However State Budget Director Robert Mujica announced the state. The first round of refunds are anticipated to be sent out in May.

Where S My Refund New York H R Block

Paper checks will be sent starting Friday.

Nys unemployment tax refund. New York which has the second highest unemployment rate in the country is one of just 11 states that is fully taxing unemployment benefits according to HR Block. Enter your Social Security number. New York and Minnesota have top rates of 882 and 985 respectively.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. Select the tax year for the refund status you want to check. President Joe Biden announced in March that the federal government would not tax the first 10200 of unemployment benefits for taxpayers earning less than 150000 in 2020.

Enter the amount of the New York State refund you requested. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. Allow at least six weeks from the date on the notice you received from the Internal Revenue Service or New York State Department of Taxation Finance for our office to issue your refund.

Instead of the roughly 1500 refund she typically receives she got. While you may be eligible to exclude a portion of your unemployment benefits on your federal tax return there is no exclusion in New York State. It gives a federal tax break on up to 10200 of unemployment benefits from 2020.

Not the amount of the refund. The average refund for overpayment is about 1200. Are unemployment benefits exempt from income tax.

The 10200 tax break is the amount of income exclusion for single filers. Unlike IRS NY will still tax first 10200 of unemployment benefits. If you exclude unemployment compensation on your federal return as allowed under the American Rescue Plan Act of 2021 you must add.

See Refund amount requested to. So far the refunds have averaged more than 1600. The IRS has sent 87 million unemployment compensation refunds so far.

Anyone who received unemployment benefits in 2020 can claim up to 10200 tax-free according to a provision in the 19 trillion coronavirus relief bill. You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. On March 17 they changed the tax laws and made the first 10200 of unemployment tax free so what the IRS did is theyre adjusting and people are starting to receive their refunds said.

New York will continue to apply state income tax to 2020 unemployment benefits in. You can work ten hours or less and not see a reduction in your weekly benefits 11 to 16 hours and get 75-percent of your weekly benefit rate and. People whose adjusted gross income was less than 150000 can exclude up to 10200 of unemployment benefits from taxes in 2020.

STATEN ISLAND NY. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. For those taxpayers who already have filed and figured their tax based on the full amount of unemployment compensation the IRS will determine the correct taxable amount of unemployment compensation and tax the statement read in part.

Last week the IRS announced it began sending out refunds to eligible taxpayers who have paid taxes on 2020 unemployment benefits. The total amount of unemployment benefits you received is taxable to New York State under New York State tax law. The IRS is issuing refunds automatically to taxpayers who filed a return before the unemployment exclusion was.

The IRS will issue refunds through direct deposit if they have your banking info otherwise the refund will be mailed as a paper check to the address on record. Choose the form you filed from the drop-down menu. The newest round of refunds has already gone out as direct deposits.

The unemployment benefits she received during that time also resulted in a smaller tax refund this year. However a lower marginal tax rate would likely apply to taxpayers eligible for the federal tax break. Under longstanding New York State law unemployment compensation is subject to tax which means you should report the full amount of unemployment compensation on your New York State personal income tax return.

You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. So far the refunds are averaging more than 1600. However not everyone will receive a refund.

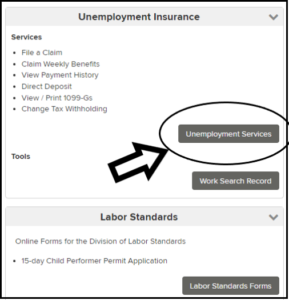

New York State Department of Labor - Unemployment. The IRS said last week it sent more than 28 million payments. You did not get the unemployment exclusion on.

Under longstanding New York State law unemployment compensation is subject to tax which means you should report the full amount of unemployment compensation on your New York State personal income tax return. Refunds will be paid to your Unemployment Insurance benefits debit card or to your bank account depending on the payment method associated with your claim.

What Benefits Can You Get In New York Tax Credits Unemployment Insurance As Com

Don T Tax The Jobless New York Must Return Cash To Those Who Received Pandemic Enhanced Unemployment Aid New York Daily News

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

What Benefits Can You Get In New York Tax Credits Unemployment Insurance As Com

1099 Unemployment Nyc 2011 2022 Fill Out Tax Template Online Us Legal Forms

Felder Demands Tax Relief Again Ny State Senate

Tax Refund Update Eyewitness News

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Unemployment And Withholding Taxes Homeunemployed Com

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

Will New York Tax Unemployment Payments We Still Don T Know Syracuse Com

Stimulus Check Live Updates The November Changes To Benefits Child Tax Credit Tax Refunds Marca

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

No comments:

Post a Comment