The official unemployment rate somehow is at 52. 866-403-6163 or UC Chat Weekdays 800 AM - 430 PM Eastern Time httpswwwucpagovemployers-uc-services-uc-tax.

Free Pennsylvania Unemployment Compensation Labor Law Poster 2022

The economy is slowing down.

Pa unemployment employer. Pennsylvanias Unemployment Compensation UC Benefits System - Find a job post a résumé setup a virtual recruiter and get hired. If your regular payday has passed without payment contact the Department of Labor Industry LI Bureau of Labor Law Compliance at 1-800-565-0665 any of our district office numbers or by emailing the bureau at RA-LI-SLMR-LLCpagov. The calendar year 2021 employer state unemployment insurance SUI experience tax rates continue to range from 12905 to 99333.

Many of our telephone and mail UC services are available on the Internet. Employer to discuss the reason for you are no longer working. Pennsylvania law requires that employers pay wages on regularly scheduled pay dates designated in advance by the employer.

Equal Employment Opportunity Data. Copyright Commonwealth of Pennsylvania. Pennsylvania also allows employers to post jobs and view résumés of potential recruits with ease start your hiring process now.

Assistance is available from our Employer Contact Center. 720000 was the expected number. Department of Labor Office of Federal Contract Compliance.

PA Unemployment Appeal Lawyer When you first apply for Unemployment Compensation benefits both you and your employer will receive a Notice of Determination. In Pennsylvania state UC tax is just one of several taxes that employers must pay. Different states have different rules and rates for UC taxes.

For employers we represent in addition to defending the Pennsylvania Unemployment Compensation claim we will also advise and assist the business to adopt sound employment policies and procedures to limit or prevent future claims. Pennsylvania Department of Revenue 2021 W21099 Upload Line-Item Limit. It is our goal to minimize employee claims for Unemployment Compensation benefits.

They expected 720000. Pennsylvania Unemployment Compensation Handbook. Which informs you of whether or not you were found eligible for benefits.

Hazardous Substance Reporting On-Site Chemical Use and Reporting. Unemployment Compensation Tax and Employer Services. County labor force data by sex age minority and veteran status is available to assist in the completion of area analyses as required by the US.

Other important employer taxes not covered here include federal unemployment insurance UI tax and state and federal withholding taxes. You can register on behalf of your company or on behalf of another company acting as their agent with a valid Power of Attorney. Pennsylvania Department of Labor Industry Office of Unemployment Compensation website.

Register as the account type if you wish to manage any unemployment claim associated with your company. To 4 pm Eastern Standard Time. If the employer does not reply to the Unemployment Compensation office within the time allowed the Unemployment Compensation office will move forward with a determination and will base the eligibility for unemployment compensation benefits on the information before it which is typically the.

Any W21099 upload that includes over 25000-line items will fail. Only 235000 jobs were created in August. Employers and Agents6 min s estimated.

The new employer rate remains at 36890 for non-construction employers and 102238 for construction employers. You may e-mail Employer Services at UIEMPCHARGEpagov and include your employer account number the claimants full name and the last four digits of the social security number and the nature of your question. The Unemployment Compensation Tax and Employer UC.

ACCESSIBILITY PRIVACY SECURITY. Pennsylvanias Unemployment Compensation program administered by the Department of Labor and Industry protects workers during job loss by providing temporary income support to people who become unemployed through no fault of their own. 3 months ago pennsylvania Invalid employer.

Both yourself and your former employer are able to appeal this decision. Y Iouf and your employer. Or you may call us at 833-728-2367 on weekdays from 8 am.

Internet Services in Pennsylvania. What happens if employer does not respond to unemployment claim in PA. Here are the basic rules for Pennsylvanias UC tax.

Beginning with the 2021 tax season the Department has added a limit to the number of line items per file to 25000 in addition to 20MB size limit per file.

Pin By Dorcas Musyimi On Career In 2021 Resume Templates Modern Resume Template Modern Resume Template Free

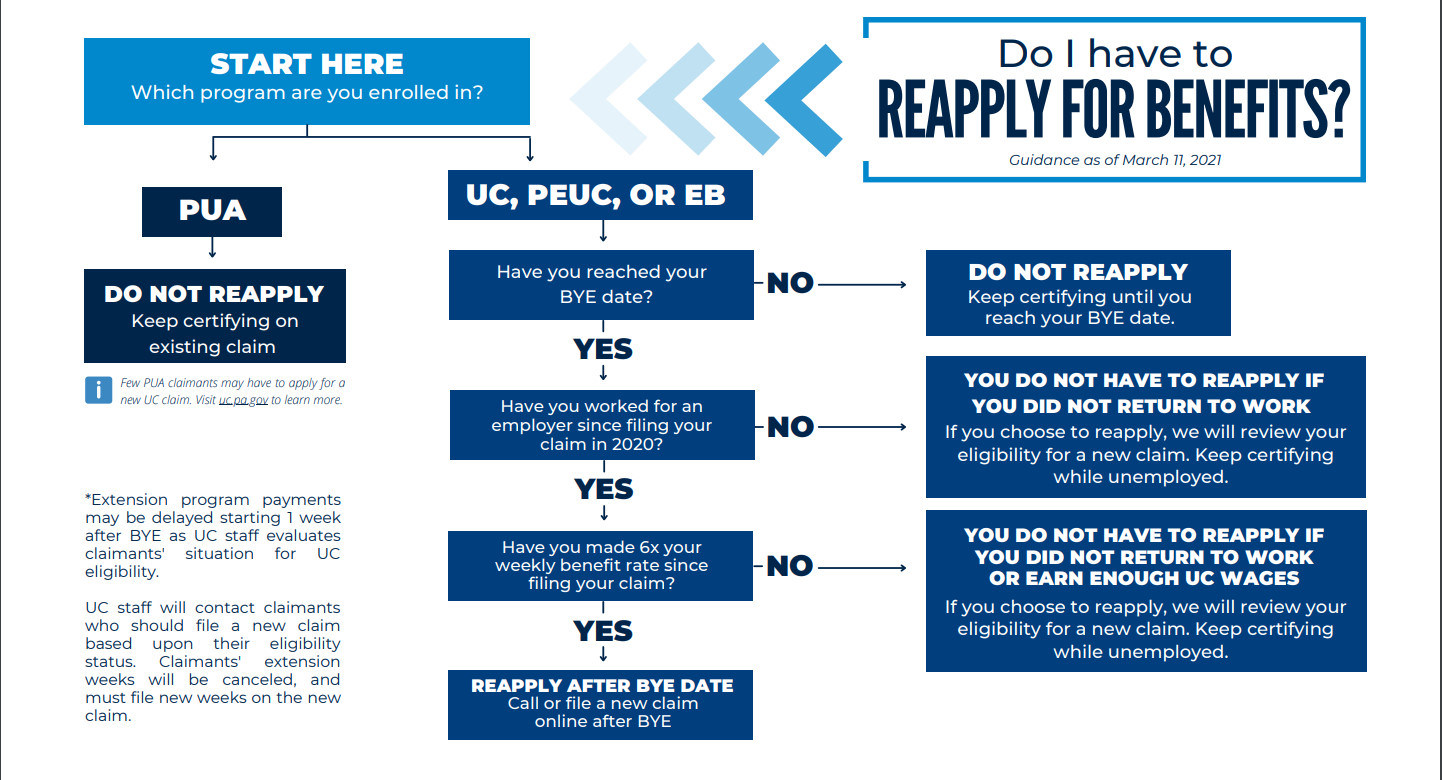

Pennsylvania Unemployment Benefit Year End Bye Unemploymentpua Com

Pa Now Accepting Applications For Pandemic Unemployment Assistance Pua Benefits Fox43 Com

:quality(70)/d1hfln2sfez66z.cloudfront.net/05-19-2020/t_f0bd770e57f0491d8e4bcd53dcc5ce0d_name_B0B9CE4646B84238AA29FDF1E715F19C.jpg)

Top 5 Mistakes People Make Filing Unemployment That Could Delay Your Benefits Wpxi

Pa S New Unemployment System What You Need To Know Whyy

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Pennsylvania Unemployment Insurance Paui Setup Cwu

Pennsylvania How Unemployment Payments Are Considered

No comments:

Post a Comment