July 1 2020. December 10 2021 744 am.

No Joy This Season For N J Workers Still Waiting For Unemployment Benefits New Jersey Monitor

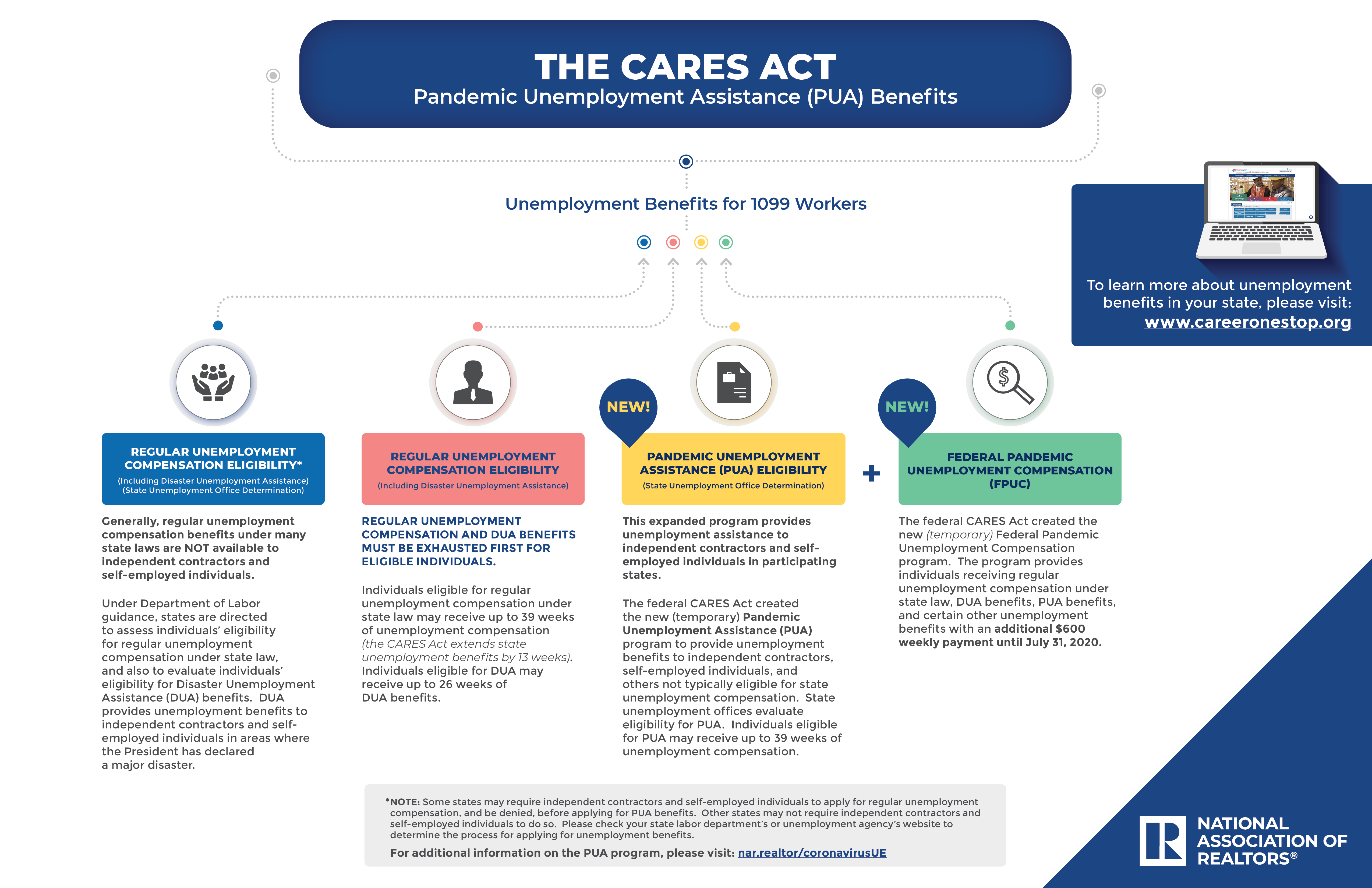

The first payable week under the Extended Benefits program is July 4 2020 as the 13 weeks of Pandemic Emergency Unemployment Compensation PEUC must be paid prior to Extended.

Nj unemployment benefits 2020. If you returned to work since filing this claim you may be eligible to file for a new claim I am confused. 26 weeks from the state another 13 weeks from the federal government and then another 20. The benefit year on your unemployment claim dated 06-28-2020 has expired.

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. I tried calling but have yet to get in contact with anyone from NJDOL. How Long Do Benefits Last.

The maximum anyone can receive regardless of how many weeks they worked during the base year or how much they earned is 26 times the maximum weekly benefit rate. The maximum weekly benefit for new state plan Temporary Disability and Family Leave Insurance claims increases to 993 from 903 while the maximum weekly benefit for new Workers Compensation claims rises to 1065 from 969. Below are answers to frequently asked questions about benefit payments and taxes.

Paying Federal Income Tax On Your Unemployment Insurance Benefits. Workers still waiting for unemployment benefits. In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731.

State extended benefits were triggered in July 2020 due to the states unemployment rate. Her maximum benefit amount will be 300 x 26 7800. Your base period is defined as the first four quarters out of the past five quarters before you file your initial New Jersey unemployment weekly claim.

Protesters urging official to fix what they called a broken unemployment system on May 22 2020. Read our FAQs on paid leave job protection and caregiving. How do I claim my weekly NJ unemployment claim by phone.

The maximum New Jersey unemployment amount in 2020 is 713. FOR IMMEDIATE RELEASE. The maximum benefit rates are recalculated each year based on the statewide average weekly wage.

For important information on the 2020 tax year click here. 888-795-6672 you must call from a phone with an out-of-state area code New Jersey Relay. Congress hasnt passed a law offering a.

No joy this season for NJ. Photo by Joe RaedleGetty Images Lois Hart fears this will be the second Christmas in a row she will disappoint her eight grandchildren. Per federal regulations on April 17 2021 NJ state extended.

Overall eligible workers can get a total of 59 weeks of benefits. The benefit rates and taxable wage base for 2022 reflect the 141952 average weekly wage for 2020 which rose by 99 from 2019 largely due to the number of low-wage workers who were out of work during the pandemic and the higher wage paid to those. Under normal circumstances laid off workers who meet the requirements may receive benefits for up to 26 weeks during a 52-week period.

To be eligible for Unemployment Insurance benefits in 2020 you must have earned at least 200 per week during 20 or more weeks in covered employment during the base year period or you must have earned at least 10000 in total covered employment during the base year period. You will still be able to receive benefits for eligible weeks prior to September 4 2021. State extended benefits were triggered in July 2020 due to the states unemployment rate.

To be eligible for New Jersey Unemployment Insurance benefits in 2020 workers must have earned at least 10000 in the base year period or at least 200 per week for 20 weeks. We have distributed 37 billion in benefits to help more than 15 million claimants through the darkest days of the pandemic. Additionally on July 1 2020 New Jerseys high unemployment rate triggered state extended benefits for NJ workers who have exhausted unemployment benefits if among other requirements they meet the minimum earnings requirement and the date of their initial UI claim is May 12 2019 or later.

No unemployment benefits are available to you at this time. Your maximum benefit amount depends on how much money you earned in your base period. See links to assistance with food housing child care health and more.

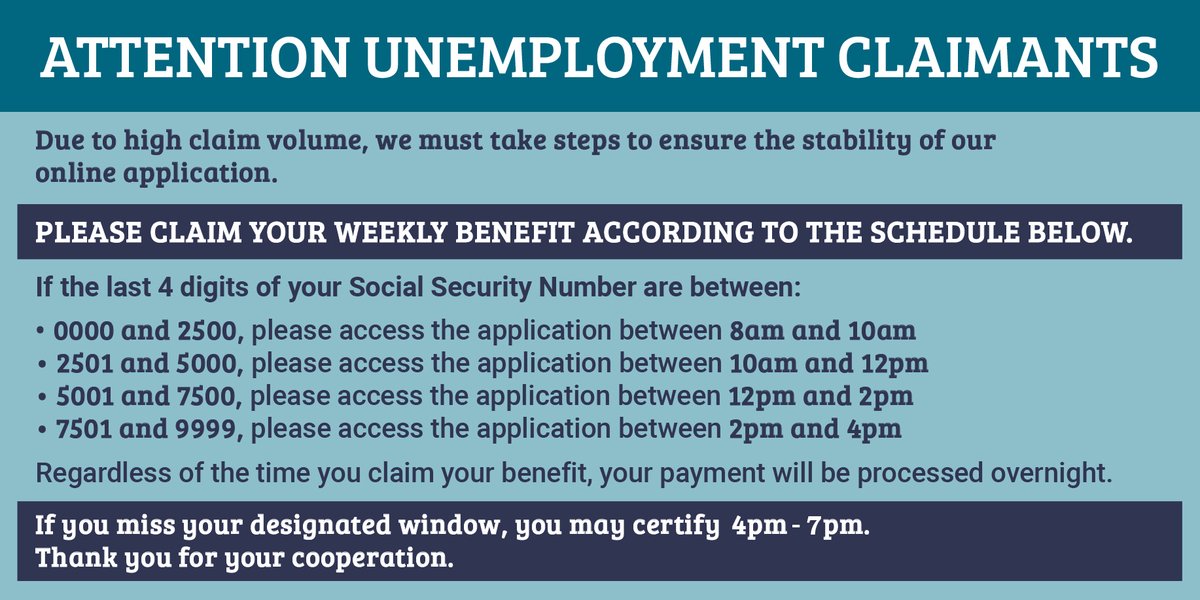

Vc_row vc_column vc_column_textNew Jersey is ending extended unemployment benefits for. TRENTON A record 206253 new unemployment claims were filed with the New Jersey Department of Labor and Workforce Development for the week ending March 28 bringing the two-week total of new claims to just over 362000 as COVID-19 bore down on the states workforce and businesses. I tried to reopen my claim.

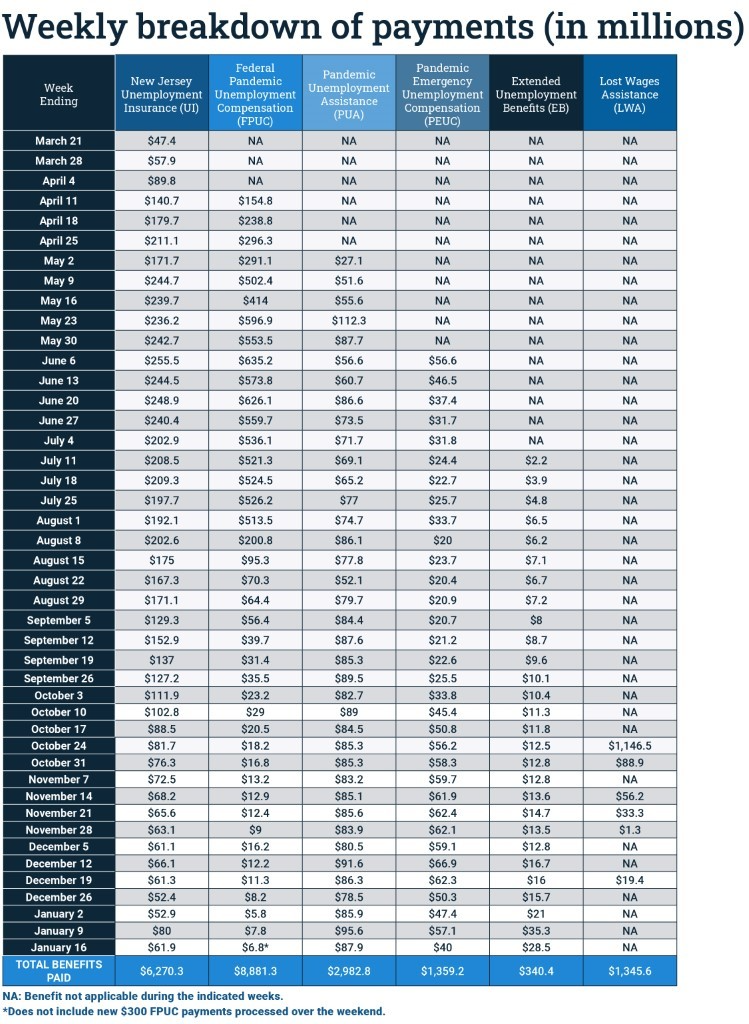

Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes. Regular state UI and extended benefits provided roughly a quarter approximately 9 billion of that total according to the New Jersey Department of Labor and Workforce. Federal benefits created during the benefit expired September 4 2021.

Right now the maximum total benefit amount any one claimant can receive during their annual claim period is 20904 804 x 26. We have distributed 37 billion in benefits to help more than 15 million claimants through the darkest days of the pandemic. Call a Reemployment Call Center.

TRENTON The New Jersey Department of Labor and Workforce Development announced that it would begin providing 20 weeks of extended unemployment this week to New Jersey workers who have exhausted their state and federal jobless benefits. Extended Benefits EB Program In accordance with New Jersey Unemployment Extended Benefits Law the Extended Benefit EB program has been activated effective May 3 2020. The Center Square New Jersey doled out nearly 35 billion in Unemployment Insurance UI benefits to 16 million claimants between March 2020 and the week ending Sept.

With the aid of the enhanced federal unemployment benefits programs the New Jersey Department of Labor and Workforce Development NJDOL has paid 34 billion in benefits to more than 16 million claimants since March 2020 including to hundreds of thousands who would have been ineligible for benefits without the federal expansions. COVID jobless benefits end this month for 80K in NJ.

Njdol Jobless Residents Receive New Stimulus Payments

Njdol Commissioner Njdolcommish Twitter

The Cares Act Pandemic Unemployment Assistance Benefits Flowchart

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Njdol Commissioner Njdolcommish Twitter

Total Pandemic Relief To Nj Workers Nears 35b As Federal Benefits Expire New Jersey Business Magazine

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

300k Workers Move To N J S Unemployment Benefits After Federal Programs End New Jersey Monitor

New Jersey Unemployment Rate 2020 Statista

Njdol Commissioner Njdolcommish Twitter

N J Labor Commissioner Answers Questions From Workers Filing For Unemployment Benefits Roi Nj

No comments:

Post a Comment