Mitchell Hartman May 18 2020. I live in California and I filed for unemployment on march 19th.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

An applicant fills out an.

Unemployment benefits 0 dollars. We must act TODAY. Once you complete your non-payable week your payment amount will be between zero dollars and your Weekly Benefit Amount depending on your answers to the eligibility questions. The majority of states will allow you to get benefits for up to 26 weeks but others set the limit to as little as 12 weeks or as high as 28 weeksFor example you can get 12 weeks of benefits in Florida 13 weeks in Missouri and 21 weeks in Idaho.

Generally a mailed notice showing a 0 benefit award available may mean that 1. Benefits are not based on financial need. If youre already filed your taxes you should amend your.

I was hoping itd be a request for my 1099 forms or other self-employment earnings or at least a request for an appointment but it was just really really late a notice saying i was approved for 0 dollars of unemployment benefits starting. This bill makes the first 10200 of unemployment benefits non-taxable to households with incomes of under 150000 for 2020. Their current benefit is defined as 0 So because Lyft and Uber are continuing to disobey AB5 that qualifies us for regular unemployment on Sunday all other people certified to receive EDD will get a 600 increase in their unemployment benefit.

You make a new withholding choice on each time you certify for benefits. The official rate of 48 is less than a quarter of the true unemployment rate and is so far from reality its almost comical. Ohio paid out millions of dollars in unemployment to fraudulent claims while also overpaying some legitimate claims.

I was approved for unemployment at the end of March and today I went online to certify and at the end it told me my benefits payment is zero. And drivers and other misclassified workers will receive 0 NOTHING. 25 tax cut for West Virginians making between 50k -.

If you lose your job and its not your fault chances are you are eligible to receive unemployment benefits through the Department of Labors USDOL Unemployment Insurance UI programs. You have to be kidding me. Section 9663 of the American Rescue Plan ensures that most people who receive at least one week of unemployment compensation at any time in 2021 will be able to obtain a Silver plan with 0 premiums.

A report from the state auditor shows ODJFS paid out. I filed for florida unemployment i got laid off and couldnt find a job on 03282020 but its still pending Monetary Status. While an unemployment claim stating that you are eligible for 0 shouldnt deter you from applying there are some factors you should consider before filing a claim.

West Virginia households with adjusted gross income between 25000 and 50000 saw their average federal income tax liability drop from 2190 in 2017 to 1783 in 2019 a 26 reduction in federal income tax liability. Weekly benefits amount says 0. This item does not apply to your claim.

EDD need to verify your identity for the reported wages that belong to you If you filed for UI and received an award notice with 0 benefits available it could be due to one. EDD have no wage records reported by an employer to support an unemployment claim or 2. When you certify for benefits online over the phone or by mail you may answer a question which allows you to request federal income tax withholding at 10 of your payable amount.

If you have not worked for an employer W2 earnings since starting your Unemployment claim you do not need to take any action after your Benefit Year Ending Date. I was laid off on the 18th and filed on the 19th. After going on my account it shows Claim balance000 Weekly benefits amount.

Each state sets the standard length of time during which you can receive unemployment benefits. Californias 0 award notices are a way of denying traditional unemployment benefits to workers according to Bill Sokol a Bay Area-based labor attorney for Weinberg Roger. The problem is the award letter and UI online both display a 000 balance and weekly benefit.

Ive never collected unemployment and have made a. Half of Americans who lost work or wages are getting 0 jobless benefits. It gives me no reason as to why and my companys HR told me they havent contested any claims since they put us on furlough.

And Section 2305 ensures that the Silver plan will also include cost-sharing reductions that bring the actuarial value of the plan to 94 which. You will be notified by mail of your eligibility. The LISEP 228 unemployment number captures all types of unemployment.

Unemployment benefits are used to help workers who lost their jobs by no fault of their own. Unemployment compensation is taxable. Anyway heres an update.

If you worked more than 32 hours or had gross earnings greater than your weekly benefit amount your payment amount will be zero dollars. Benefit Year Ending Date before July 4 2021. The trade-off in economic terms is this.

Simply ignore the File A Claim and continue certifying each week as before. No work needed 300 dollars a week or self-worth of a job and 300 dollars a week. Including those forced to retire early those forced into PT work when they wanted fulltime work those unemployed for more than 26 weeks.

I was given an approval letter certified weeks got the debit card or check option notice identity verification and log in email. On march 27th I recieved an email letting me access my benefits program. I was working full time making 30000 a year.

The benefits are retroactive which means that you could potentially qualify for financial support insofar that you became unemployed as a direct result of the coronavirus pandemic on or after January 27. Even if you did have W2. This is a big deal if you got unemployment last year.

Very Little W2 Earnings. For more information refer to the handbook A Guide to Benefits and Employment Services DE 1275A available online at wwweddcagovforms. I got something from the NJ department of labor and workforce development in the mail today.

What does this mean. You must look for full time work each week. The issue still remains though that given that having no job at all will give you the equivalent of minimum wage in unemployment benefits workers at minimum wage are effectively earning 0 dollars.

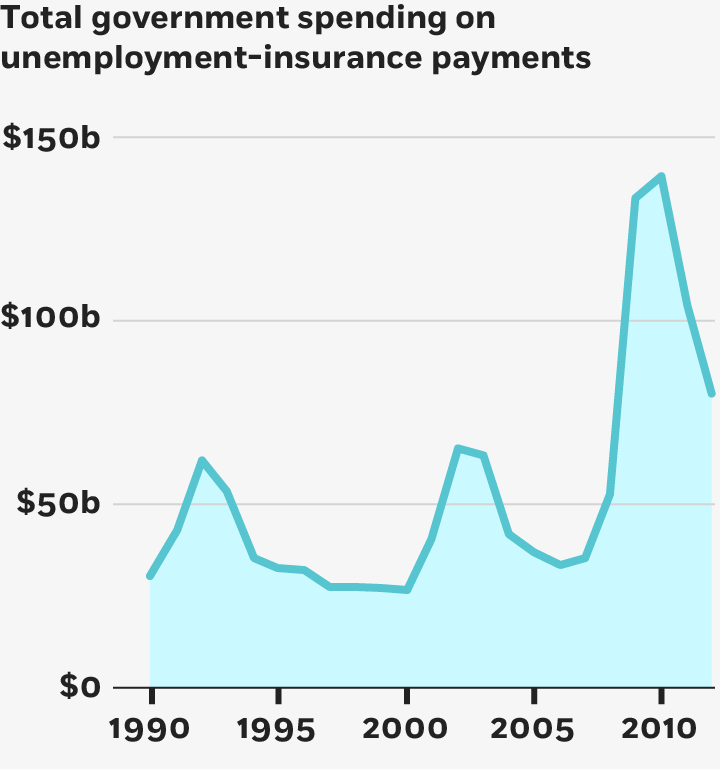

Does Extending Jobless Benefits Help In A Recession Chicago Booth Review

Pua Unemployment Il Ides Asks Some To Pay Back Illinois Unemployment Benefits Slashes Weekly Payments Abc7 Chicago

End Of 600 Unemployment Bonus Could Push Millions Past The Brink The New York Times

Pandemic Unemployment Assistance 20 Questions And Answers For Employers Ogletree Deakins

Massachusetts To Reinstate Work Search Requirements For Unemployment Benefit Claims

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Extra Pua Peuc Unemployment Benefits Delayed For Some Workers

300 Unemployment Bonus Calculator By State Forbes Advisor

The Nigerian Fraudsters Ripping Off The Unemployment System Wired

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times

4th Stimulus Check Update Benefits And Checks Coming To These States Marca

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

No comments:

Post a Comment