As mentioned previously fourth stimulus checks may not be going ahead on a federal level but different state governments could well be lending a helping hand in some shape or form. 29 and employers have 30 days from that date to protest the rate.

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

In recent years this construction rate has ranged from 68 to 81.

Michigan unemployment tax rate 2022. In 2022 there are no additional Solvency Rates and Obligation Assessments added to your tax rate. However employers in general receive a 54 FUTA tax credit reduction when they file their FORM 940 Employers Annual FUTA Tax Return resulting in a net FUTA tax rate of 06. This history is known as an employers unemployment insurance experience.

The rates in the third and fourth years of liability are partly based on the employers own history of benefit charges and taxable payroll. Form UIA 1771 Tax Rate Determination for Calendar Year. The rates will be as follows.

That is slightly below the national average of 48 for the entire United States according to data from the Michigan Department of Technology Management and Budget for September. The Michigan 2021 state unemployment insurance SUI tax rates continue to range from 006 to 103. The tax rates were mailed on Dec.

The unemployment tax rate for experienced contributory employers those who have been in. COVID-19 caused high rates of unemployment across the country and depleted many state unemployment insurance funds. Michigan Announcement Relating to 2022 Unemployment Tax Rates Unemployment rates for 2022 will remain unchanged from 2021.

Historically Unemployment Rate in Michigan reached a record high of 2360 in April of 2020 and a record low of 320 in February of 2000. The range of rates for experienced employers will continue to run from 006 to 103. Now these funds need to be replenished so a number of states are increasing taxes.

2022 Michigan Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The wage base and rate will both change in 2022. The wage base for the employee will increase from 138200 to 151900 and the tax rate will decrease from 28 to 14.

Unemployment Rate in Michigan 2022 Data 2023 Forecast 1976-2021 Historical Unemployment Rate in Michigan was 590 in November of 2021 according to the United States Federal Reserve. Withholding Formula Michigan Effective 2022. However Governor Andy Beshear line-item vetoed the provisions.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. How does the taxable wage base affect my organizations unemployment tax liability. However Governor Andy Beshear line-item vetoed the provisions that extended the UI tax relief to calendar year 2022 saying that the state should wait and see until 2022 because the Commonwealths financial situation is fluid The legislature did not.

Contributing employers must pay taxes on the first 9500 of each employees wages in the 2021 calendar year. Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages. The increase to the 2021 SUI taxable wage base up from 9000 in 2020 was confirmed by the Michigan Unemployment Insurance Agency UIA.

How SUI is changing in 2022. As a result the Obligation Assessment OA added to employer SUI tax rates since 2012. Tax Rates Generally in the first two years of liability the tax rate is set by Michigan law at 27.

The Michigan income tax has one tax bracket with a maximum marginal income tax of 425 as of 2022. UIA mails Form 1771 annually Tax Rate Determination for Calendar Year detailing an individual employers unemployment tax rate. HB 413 would also have frozen the rate schedule to Schedule A and taxable wage base to 10800 for calendar year 2022.

It shows an employers prior Actual Reserve benefits charged and contributions paid basis of the CBC and ABC components since the last annual determination and the employers new Actual Reserve. A higher wage base limits b higher percentages again known as the tax rates that are. This will result in the maximum tax decreasing from 38696 to 21266.

Are met a reduced two-tier individual income tax rate structure of 253 and 275 or a 25 tax rate beginning in 2023. Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount. New employers except for certain employers in the construction industry pay at 27.

HB 413 would also have frozen the rate schedule to Schedule A and taxable wage base to 10800 for calendar year 2022. Under SB 1828 and effective January 1 2022 the law createsa two-tier individual income tax rate structure of 255 and 298 depending on filing status and taxable income and if general fund revenue thresholds. The FUTA tax rate is currently 60 on the first 7000 in wages paid per employee each year.

Notification of State Unemployment Tax Rate Early each year the UI issues its Tax Rate Determination for Calendar Year 20__ Form UIA 1771. Michigan Governor Gretchen Whitmer announced that Michigan employers will see a state unemployment insurance SUI tax rate reduction for 2020 thanks to the early payoff of the bonds used by the Michigan Unemployment Insurance Agency UIA to repay their federal SUI loan. The exception is for new employers in the construction industry whose rate for the first two years is the average construction contractor rate as determined by the Unemployment Insurance Agency each year.

Revised tax rate notices were issued in April 2021. These increases can come in the form of. Your Michigan tax liability has the potential to increase over prior years when the taxable wage base was 9000 due to the current years increase.

Detailed Michigan state income tax rates and brackets are available on this page. The unemployment tax rate for new employers will remain at 20 for 2022 under Act 8209 24 VIC. For comparison the unemployment rate in the state for September 2020 was 82.

Consequently the employer SUI taxable wage base will increase to 9500 for 2021 unless the state legislature reintroduces and enacts similar legislation during the 20212022 legislative session.

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Sui Tax Rates Will Increase For Employers In 2022 Gusto

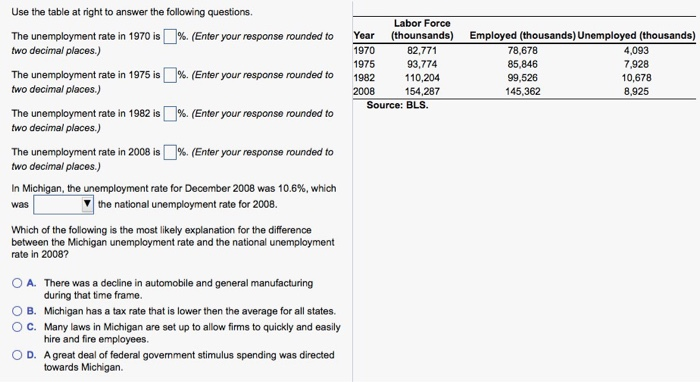

Solved Use The Table At Right To Answer The Following Chegg Com

2022 Vs 2021 Raise To Gs Pay Scale For Federal Employees Latest Updates And News Aving To Invest

United States New Home Sales Mom 2022 Data 2023 Forecast 1963 2021 Historical

2018 2022 Form Mi Uia 1772 Fill Online Printable Fillable Blank Pdffiller

Can I Print Uia 6347 Form Fill Out And Sign Printable Pdf Template Signnow

United States Imports Of Pharmaceutical Products 2022 Data 2023 Forecast 1991 2020 Historical

2022 Vs 2021 Raise To Gs Pay Scale For Federal Employees Latest Updates And News Aving To Invest

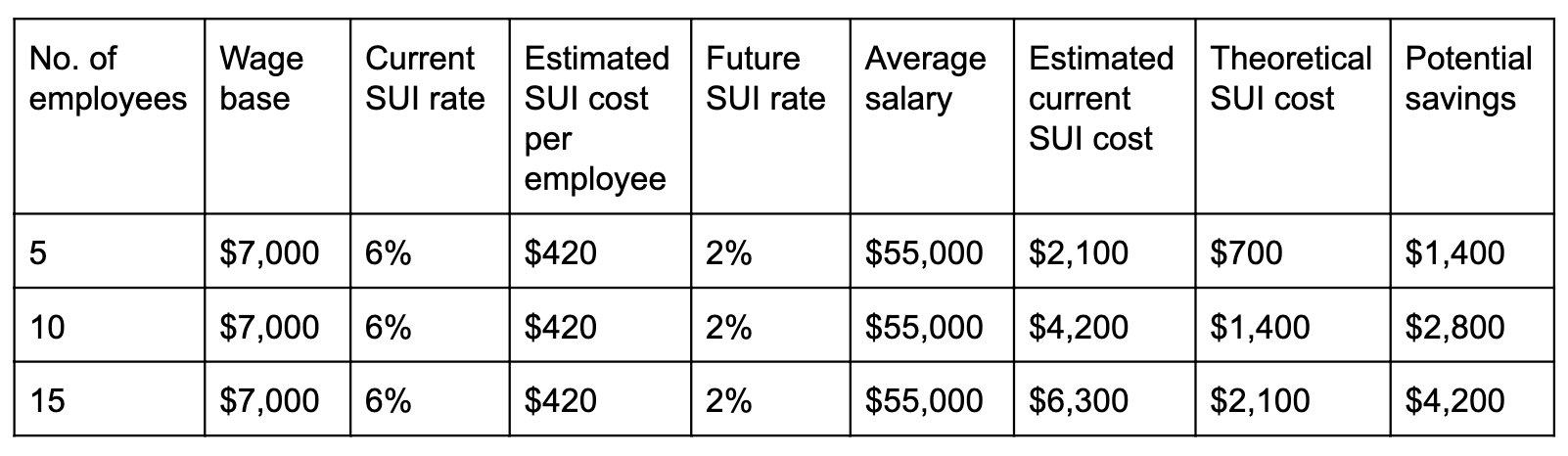

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

No comments:

Post a Comment