Ohio law is in conformity with federal law therefore the provisions applicable under federal law are also applicable under Ohio law. Ohio Unemployment Compensation Taxes Ohio employers payroll taxes called contributions which go into the Ohio Unemployment Compensation Trust Fund are used to pay benefits to unemployed workers.

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

From April to July I relied on unemployment and the federal pandemic assistance like many people at that time.

Is ohio unemployment taxable. Unemployment compensation is taxable income that you must report to the IRS. The American Rescue Plan excludes 10200 in 2020 unemployment compensation from income used to calculate the amount of taxes owed. Unemployment compensation is taxable income.

ODJFS issued approximately 17 million 1099-G forms in 2021 and 200000 forms in 2020-30- The Ohio Department of Job and Family Services manages vital programs that strengthen Ohio families. Ohio 2020 SUI tax rates increase taxable wage base decreases. The change in a bill signed by Gov.

Legitimate unemployment claimants who received benefits in 2021 need 1099-G forms so they can report this income when filing their annual taxes. Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year. In Ohio theres discussion in Columbus about whether state lawmakers will follow the federal law and pass legislation next week that would also exempt 10200 in unemployment benefits on state tax returns.

Ohio taxes unemployment compensation. The UI tax funds unemployment compensation programs for eligible employees. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19.

Visit the IRS website here for specific information about the IRS adjustment for tax year 2020. The 10200 per person exclusion applies to taxpayers single or married filing jointly with modified adjusted gross income of less than 150000. Do Not Sell My Personal Information.

In Ohio state UI tax is just one of several taxes that employers must pay. Thus if taxpayers do not qualify for the federal deduction then all unemployment benefits included in federal AGI are taxable to Ohio. Visit the IRS website here for specific information about the IRS adjustment for tax.

Normally the federal government and Ohio treat unemployment benefits as taxable income but the American Rescue Plan exempts the first 10200 of unemployment benefits in 2020 from federal taxes. O Ohio does not have its own deduction for unemployment benefits. 285 on taxable income from 21751 to 43450.

On July 19th of 2020 due to my main gig revolving around live events and live events being nowhere to be found I was let go. Employees make no contribution themselves and this payroll tax cannot be withheld from an employees paycheck. Taxpayers who previously claimed the unemployment benefits deduction on their originally filed federal and Ohio tax returns.

COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received. The Passage of the American Rescue Plan on March 11 2021 effectively changed the 2020 tax rules regarding the taxation of unemployment benefits. This tax alert provided guidance related to the federal deduction for certain unemployment benefits.

Probably that why OH DOL not has an option for state tax withholding. The taxable wage base is 9000 for 2021. Apply for Unemployment Now Employee 1099 Employee Employer.

Ohio Unemployment Compensation Taxes Ohio employers payroll taxes called contributions which go into the Ohio Unemployment Compensation Trust Fund are used to pay benefits to unemployed workers. IRS is Now Making Automatic Additional Refund Payments for Unemployment Benefits Previously Reported as Taxable State of Ohio Will Require an Amended Tax Return. The taxable wage base may change from year to year.

Are Ohio unemployment benefits taxable. Changes in how Unemployment Benefits are taxed for Tax Year 2020. Unemployment Taxes ERIC Unemployment Benefits OJI Recruit and Hire Workers.

Unemployment benefits are taxable pursuant to federal and Ohio law. Ohio Unemployment Compensation Taxes 5 Taxable Wage Base 6 Contribution Rates 6 Determining Unemployment Tax Rates 8. If your small business has employees working in Ohio youll need to pay Ohio unemployment insurance UI tax.

Its looking like Ohio will be addressing and likely approving in the General Assembly a conformity bill which would align Ohio with all. Unemployment taxes each year. Mike DeWine Wednesday.

The taxable wage base for calendar years 2018 and 2019 is 9500. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. On April 6 2021 the Department of Taxation issued the tax alert Ohio Income Tax Update.

I knew that on July 27th the gym. State Taxes on Unemployment Benefits. When you file for Ohio unemployment benefits you can opt to have taxes withheld from your benefit amount which could help you avoid a big tax bill when you file your tax return.

State Income Tax Range. Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year. The taxable wage base may change from year to year.

Employees make no contribution themselves and this payroll tax cannot be withheld from an employees paycheck. Employers Guide to Unemployment Insurance. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and.

The taxable wage base for calendar year 2020 and subsequent years is 9000. Unemployment benefits are taxable pursuant to federal and Ohio law. Act by December 31 to potentially lower tax rates The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92.

Ohio Unemployment Compensation Exclusion Billings Company Cpas Accounting Tax Elyria Oh

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Ohio Residents Can Again Seek Pandemic Unemployment Assistance Wtol Com

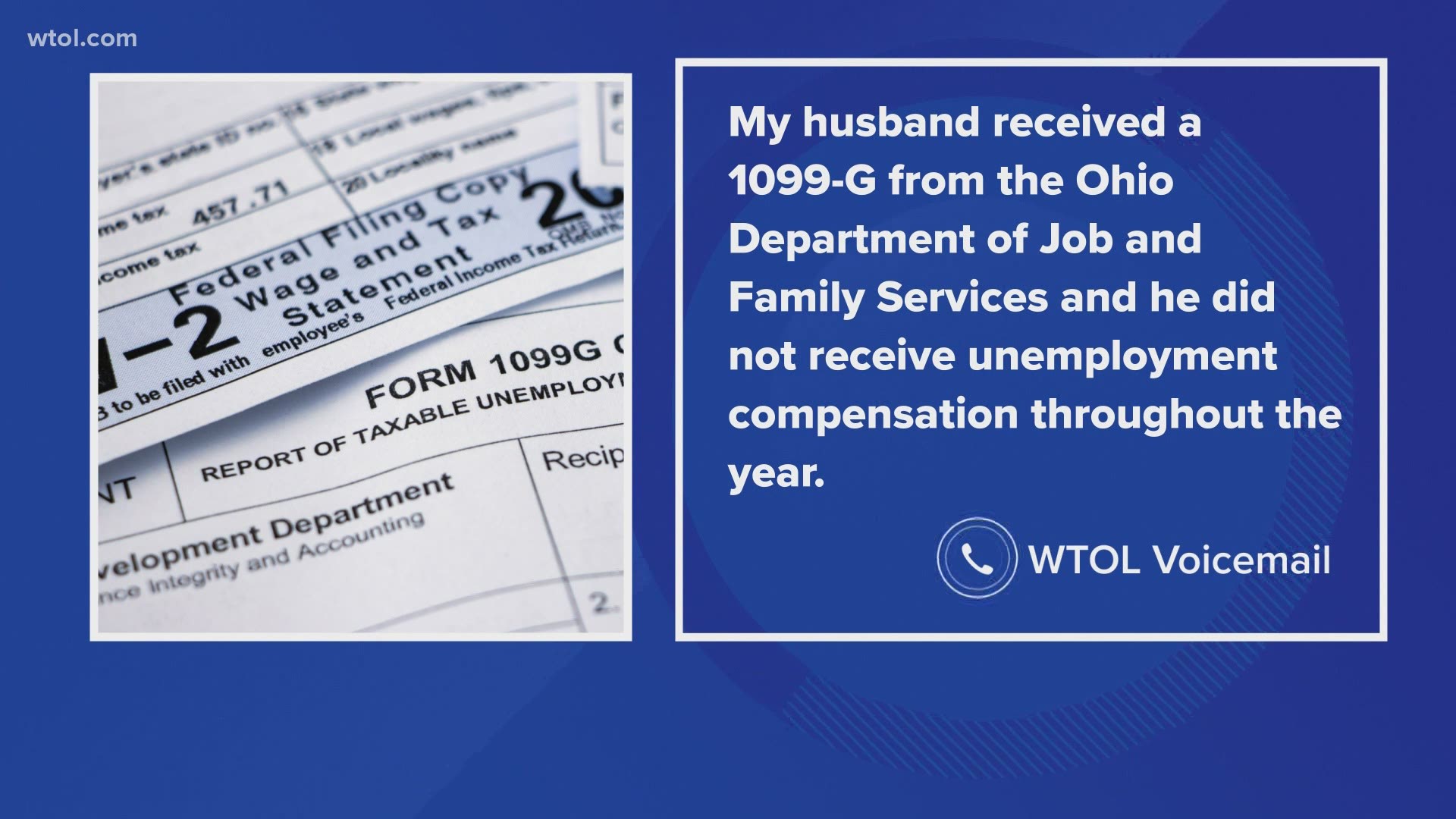

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Ohioans Who Paid Income Tax On Last Year S Unemployment Benefits May Get Refunds Cleveland Com

Ohio Urges Victims Of Unemployment Fraud To Act Now To Avoid Tax Troubles Strauss Troy Co Lpa

How Ohio Has Underfunded Unemployment Compensation

How Ohio Has Underfunded Unemployment Compensation

No comments:

Post a Comment