This is true for shareholders of an S corporation in particular as they are. Unlike C corporations a Michigan S corporation does not itself pay any income taxes.

Governor S New Order Aims To Help Workers Penalized For Previous Jobs

I helped an S-Corp owner with their application in California and the unemployment website accepted their application.

Michigan unemployment s corp owner. Many corporation officers find it surprising that even though they are owners of a company they still may be subject to paying unemployment insurance UI premiums and taxes on the wages that they paid to themselves. If you acquire any part of the Michigan assets organization trade or business of another employer by purchase rental lease inheritance merger. If you have any employees or use subcontractors a workers compensation policy is required for your business.

Officers of the corporation receiving paychecks for services are under the same federal rules for taxation as other traditional employees. Contact info for Michigan Unemployment Insurance Agency. If you are paying unemployment taxes and the business closes you could draw benefits but as an owner not drawing salary you cannot collect unemployment.

Effective June 28 2012 the Michigan Employment Security MES Act was amended by the removal of the 7-week limitation of unemployment benefits for certain family members employed by family owned corporations. If you havent elected your LLC to be taxed as an S corp or a C corporation then the self-employment tax does not cover federal unemployment insurance. S-Corp Shareholders and Unemployment Insurance.

If the S-Corp owner has been paying his or her self a W-2 wage as required by the IRS and has been paying state and federal unemployment taxes on those wages then you should be able to apply for unemployment. Independent contractors Gig economy or freelance workers Small business owners Temporary or seasonal workers. On the flipside if you have elected your limited liability company to be taxed as a C or S.

While an S corporation with more than one shareholder does file tax returns the individual shareholders owners must include their share of the corporations income or loss on their personal tax returns just as is done in sole proprietorships partnerships and. Owners are considered an employees of the business. As the owner of a C-Corp or S-Corp that employees W-2 workers in the United States you have the option to file for unemployment if you have closed your business and are no longer receiving any form of.

The IRS has officially stated that shareholders who work for S corporations even if the shareholder is the only owner or worker are considered employees for purposes of the Federal Unemployment Tax Act. Michigan allows residents to collect unemployment benefits for a maximum of 20 weeks per benefit year regardless of wheter you find a job stop benefits and need to reapply later on in the year. Yes unemployment for small business owners is now possible if you have lost income or are unable to work due to COVID-19.

In these situations the new owner or employing unit is known as the successor and this process of acquiring an existing organiza-tion trade or business is known as successorship. Michigan S Corporation Taxation. The point here is that you cant keep getting unemployment once you are offered a job.

John Milikowsky founding partner of Milikowsky Tax Law reviews the options Business Owners and 1099 contractors have to file for Unemployment Insurance. Unemployment costs may be higher. Yes S Corporation owners are eligible for unemployment insurance however depending on some crucial factors.

If the owners and officers receive a salary from the company then they are not exempt from paying unemployment taxes on those wagesThe MI unemployment tax must be paid by any business employing 1 or more individual this includes ownersofficers who receive salary compensation from the business. The answer is yes and no. The unemployed worker works for his wife who is the sole owner of a business that is not incorporated.

If the S-corp still has earnings after the. A sole proprietor or an LLC does not pay wages but if you are paying yourself a salary through an S-Corp or a C-Corp you pay unemployment benefits and would qualify if you met the minimum. The election is done by filing Form 255 3 with the Internal Revenue Service.

The IRS has officially stated that shareholders who work for S corporations even if the shareholder is the only owner or worker are considered employees for purposes of the Federal Unemployment Tax Act. Some states like Arkansas Ohio New Jersey Wisconsin and New York require additional filing at. An individual who through ownership in stock and his position in the corporation exercises a substantial degree of control over its operation is considered a self-employed business person.

This means there must be at least 52 weeks between Michigan unemployment claim filings to receive full benefits. Still waiting on the paperwork since the application was submitted on Friday but Ive heard that the website will tell you right. Hpswwwmichigangov-leo058637-336-78421_97241---00html Examples of workers eligible for Pandemic Unemployment Assistance include.

This may allow S corporation officers to receive unemployment benefits. This means that a shareholder can be on the payroll and if he is the S corporation must pay unemployment insurance tax on his behalf. According to the Illinois Department of Employment Security.

Can small business owners file for unemployment. All that said if you find another job not the S-corp and then find work for the S-corp you can quit the job and go back to the S-corp. Small business owners say Governor Gretchen Whitmers executive order to shutdown non-essential businesses have.

A Michigan S-corporation is a standard corporation that has elected for the special S-corp tax status with the IRS. Employer must inform the Unemployment Insurance Agency UIA of the fact that some or all of the interest owners of the corporation are related to the unemployed worker or that the unemployed worker owns an interest in the corporation. This leaves you unable to file a claim should you ever leave a company.

However like the rules of many other government programs unemployment guidelines are different due to the coronavirus pandemic. Under normal circumstances A business owner. Under Section 402h of PAs unemployment Code if you are self-employed then then you are are ineligible for benefits.

Sole proprietors only require a workers compensation policy when they have 1 full time or 3 part-time employees. An S corporation is a type of corporation with pass-through tax laws allowing the owners to claim the corporations profits as income.

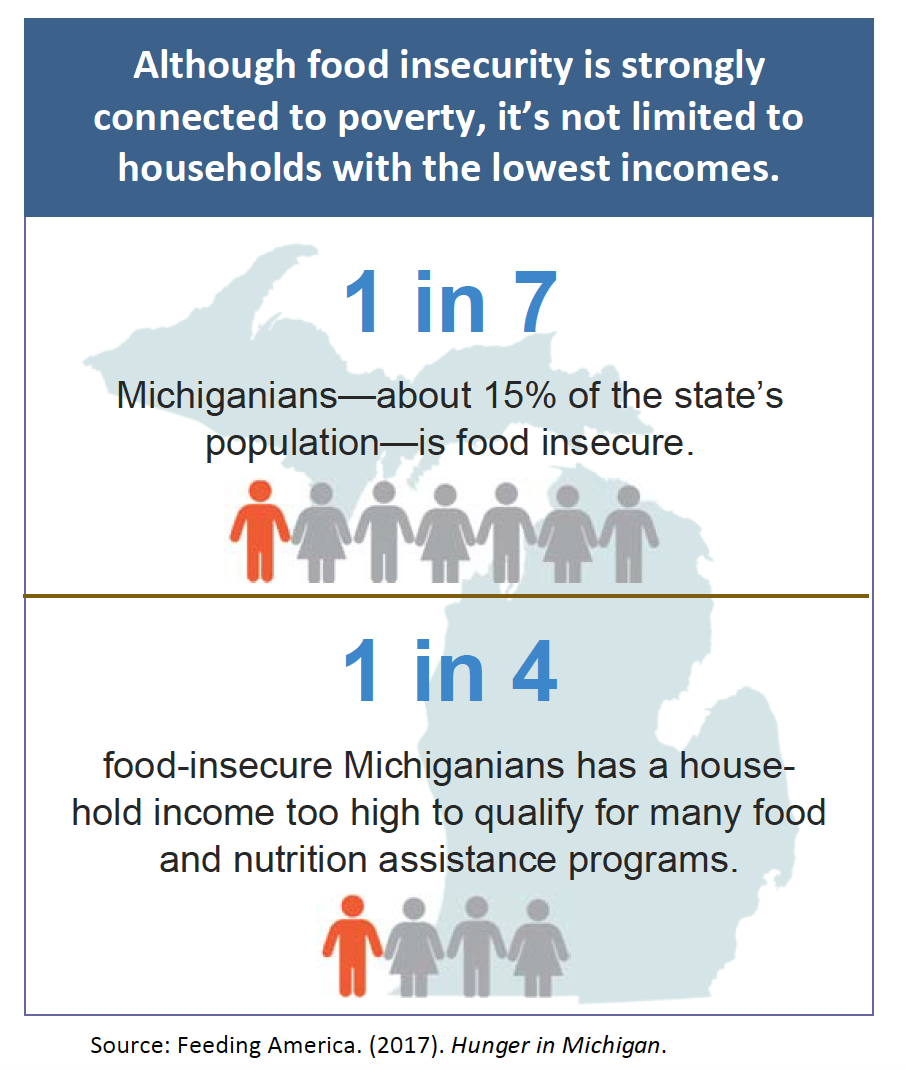

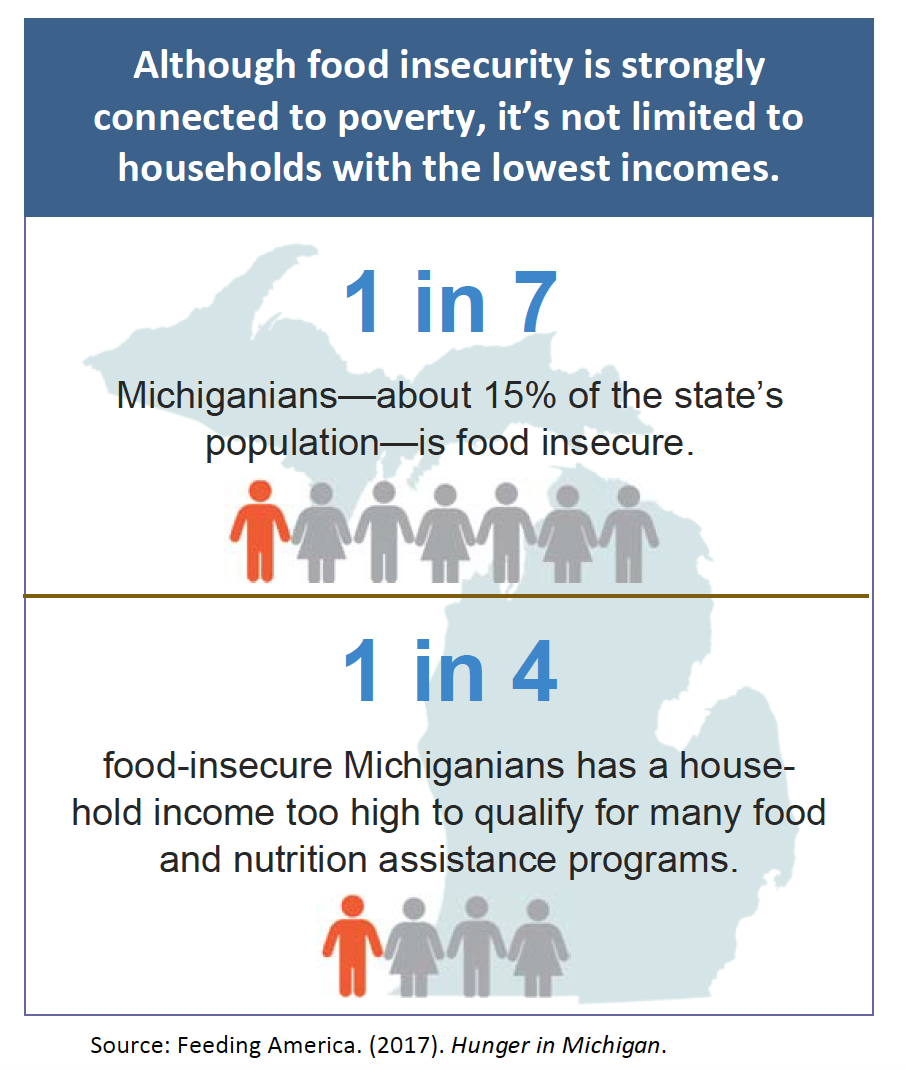

Still Hungry Economic Recovery Leaves Many Michiganians Without Enough To Eat Mlpp

Labor And Economic Opportunity December 2021

Update On Uia Work Search Requirements Semca

How To Apply For Unemployment Benefits Information And Resources Semca

Michigan Unemployment Benefits For Limited Liability Company Members Rehmann

Labor And Economic Opportunity December 2021

No Appointment Necessary Semca Michigan Works American Job Centers Open For Walk In Service Semca

10 Reasons Michigan Is America S Comeback State Cool Infographic Economic Development Michigan Michigan Fun

No comments:

Post a Comment