Can I claim benefits if I work part-time. A base period of April through December of the prior year and January through March of the current year is used for claims filed in July through September.

How To Calculate Amount Of Unemployment In Ohio 9 Steps

The maximum total number of weeks available to claim unemployment compensation in Ohio is 63 weeks.

Ohio unemployment base period. Ohio uses a base period similar to that of California and Georgia. 20 weeks You must have worked full-time or part-time at least 20 weeks during the base period see the first chart below for any number of employers who pay unemployment contributions. What If My Application for Ohio Unemployment Benefits Is Denied.

Wage requirements are the biggest requirement examined by the Ohio unemployment department. Federal extension for unemployment compensation is available for 37 weeks. This affects which quarterly earnings are considered as your base period see below when calculating your weekly benefit amount.

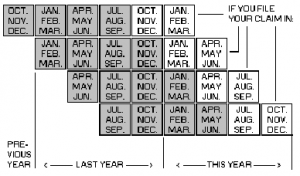

Employment in the base period. So for example if you file in May your base period would be January through December of the previous calendar year. Ohio Unemployment Base Period.

Ohio applicants must have worked during the last 12 to 18 months which is called a base period The base period includes the earliest 4. Individuals who live in Ohio but worked in another state during their base period should file in the other state. Claimant was not discharged from recent employment for just cause.

You worked for at least 20 weeks during a base period for a company thats covered by Ohio unemployment insurance. Regular unemployment insurance from the State of Ohio is available for 26 weeks. For claims filed April through June the base period is January through December of the previous year.

Interstate Claim Individuals who worked in Ohio during their base period the first four of the last five completed calendar quarters but now live in another state may file Ohio unemployment claims. Youre unemployed through no fault of your own. A week may be established with any.

Your wages earned in the base period must be at least 3600 and equal a minimum of 15 times the wages earned in your highest base period quarter for you to be eligible. What is Base Period or Base Year. What is the Alternative or Alternate Base Period.

Under Ohio law most employers are required to pay contributions for unemployment insurance. Base period is the first four of the last five completed calendar quarters immediately before the first day of an applicants benefit year. To be eligible for UI benefits in Utah you need to have earned wages in at least two calendar quarters in your base period.

This can be and has been extended during times of economic hardship. In Ohio the standard base period is the first four out of the last five calendar quarters before you file your claim. Unemployment benefits continue up to a maximum of between 20 and 26 weeks depending on the number of your qualifying weeks in your base period.

Unemployment applicants must have worked a minimum of 20 weeks during the base period to become eligible for unemployment benefits. If a claim is filed anytime between January to March 2020 the base period will be 12 months from October 1 2018 through September 30 2019. Like most states Ohio limits the period you can receive unemployment benefits to a maximum of 26 weeks.

How to find Standard Base Period. The base period is the first 12 month or four calendar quarters within the past 15 months or five calendar quarters. Unemployment benefits paid to eligible claimants are charged to the accounts of the claimants employers during the base period of the claim.

Your base period is the period of time that you worked prior to losing your job in which you establish the amount of money that you will receive in unemployment. There is a required minimum Average Weekly Wage for the base period weeks of covered employment. There must be a qualifying se paration.

For example if you filed your claim in August of 2021 the base period would be from April 1 2020 through March 31 2021. It does not usually permit benefits extensions apart from in exceptional situations such as during the coronavirus pandemic. Understand that using the unemployment benefits estimator is not an application for benefits or.

How long do you have to work to get unemployment in Ohio. In 2018 that minimum is 256 The claimant must be unemployed at the time of filing. Ohio unemployment eligibility also relies on the applicant earning enough wages for a certain period of time.

Enter the date that you filed your claim or will file your claim for unemployment. The base period in Ohio is the earliest four of the five complete calendar quarters before you filed your claim for benefits. If you file in 2020 you must have at least an average weekly wage of 269 before taxes and deductions during this base period.

What can stop you from getting unemployment in Ohio. A base period in Ohio consists of the past 4 quarters of three. How Ohios Unemployment Insurance Benefit Amounts Are Calculated Minimum number of weeks worked.

These factors are recorded on the employers account and are used to compute the annual tax rate after the employer becomes eligible for an experience rate. You earned enough money and worked enough weeks in your base period to qualify for benefits. The more money that you made in your base period the larger the amount that you will recieve every week for unemployment.

Your employment must be covered employment meaning that your employer pays Ohio unemployment insurance. You must have worked full-time or part-time at least 20 weeks during the base period see the first chart below for any number of employers who pay unemployment contributions. Work for such an employer is covered employment.

You must have worked a minimum of 20 weeks during the previous base period to be considered unemployed. To qualify you must have worked at least 20 weeks during your base period. Ohio will usually consider your claim effective as of Sunday of the same week that you file.

Covid 19 Unemployment Benefits Hamilton Ryker

How Do Probationary Periods Affect Unemployment Insurance Kramer Elkins Watt Llc

Base Period Calculator Determine Your Base Period For Ui Benefits

Ohio Unemployment Information Benefits Eligibility Etc Aboutunemployment Org

How Ohio Has Underfunded Unemployment Compensation

Unemployment Compensation For Low Paid Workers

Ohio Relaxes Unemployment Regulations In Response To Covid 19 Tucker Ellis Llp

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Base Period Chart Fill Online Printable Fillable Blank Pdffiller

How Unemployment Benefits Are Calculated By State Bench Accounting

Base Period Calculator Determine Your Base Period For Ui Benefits

No comments:

Post a Comment