Industrial Board of Appeals of the State of New York Department of Labor 70 AD2d 283 3d Dept 1979 affd 52 NY2d 777 1980 located here. Vacation pay does not include pay you received or are owed for unused vacation days simply because your employment ended.

Nys Department Of Labor On Twitter We Hear Your Concerns We Are Doing Everything We Can To Address The Surge In Volume And Ensure All Benefits Are Paid Please Continue Trying To

In some states lump-sum payments for vacation time awarded at termination will not decrease benefits.

Nys unemployment vacation pay. Your last day of employment is the last day you were actually working or were on paid leave such as scheduled vacation or medical leave. Courts in New York have held that an agreement to provide benefits or wage supplements like vacation can specify that employees lose accrued benefits. Am I eligible for unemployment in New York State.

At this point vacation days affect unemployment benefits. It does include pay you received or were owed for vacation days that were scheduled before you lost your job and that fell within the week you are claiming. A New York-specific employee policy on paid time off PTO vacation or sick leave.

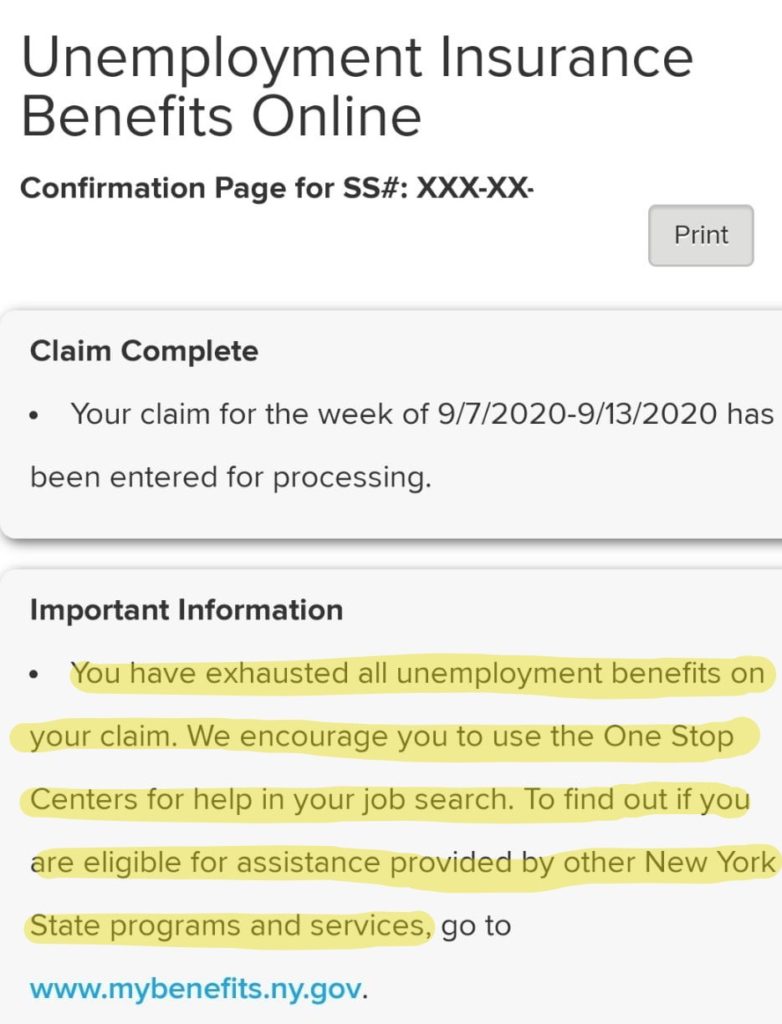

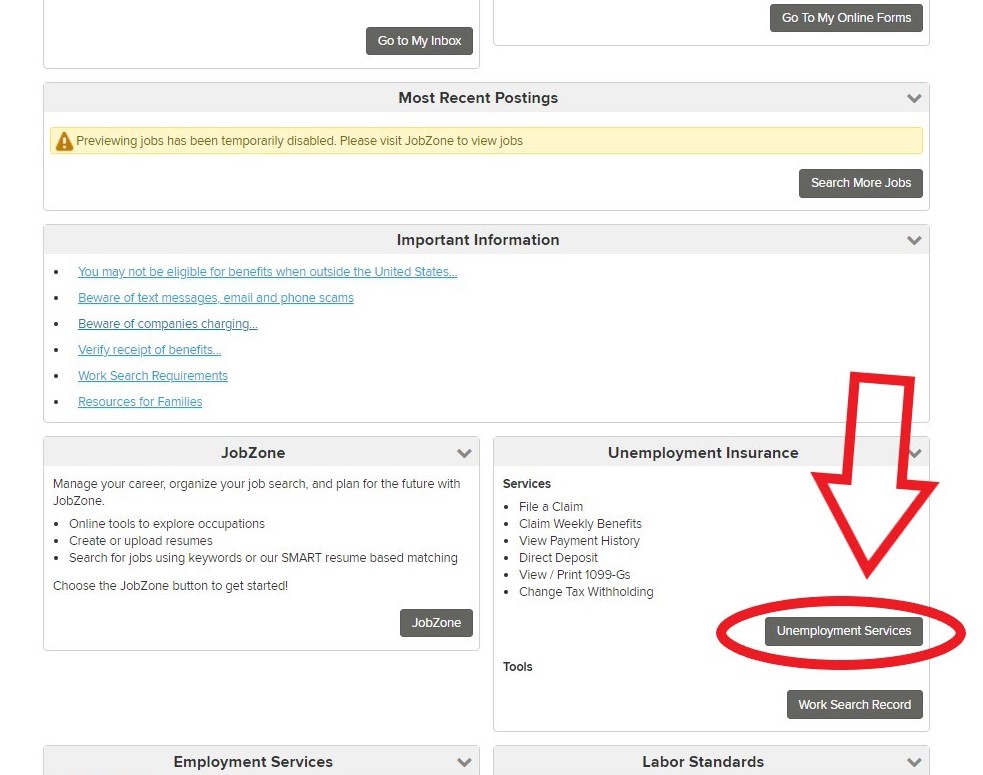

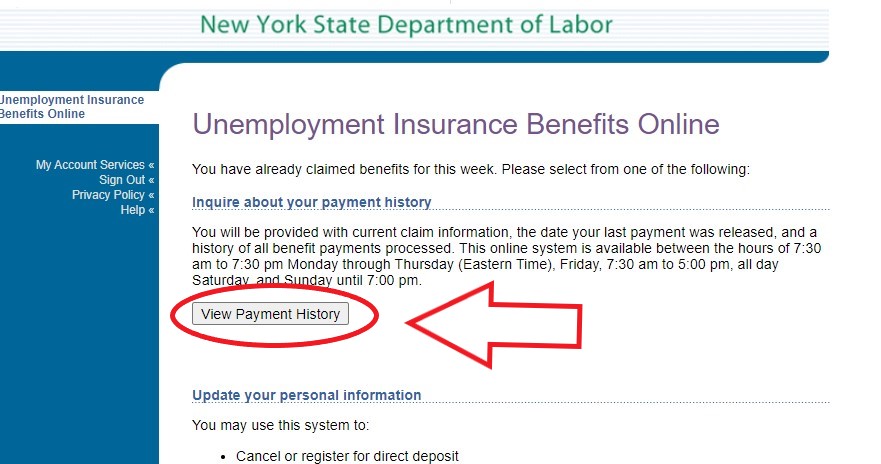

For a complete record of your Unemployment Insurance benefit payments sign in to your online account at wwwlabornygovsignin. On the My Online Services page click on Unemployment Services then View Payment History You can also call our Tel-Service line at 888 581-5812. UI law defines dismissal pay as payments made by an employer to an employee due to separation from employment.

However if you previously scheduled vacation time for the week in which you are claiming benefits you must report those days to unemployment. If the state of New York considers the money and benefits you receive from a former employer when you involuntarily lose your job as severance you can collect unemployment and severance simultaneously. However some states allow all workers without a set date for.

An employee is entitled to only one lump sum payment for all vacation and overtime compensatory time credits earned and accumulated as of the date of the beginning of military leave without pay. Receiving a payout for unused accrued vacation days is not considered vacation pay in the eyes of the NY Department of Labor. Call the New York unemployment phone number at 888 209-8124 MF 800 am.

Section 198c of the New York State Labor Law Benefits or Wage Supplements. In some situations after you leave a job you may receive the monetary value of your vacation days in your last paycheck. For example if you applied on September 6th but had an effective start date of March 15 then in addition to getting payments from September 6th and on you can also receive payments from March.

If you received or were owed vacation pay for any day during a planned workplace. Is WARN pay the same as dismissalseverance pay. Payments made under the New York State WARN Act Worker Adjustment and Retraining Notification ActArticle 25-A of the Labor Law are not considered.

If the vacation and holiday pay is paid out as part of a layofffurlough and the vacation was not scheduled in advance it will have no impact on unemployment benefit eligibility. Every employer is required to notify employees in writing or by publicly posting the employers policy on sick leave vacation personal leave holidays and hours of work. Depending on your employers policies you may ask to receive money for your vacation days instead of taking the days off.

Many people applied for Unemployment with a backdated claim. You can estimate what your benefits will be using this calculator. An employee has no inherent right to paid vacation and sick days or payment for unused vacation and sick days in the absence of an agreement either express or implied.

But once they establish a vacation plan employers must follow it. Consequently New York employers have discretion in how they structure their vacation benefits. Section 198-c1 of the NYLL requires that any employer who is a party to an agreement to pay or provide benefits or wage supplements to employees pay the amounts owed within thirty days of the.

Payment of accrued but unused vacation or paid time off within the first thirty days after you are terminated does not affect your entitlement to unemployment insurance so long as you receive dismissal or severance pay if any on or. Earned a minimum amount of wages determined by New York guidelines and. It can be incorporated into an employee handbook or used as a stand-alone policy document.

How Vacation Pay Affects Unemployment. The pay you receive for accrued sick days paid time off or unused vacation does not usually impact your eligibility for unemployment. However the claimant is ineligible if the claimant is actively receiving vacation pay for vacation time scheduled prior to the claimants last day of employment.

See Glenville Gage Company Inc. It is paid weekly and you need to certify each week in order to get paid for that week. Your benefit amount is based on your earnings.

Follow the prompts to check your payment history and payment status. Dismissalseverance pay does not include payments for pension retirement accrued leave and health insurance. Vacation or holiday pay.

Any such credits for which an employee is not paid should be restored when the employee returns to the payroll from military leave. In New York however like most states employers do not have to give their employees paid vacation. Worked in New York during the past 12 months this period may be longer in some cases and.

This Standard Document applies only to private workplaces and is based on New. However if you use TTYTDD call a relay operator first at 800 662-1220 and ask the operator to call the Telephone Claims Center. Administration Code Section 1217-810 provides information regarding unemployment benefits.

If you are a hearing impaired individual who is being assisted by another person call the Telephone Claims Center at 888 783-1370. Vacation pay is a typical employee benefit throughout the United States. This Standard Document addresses the accrual use and carryover of PTO vacation and sick leave.

26 rows You may not file for a week when you work more than 30 hours or earn. It states that the receipt of your vacation pay in a lump sum will not prevent you from filing for unemployment said Claudia Mott a certified financial planner with Epona Financial Solutions in Basking Ridge. When employees receive ongoing payments for vacation while they are unemployed those payments will often reduce their unemployment checks.

It may be paid as a series of payments or as a lump sum. The maximum weekly benefit in New York is 504 people who make approximately 52000 will receive the maximum. Severance pay is considered dismissal pay.

To be eligible for this benefit program you must a resident of New York and meet all of the following.

![]()

New York Unemployment Tips Hotel Trades Council En

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

How Does Unemployment Work In New York Employment Lawyers

How To Certify Weekly Benefits Nys Unemployment Insurance Jamling Law Firm Youtube

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

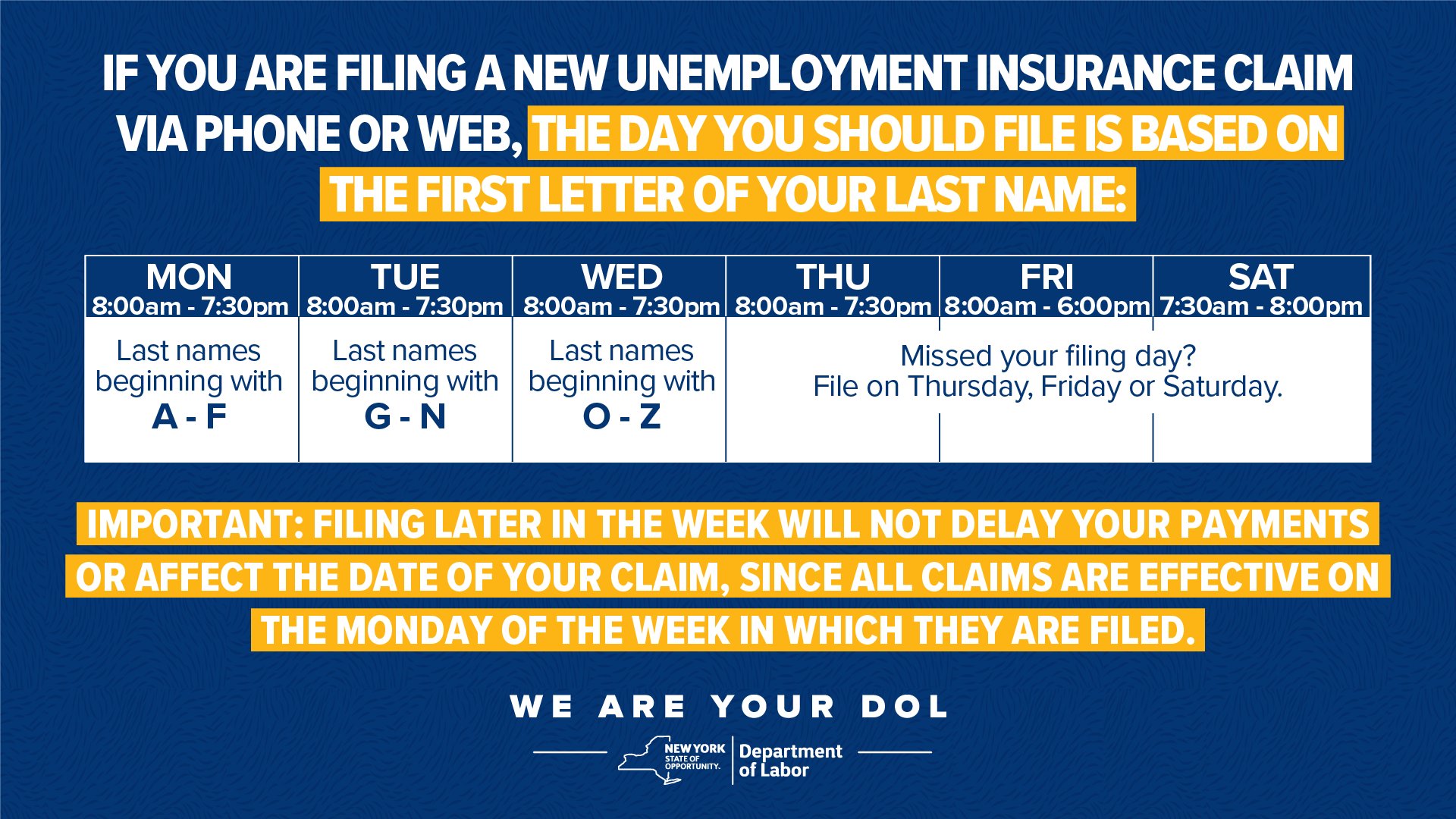

Nys Department Of Labor On Twitter Icymi The Best Way To File A New Claim For Unemployment Insurance Ui Benefits Is Online At Https T Co T2tezsp2lf With All The Information Listed Below Click The

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Unemployment Benefits Id Card New York State 1945 Vintage Etsy In 2020 New York State New York Travel New York

All About Extended New York Unemployment Benefits

Employees Say Vacation Days Make Or Break A Job Infographic Infographic Infographic Marketing Job Hunting

No comments:

Post a Comment