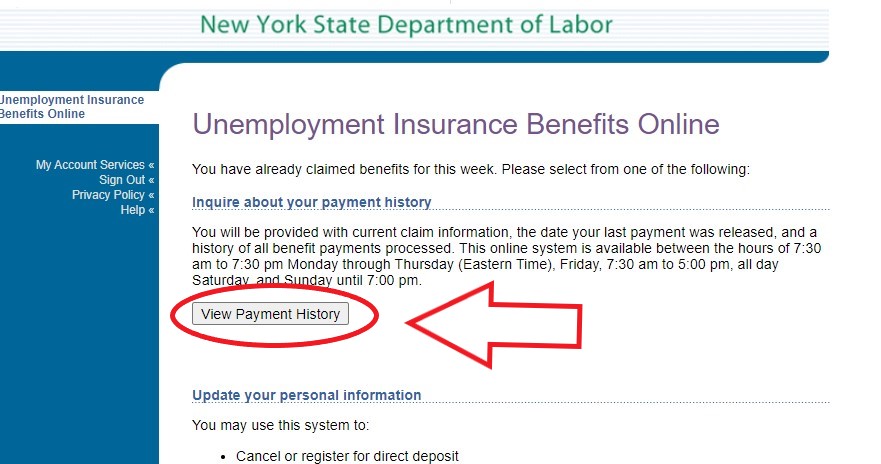

Niagara County Employment And Training Worksource One Covid 19 Resources Unemployment Returning To Work

Marketing Resume Job Resume Samples Free Resume Samples

How To Best Support Employees Reduced To Part Time Hours And Collecting Nys Unemployment Benefits Deb Best Practices Nys Certified Wbe

New York State Department Of Labor Tomorrow Is The First Day To Certify For Benefits Under Nys Dol S New Partial Unemployment System Please Read Or Listen To The Directions When

Koster Doesn T Exaggerate Income Threshold To Qualify For Medicaid Medicaid Missouri Spectrum Disorder

New York Ny Dol Unemployment Insurance Compensation After End Of Pandemic Programs What You Can Get In 2022 And Claiming Retroactive Payments News And Updates Aving To Invest

Morningside Park Nyc Google Images Harlem Nyc Nyc Neighborhoods Nyc

New York Unemployment Benefit Changes Stokes Wagner Jdsupra

Nys Department Of Labor On Twitter Question Can I Turn Down A Job Offer And Continue Receiving Regular Unemployment Benefits Or Pua Because I M Afraid Of Catching Covid 19 See The Answer In

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

No comments:

Post a Comment