This includes Form 1099-NEC income. This form does not include unemployment compensation.

Make sure it says 2020.

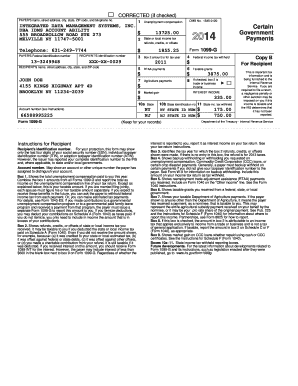

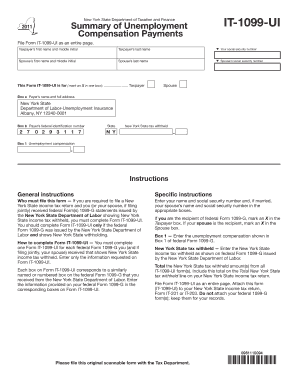

Unemployment ny 1099. State Department of Labor-Unemployment Insurance Albany NY 12240-0001 Box b Payers federal identification number 2 7 0 2 9 3 1 1 7 State New York State tax withheld N Y Box 1 Unemployment compensation Instructions General instructions Specific instructions Who must file this form If you are. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. If you are using a screen reading program select listen to have the number announced.

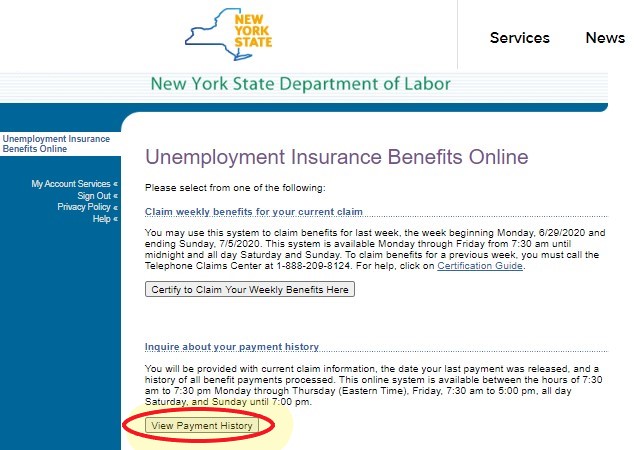

Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. Unemployment compensation is taxed by. Claimants who fail to do so can face serious consequences.

If you itemize deductions you may deduct your contributions on Schedule A Form 1040 as taxes paid. Under I Want To select View 1099-G If you did not select electronic as your delivery preference by January 9 th 2021 you will automatically be mailed a paper copy of your Form 1099-G. Reporting Form 1099 Income to Your Unemployment Office If youre collecting unemployment insurance benefits you must report any source of income you receive.

If you have more than one 1099-G form add all the amounts from Box 1 on each form and enter the total amount on Line 19 of your 1040 form. Visit the Department of Labors website. Log in to your NYGov ID account.

Federal income tax withheld from unemployment benefits if any. How To Get My W2 From Unemployment Nj. Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form.

Recipients must report this information along with information from other income tax forms such as Form W-2 on their. Click it and your PDF of the form should pop up. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

Normally self-employed and 1099 earners such as sole independent contractors freelancers gig workers and sole proprietors do not qualify for unemployment benefits. File a claim online to receive temporary income while you search for a job. 1099-G Tax Form.

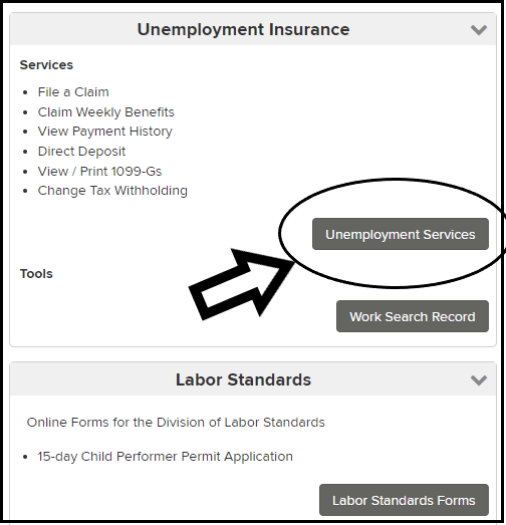

Click the Unemployment Services button on the My Online Services page. On the bottom it will have your unemployment compensation any adjustments made and finally where the amount of federal. If you received a refund offset or credit of New York State income taxes or MCTMT the amount on your New York State Form 1099-G Statement for Recipients of State Income Tax Refunds may differ from your actual refund you received because all or part of your overpayment was.

How to Get 1099G Online - Department of Labor. Does unemployment send you a 1099. How to complete Form IT-1099-UI You must complete one Form IT-1099-UI for each federal Form 1099-G you and if filing jointly your spouse received that shows New York State income tax withheld.

Denise Caldwell is a finance writer who has been writing on taxation and finance since 2006. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB and Lost Wages Assistance LWA.

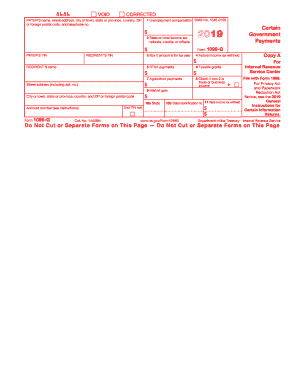

In January 2021 unemployment benefit recipients must access Form 1099-G which reports Certain Government Payments from the NYS Department of Labor website. Unemployment compensation program or to a governmental paid family leave program and received a payment from that program the payer must issue a separate Form 1099-G to report this amount to you. The earnings must be submitted to your unemployment office when you file your claims.

The Tax Department issues New York State Form 1099-G. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. If you received more than 10 in unemployment compensation during the year your state will send you a Form 1099-G.

View Your 1099-G Information. To access your Form 1099-G online log into your account at unemploymentstatemius. If you received unemployment compensation in 2021 including any income taxes withheld visit the New York State Department of Labors website for Form 1099-G.

Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. To access your Form 1099-G log into your account at labornygovsignin.

Credited to estimated tax for a later year. Enter the security code displayed below and then select Continue. Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments.

Get Unemployment Assistance. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file. A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you including.

More information about Form 1099-G. The following security code is necessary to prevent unauthorized use of this web site. What You Need to Know.

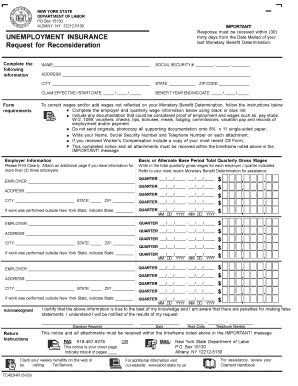

This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file. Get and Sign New York 1099 Unemployment Get Form. Form 1099-G was issued by the New York State Department of Labor and shows New York State withholding.

The 1099-G will show the amount of unemployment benefits received during 2020. Although unemployment benefits arent subject to payroll taxes they are considered taxable income. Is unemployment compensation taxable in NY.

The 1099-G tax form includes the amount of benefits paid to you for any the following programs. However the federal government created new provisions that allow 1099 earners to tap into unemployment benefits during the ongoing COVID-19 pandemic. Enter only the information requested on Form IT-1099-UI.

Those who received unemployment benefits for some or all of the year will need a 1099-G form. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021.

Nystateunemployment Fill Online Printable Fillable Blank Pdffiller

Fillable Online New York 1099 G Payers Name Street City State Zip Form Fax Email Print Pdffiller

How To Get A 1099 G Form From Unemployment In New York State Online Or A Hard Copy By Mail Youtube

New York Unemployment Compensation Form Fill Out And Sign Printable Pdf Template Signnow

Unemployment Compensation Unlike Shah Cpa Firm Pllc Facebook

Unemployment And Withholding Taxes Homeunemployed Com

Unemployment And Withholding Taxes Homeunemployed Com

Nys Unemployment 1099 Fill Online Printable Fillable Blank Pdffiller

Nys Unemployment 1099 Fill Online Printable Fillable Blank Pdffiller

Nys Unemployment 1099 Fill Online Printable Fillable Blank Pdffiller

No comments:

Post a Comment