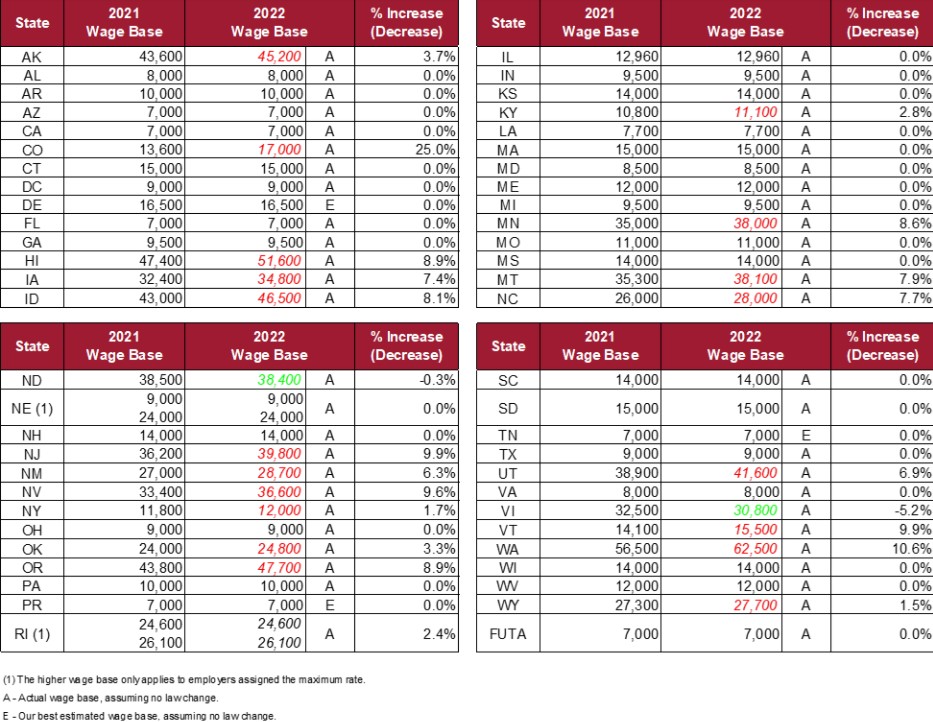

The wage base for the employee will increase from 138200 to 151900 and the tax rate will decrease from 28 to 14. To access from the APA home page select Compliance and then State Unemployment Wage Bases under Overview The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most states have wage bases.

Labor And Economic Opportunity December 2021

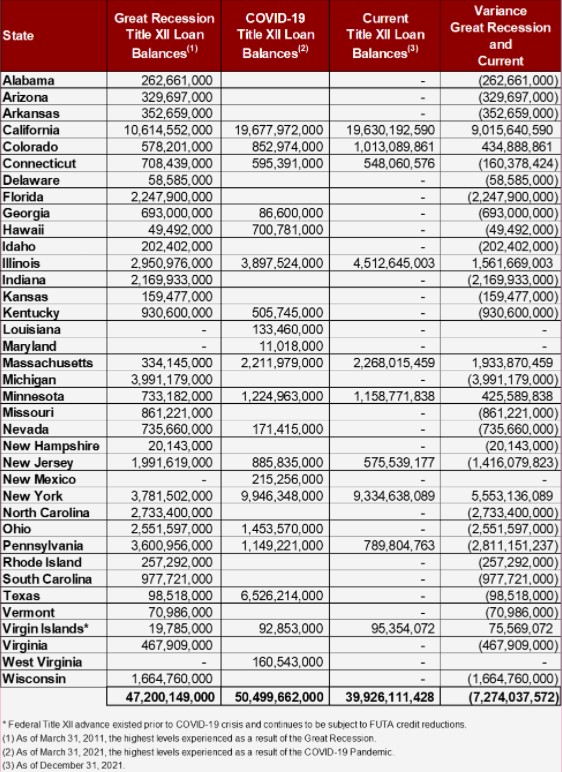

COVID-19 caused high rates of unemployment across the country and depleted many state unemployment insurance funds.

Michigan unemployment tax rate 2022. A higher wage base limits b higher percentages again known as the tax rates that are. 5 Small Business Trends to Expect in 2022. The unemployment tax rate for experienced contributory employers those who have been in.

The rates will be as follows. The pandemic has definitely made its mark upon the world especially in the business world. Since these states had an outstanding balance on January 1 2021 employers with employment in these states may be subject to an increase in Federal Unemployment Tax for 2022 if the loan amount remains outstanding as of January 1 2022 and.

Your Michigan tax liability has the potential to increase over prior years when the taxable wage base was 9000 due to the current years increase. Standard rate 257 207 employer share. The Michigan 2021 state unemployment insurance SUI tax rates continue to range from 006 to 103.

SUI New Employer Tax Rate Employer Tax Rate Range 2021 Alabama. 050 employee share 15 59. The range of rates for experienced employers will continue to run from 006 to 103.

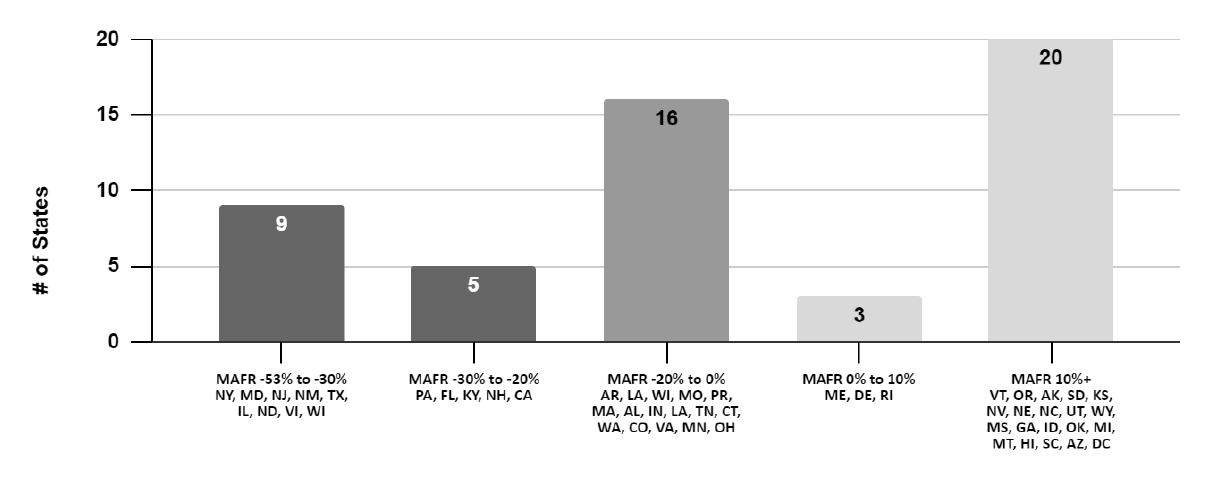

How SUI is changing in 2022. The Michigan income tax has one tax bracket with a maximum marginal income tax of 425 as of 2022. More information on the work registration requirement.

New employers except for certain employers in the construction industry pay at 27. Tax Rates Generally in the first two years of liability the tax rate is set by Michigan law at 27. The wage base and rate will both change in 2022.

15 62 emergency. That is slightly below the national average of 48 for the entire United States according to data from the Michigan Department of Technology Management and Budget for September. Under SB 1828 and effective January 1 2022 the law createsa two-tier individual income tax rate structure of 255 and 298 depending on filing status and taxable income and if general fund revenue thresholds.

Detailed Michigan state income tax rates and brackets are available on this page. Are met a reduced two-tier individual income tax rate structure of 253 and 275 or a 25 tax rate beginning in 2023. The rates in the third and fourth years of liability are partly based on the employers own history of benefit charges and taxable payroll.

The list of state wage bases is from 2019 to 2022. This will result in the maximum tax decreasing from 38696 to 21266. In recent years this construction rate has ranged from 68 to 81.

Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount. Contributing employers must pay taxes on the first 9500 of each employees wages in the 2021 calendar year. The exception is for new employers in the construction industry whose rate for the first two years is the average construction contractor rate as determined by the Unemployment Insurance Agency each year.

The unemployment tax rate for new employers will remain at 20 for 2022 under Act 8209 24 VIC. Notification of State Unemployment Tax Rate Early each year the UI issues its Tax Rate Determination for Calendar Year 20__ Form UIA 1771. Consequently the employer SUI taxable wage base will increase to 9500 for 2021 unless the state legislature reintroduces and enacts similar legislation during the 20212022 legislative session.

This history is known as an employers unemployment insurance experience. How does the taxable wage base affect my organizations unemployment tax liability. Michigan State Unemployment Insurance SUI Michigan Wage Base.

Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages. Form UIA 1771 Tax Rate Determination for Calendar Year. The increase to the 2021 SUI taxable wage base up from 9000 in 2020 was confirmed by the Michigan Unemployment Insurance Agency UIA.

And verify ther registration with either an in person or virtual appointment. These increases can come in the form of. 030 142 including solvency surtax California.

7 2021 unemployed workers filing a new claim for benefits will be required to register for work with Michigan Works. Now these funds need to be replenished so a number of states are increasing taxes. This money came in prior to the other half of the sum that will arrive in April of 2022 during tax season with each of these monthly payments having gone out on the 15th day of the month.

It shows an employers prior Actual Reserve benefits charged and contributions paid basis of the CBC and ABC components since the last annual determination and the employers new Actual Reserve. Withholding Formula Michigan Effective 2022. Including federal and state tax rates withholding forms and payroll tools.

Michigan Announcement Relating to 2022 Unemployment Tax Rates Unemployment rates for 2022 will remain unchanged from 2021. As a result the Obligation Assessment OA added to employer SUI tax rates since 2012 was eliminated for 2020Tax Alert 2020-0131 The OA was used from 20122019 to repay the 32 billion in bonds issued to retire the federal UI loan in December 2011 and return the net FUTA rate to 06. 065 68 including employment security assessment of 006 Alaska.

For comparison the unemployment rate in the state for September 2020 was 82. 2022 Michigan Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Kiel Institute Economic Outlook German Upswing Loses Momentum

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Demand For Michigan Workers Is Very High But Many Have Given Up Looking Bridge Michigan

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Labor And Economic Opportunity December 2021

2022 Federal Payroll Tax Rates Abacus Payroll

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Depression Level Michigan Unemployment Tops 1 Million From Coronavirus Bridge Michigan

No comments:

Post a Comment