Typically the end of the benefit year means the jobless would have to establish a new claim to determine eligibility for benefits and to. 1 2020 to Dec.

18 2021 741 pm.

Nj unemployment year end statement. Updates to the law. You should receive a year-end statement from your states unemployment agency by January 31 for the previous years unemployment benefits. COVID jobless benefits end this month for 80K in NJ.

Click here for the Request for Change in Withholding Status form. We provide the IRS with a copy of this information. Its not a glitch so do not open a new claim.

I tried to certify this past Sunday on schedule and received a message that the my benefit year ended. New Jersey has extended benefits on more than 275000 claims through automation in the past six weeks. You can opt to have federal income tax withheld when you first apply for benefits.

If you received unemployment benefits in 2020 you will receive Form 1099-G Certain Government Payments. Read our FAQs on paid leave job protection and caregiving. New Jersey is the only state to automate the federally required benefit year-end review and refiling of unemployment claims a process that could have taken up to three months without this enhancement in place.

New Jersey claimants currently receiving benefits do not have to take any action. However the Department has seen 2034337 new jobless claims in the past year far eclipsing any other period. 1 2019 to Sept.

18 2021 741 pm. Filed in NJ and have been receiving benefits since. Employed persons can show pay sheets or a printout from their employers.

For more information on receiving unemployment benefits please visit myunemploymentnjgov. A person files for unemployment gets benefits gets the 13 weeks and is now ready for the 20 weeks but the end of the benefit year will come before the 20 weeks is. I need info on my 1099-G form from NJ Unemployment.

The year-end statement provides all the required information for inclusion on a W-2 form. Additionally a year-end summary of all payment activity is mailed to employers by January 15. You will still be able to receive benefits for eligible weeks prior to September 4 2021.

You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development Unemployment Insurance PO Box 908 Trenton NJ 08625-0908. So I would like to get my W2 form from NJ government. If you have had any employment in New Jersey during the period of time used to calculate your benefits you will receive this form.

I live in PA and worked in NJ for the last 2 years. As more reach end of benefit year Updated. The form is called a Certain Government Payments Form 1099-G.

It will show you the amount of money you may collect each week weekly benefit rate and the total amount of money you may be entitled to collect during the one-year period that your claim is in effect maximum benefit amount. December 10 2021 744 am. For the week ending Feb 27 NJ recorded 392 fewer new unemployment filings compared with the prior week a 35 decrease marking the 3rd straight week of declines.

When the review is complete they will receive confirmation their certification was successful when they claim their weekly benefits. Federal law requires a review of unemployment claims after one year for benefits to continue. For anyone who recently reached the end of their benefit year a review has either been completed or is under way.

New unemployment claims tick up in NJ. You dont need to include a copy of the form with your income tax return. If you got an authorization code by mail in the last two years use that.

Disability During Unemployment benefits and Unemployment Insurance benefits are also taxable for federal income tax purposes. I have the monetary information I just need info on the payers - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. New Jersey received 62 billion from the 19 trillion American Rescue Plan.

Form 1099-G Income Tax Statement showing the amount of Unemployment Insurance benefits paid and amount of federal income tax withheld will be in January following the calendar year in which you received benefits. Is your benefit year ending soon. First time on unemployment and need some help.

Because unemployment benefits are taxable any unemployment compensation received during the year must be reported on your federal tax return. If unemployment is your only income and the state deposits the money into your account you may not have your statements available when you need them. The permanent authorization code issued by the Department of Labor not to be confused with the PIN used to file your NJ-927 and WR-30 with the Division of Revenue.

A base year is the first four of the five prior quarters before a claim was filed. Request Your Unemployment Benefit Statement Online. For those whose benefit year ends in April through June the base year considered for a new claim would be Jan.

PPP is based on Schedule C profit which is not what the UI offices are looking at again in my state and its not income. Federal benefits created during the benefit expired September 4 2021. New Jersey is ending extended unemployment benefits for roughly 80000 people as businesses.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information. New Jersey makes statements available on the Internet to anyone with an account. The current unemployment rate is 73 where at the height of the pandemic the state saw 166 unemployment in April 2020.

Was laid off in late August. For a new claim filed in March the base year is Oct. The year-end statement provides all the required information for inclusion on a W-2 form.

Your Year-End Statement To download your year-end statement you will need your Federal Employer Identification Number FEIN formatted as a 15-digit number and the permanent authorization code issued by the Department of Labor not to be confused with the PIN used to file your NJ-927 and WR-30 with the Division of Revenue.

Legal Letter Format Pdf Editable Pack Of 5 Legal Letter Business Letter Template Lettering

Organ Donation Thesis Statement Examples Thesis Statement Examples Thesis Statement Writing Topics

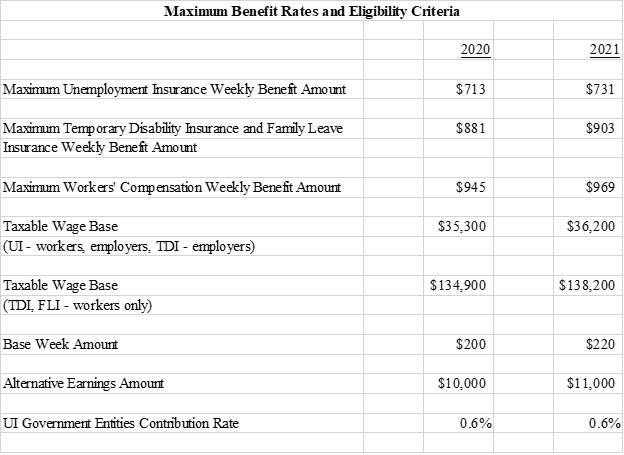

Njdol Maximum Unemployment Benefit Rates Increase On January 1st

Proof Of Unemployment Letter Sample Manswikstromse Throughout Proof Of Unemployment Letter Template 10 P Letter Templates Letter Of Employment Letter Sample

Essay Example High School Essay Examples Essay Writing Tips Essay

Water Is Life Short Essay In Hindi Writing Generator Essay Short Essay

How To Write A 1500 Word Research Paper In 2021 Research Paper Math Problem Solving Strategies Problem Solving Strategies

Essays Unemployment Uganda Essay Examples Essay Cause And Effect Essay

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Positive Mindset

Business Letter Sample Request For Approval Copy Cover Letter Formal Buisness Letter Cover Letter Format Business Letter Sample Application Cover Letter

Free Business Plan For Home Health Agency Common App Essay Essay Writing Tips Essay

Nih Research Proposal Template Essay Research Proposal Writing

Costum Loss Of Employment Verification Letter Excel Letter Of Employment Lettering Job Letter

No comments:

Post a Comment