Here are the most commonly asked questions about Pennsylvania unemployment compensation. Earned at least 1688 in one quarter of your base period.

File Fixthedebtflat Png Miserable Billionaire American

Pennsylvania Department of Labor and Industry.

Pa unemployment eligibility. You must not be disabled. Apply and manage your UC benefits anytime anywhere. Further if a person was in PA and affected.

To determine eligibility you should complete and submit a Pennsylvania unemployment application either online or at your local Pennsylvania unemployment office. Have worked and earned income in Pennsylvania. It also contains information about details that each party-employer and claimant-is responsible for when issue crops up.

You must have a qualifying separation. This article gives information about problems that affect eligibility for PA unemployment compensation UC. Call 856 685-7420 or.

You must be unemployed through no fault of. If you give false information to the Department of Labor Industry department or withhold information to obtain UC you may be. Earned at least 100 during 18 weeks your base period.

PUA benefits ceased on September 4 2021. Check out PA unemployment claims guide to understand the filing process and eligibility criteria. PA Unemployment Eligibility Requirements To receive unemployment benefits you must meet the programs eligibility requirements which are related to your previous position.

File a Benefit Appeal. Schedule an appointment today. To qualify for benefits you need to prove you earned money throughout your base year or the year before you file for benefits.

Living out-of-state may potentially cause an eligibility issue as PUA is only for individuals unemployed for a direct COVID reason. Also workers must be determined to be unemployed through no fault of their own so if you quit or were fired you. You have to be available and able to work and you must actively look for work.

PA residents who have become unemployed through no fault of their own must meet unemployment insurance eligibility requirements in order to apply for unemployment benefits. Lose your job through no. If you are employed in Pennsylvania and are unable to work because of Coronavirus disease COVID-19 you may be eligible for Unemployment or Workers Compensation benefits.

Welcome to Pennsylvanias Unemployment Compensation UC system. Schedule an appointment today. If you are employed in Pennsylvania and are unable to work because of COVID-19 you may be eligible for regular unemployment compensation benefits.

The 4101 is rounded up to 4200. If a disability has caused you to be unable to work or unable to work in the capacity you were once able to you may be eligible for Pennsylvania disability benefitsTo determine eligibility use the information presented in the Determining Disability Eligibility section. Manage Personal.

In normal times according to the Department of Labor youre eligible for UI benefits if you. The agency determines your eligibility for unemployment in PA by checking to see if you meet the PA unemployment eligibility requirements including. Pennsylvania Unemployment Eligibility Issues.

Under various provisions of Pennsylvania law. This article is prepared to give general information only. Who qualifies to collect unemployment insurance.

The Pennsylvania UC Law establishes various requirements for eligibility for UC benefits. You must have sufficient qualifying wages and a minimum of 18 credit weeks in your base year. You must have lost your job through no fault of your own.

For weeks of unemployment after September 4 individuals will no longer receive the additional 300 per week and solely receive the benefit payment they are eligible. Among them are the following. Minimum earnings meet all to qualify.

To receive unemployment benefits in Pennsylvania there are certain criteria that you must meet. File or Reopen a Claim. To access account information such as overpayments appeal status documents and more log in to the PUA.

Unemployment Insurance benefits are subject to federal and state income taxes. Federal Pandemic Unemployment Compensation FPUC FPUC provides an additional 300 per week to individuals who are receiving at least 1 in other unemployment program benefits. Qualifications for unemployment benefits in Pennsylvania are set by the state Department of Labor and Industry.

File for Weekly UC Benefits. The claimants earnings for the week are 4101. Eligibility Requirement Details.

Eligibility requirements to obtain jobless benefits in the state of Pennsylvania. UNEMPLOYMENT COMPENSATION UC FRAUD IS A SERIOUS OFFENSE. As 42 exceeds the PBC by 2 the claimant is eligible for partial benefits of 98 140.

4904 unsworn falsifica tion to authorities. The Department of Labor Industry will continue to provide important employment benefit updates as the situation evolves. Pennsylvania Unemployment Eligibility Information.

To receive unemployment compensation workers must meet the unemployment eligibility requirements for wages earned or time worked during an established usually one year period of time. Are the Benefits Taxable in Pennsylvania. Obtain Federal Tax Documents.

Applicants must meet the following three eligibility requirements in order to collect unemployment benefits in Pennsylvania. In order to establish unemployment eligibility in Pennsylvania you have to. You must be able to work.

You must be actively seeking a new job. In addition to regular unemployment compensation benefits which provide roughly half of an individuals full-time weekly income up to 572 per week the federal CARES Act expanded UC benefits through several new programs. As 41 exceeds the PBC by 1 the claimant is eligible for partial benefits of 99 140 41 99.

That separated him or her from work. To qualify a person must have been working in PA at the time of the COVID-19 mitigationinfectionetc. The Pandemic Unemployment Assistance PUA provided up to 79 weeks of unemployment benefits to individuals not eligible for regular unemployment compensation or extended benefits due to COVID-19.

Your past earnings must meet certain minimum thresholds.

Offline Transition Information

U S Jobless Claims Drop More Than Expected To 211000 Expectations Forced Labor Finance

Pandemic Unemployment Assistance Is Accepting Claims For Self Employed Workers Senator Vincent Hughes

Top Nine Gov T Waste Examples Top Nine Editorial Goffs

Pandemic Unemployment Assistance Is Accepting Claims For Self Employed Workers Senator Vincent Hughes

.png)

Reminder Help Available As Federal Pandemic Unemployment Benefit Programs End Saturday

Glenn Fulcher Telford Pa Glenn Fulcher Twitter Telford Pension Fund Sayings

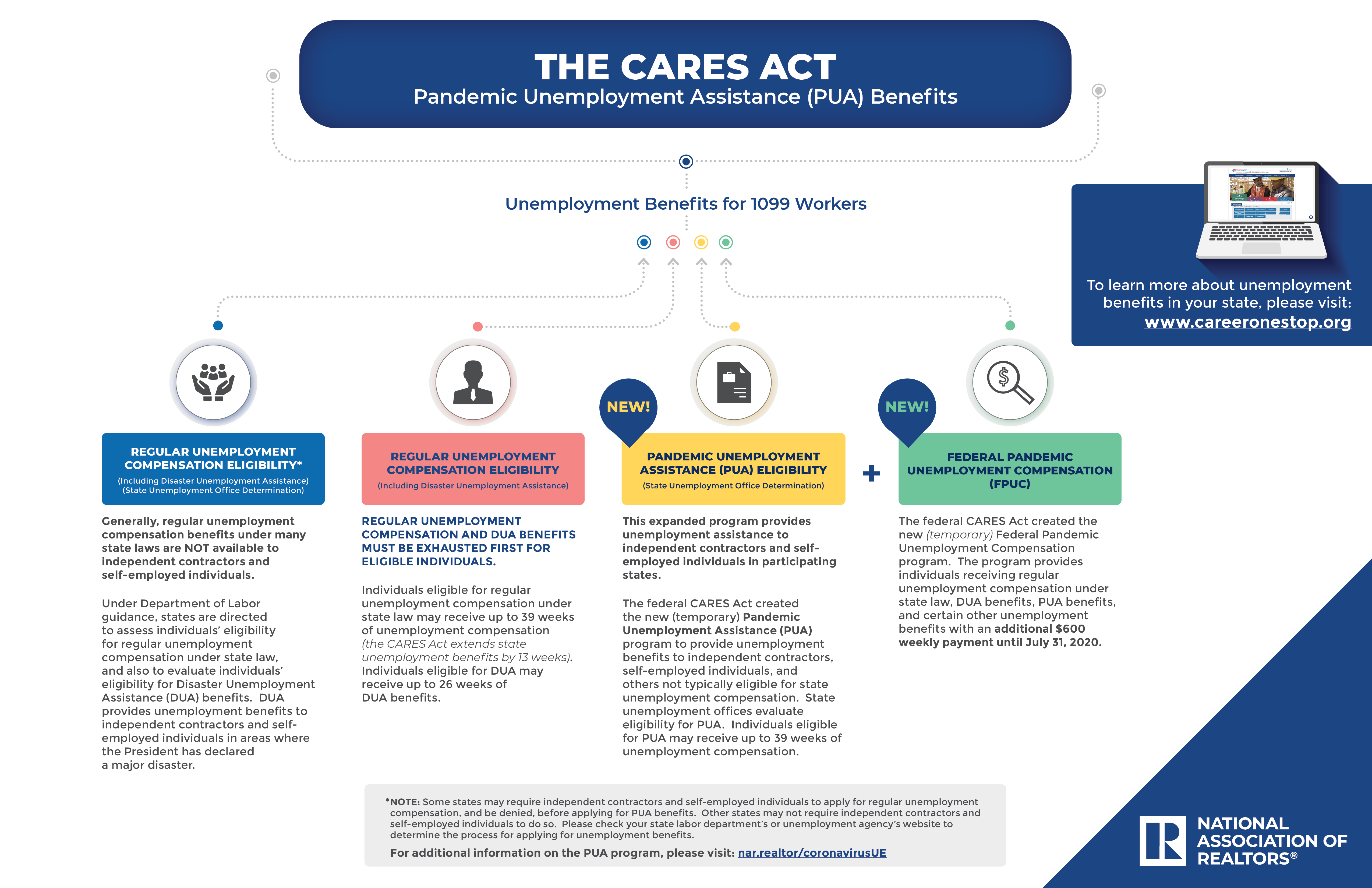

The Cares Act Pandemic Unemployment Assistance Benefits Flowchart

Applying For Unemployment Benefits During Covid 19 My Clean Slate Pa

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

No comments:

Post a Comment