This tax form provides the total amount of money you were paid in benefits from the Office of Unemployment Compensation in 2021 as well as any adjustments or tax withholding. The Pandemic Unemployment Assistance PUA 1099G form will also be made available to download online.

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

You may choose to have federal income tax withheld from your PUA benefit payments at the rate of 10 percent.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Pa unemployment 1099. The 1099-G will affect the filing of your federal income tax return if you itemized deductions the prior year and claimed state income tax paid as a deduction. T he Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be mailed by January 31 st of each year for Pennsylvanians who received unemployment benefits. In the summer months I end up being unemployed while the schools I teach for are on their summer break and can only offer me minimum classes thus resulting in a greatly reduced income or none at all.

In 2008 when the banks fucked over the economy greed the unemployed got a minimum of 99 weeks of benefits. Makes no sense to cut off UI right now. If you are self-employed or a 1099 employee and have lost contracts or income recently you might be wondering if you can file for unemployment benefits.

For example if you collected unemployment in 2018 the 1099-G should have been mailed by January 31 2019. The statements called 1099-G or âCertain Government Paymentsâ are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year. This past week I was laid off due to economic slowdown.

In Pennsylvania the state issuing agency is the Dept. A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you including. 31 there is a chance your copy was lost in transit.

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. Form 1099-G is a federal form that the Internal Revenue Service requires be provided to taxpayers to remind them of the Pennsylvania income tax refunds or credits they received the previous year. Just based upon my math I earned over the 3000 and change threshold for unemployment in PA while on W2.

They are just trying to capitalize on the fact that a huge portion of Americans received a 1099-G. If you havent received your 1099-G copy in the mail by Jan. You may need to register for an e-signature account by establishing a User ID and Password.

Pennsylvania workers who claimed unemployment benefits in 2020 will soon receive a 1099 form that is required to file their taxes according to Pa. Of Labor Industry. This year they have decided that anyone receiving a 1099-G aka unemployment cant use the free version and now has to pay 39 dollars per tax return.

Call your local unemployment office to request a copy of your 1099-G by mail or fax. Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments. The 1099G forms for Regular Unemployment Compensation UC is now available to download online.

Of Labor Industry LI Acting Secretary Jennifer Berrier. Once the 2020 1099G forms are uploaded PUA claimants can access their PUA-1099G via their PUA Dashboard. Around September my employer bumped my salary and switched me to a 1099 employee.

My employer is going to pay me a severance. Now facing a crisis the world hasnt seen in 100 years were being provided fewer weeks despite the challenges being much much worst than in 2008. PA unemployment 1099 dance I am a dance instructor in PA who gets paid for the classes I teach not on salary.

However the COVID-19 pandemic has changed that and certain relief. This statement shows the amount of PUA benefits paid and the amount of federal income tax withheld if any. So 80 for both fed and state.

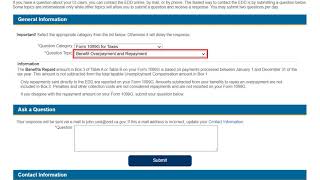

Click here to access your PUA dashboard and change your federal withholding status or access your PUA-1099G. If you also received regular UC benefits including PEUC and. The 1099G forms for Regular Unemployment Compensation UC is now available to download online.

Are 1099 Workers Eligible for Unemployment Benefits in Pennsylvania. Federal income tax withheld from unemployment benefits if any. You have read this article with the title Are 1099 Workers Eligible for Unemployment Benefits in Pennsylvania.

The amount of withholding is calculated using the payment amount after being adjusted for earnings in any. In 2nd quarter through 3rd quarter 2007 I received the maximum amount of unemployment compensation. Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received.

Once the 2020 1099G forms are uploaded PUA claimants can access their PUA-1099G via their PUA Dashboard. Home No Category Are 1099 Workers Eligible for Unemployment Benefits in Pennsylvania. In most cases 1099-Gs for the previous year are mailed on or before January 31.

Pennsylvania Unemployment and 1099 income in the same year Pennsylvania 09-02-2008 0800 AM. Unemployment Insurance benefits including Federal Extensions Pandemic Additional Compensation Pandemic Emergency Unemployment Compensation and Lost Wages Assistance. Form PUA-1099G is a federal form that the Internal Revenue Service requires to be provided to unemployment compensation recipients who were paid PUA benefits during the prior year.

Please direct questions to our Online Customer Service Center or. 1099-G Tax Form Information Step-by-Step UC Filing Guides These step-by-step guides walk you through filing unemployment and understanding the unemployment process. Federal income tax withheld from unemployment benefits if any.

This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question. To access an electronic copy of the Form s 1099-G please visit the Personal Income Tax e-Services Center. The Pandemic Unemployment Assistance PUA 1099G form will also be made available to download online.

Is there any foreseeable problem with collecting unemployment and 1099 income in the same year. If you received unemployment benefits in 2020 you will receive Form 1099-G Certain Government Payments. It has always been free.

Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments. In 2006-2007 I worked for W2 wages and was laid off. A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you including.

What Is Form 1099. Taxpayers who receive an incorrect Form 1099-G for unemployment benefits they did not receive should contact the issuing state agency to request a revised Form 1099-G showing they did not receive these benefits.

Mba Quotes Thoughts Businessmanagementdegree Bookkeeping Business Business Tax Small Business Tax

Stimulus Unemployment Answers To Your Tax Related Questions Fox43 Com

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

1099 Tax Forms On The Way For Pennsylvanians Who Claimed Unemplo Erie News Now Wicu And Wsee In Erie Pa

1099 G Unemployment Compensation 1099g

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

1099 G Tax Form Why It S Important

Taxes And Unemployment Compensation What You Need To Know Before Filing Philadelphia Legal Assistance

No comments:

Post a Comment