You must first sign in to MILogin to access or create a MiWAM account. Michigan Unemployment Sign Up OnlineYou may be able to file online by phone or in person.

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

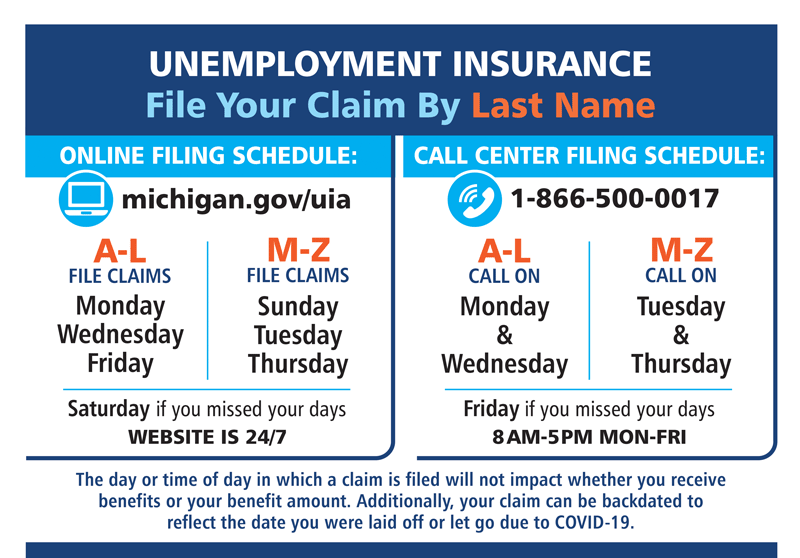

Once there you can complete the on-line claims electronic form or apply for benefits over the phone by calling b1-866-500-0017.

Michigan unemployment sign up. Michigan unemployment website crashes again delaying state update on expanded benefits 04-13. With MiWAM you can apply for benefits certify for benefits send a message update your account information and more. To register for work.

Please visit our commonly asked questions here for more information. After you have agreed to the after you create your account you will enter your social security number and date of birth to begin linking the unemployment insurance account to milogin. There are two steps to file for unemployment insurance.

For step by step instructions view the MiWAM Toolkit for Claimants. Michigan Unemployment Application Information To apply for unemployment benefits in Michigan and to discover where to sign up for unemployment the former worker has two options at his or her disposal. Has cancelled non-essential services such as workshops orientations hiring events and other group activities.

Please do not create a new MILogin account if you already have one to access the following online services. You are NOT required to report in person at Michigan Works. To register for work.

New filers for unemployment benefits must now register with Michigan Works. Workers in the state of Michigan who have questions about the unemployment program can visit or contact a local Michigan unemployment office for help. You are NOT required to report in person at Michigan Works.

When Michigan unemployment stimulus checks and 600 CARES money will arrive. Due to the coronavirus COVID-19 outbreak in Michigan Gov. Please direct any questions on payment amount to your unemployment agency.

Once you become unemployed you have two ways in which to file a claim for unemployment benefits in Michigan. Please be aware your payment amount may have changed this week due to expiration of federal benefits. File an online application for unemployment or file for an unemployment claim by telephone.

MiWAM is available 24 hours a day 7. You will be asked to set up an authentication code. With MiWAM you can make an application for benefits accredit for advantages send out a message update your account info and more.

You will need to contact our office at 248-823-5101 to schedule a virtual appointment. You can call and file by using a touch-tone telephone from anywhere in the United. Labor and Economic Opportunity - The Michigan Web Account Manager MiWAM is the UIAs online system for filing your unemployment insurance claim and managing your unemployment account electronically.

Berrien Cass Van Buren is here to help you by email phone or remote appointment with job search and career services. Affected by unemployment andor have questions about your ReliaCard. All unemployment claims can currently be filed online at MichigangovUIA or by calling 1-866-500-0017.

Bring your MiLogin information to log into your Pure Michigan Talent Connect PMTC account. The minimum amount you will receive is 81 with a maximum of 362. 1 apply for unemployment and 2 register to work.

For security reasons it is important to remember to close your browser completely when you are done. How long does Michigan unemployment take on Covid 19. Visit the UIAs website here.

Claims should be filed the week you become unemployed. Petitioners can call to ask How can I sign up for. While we can answer general questions about unemployment and tips to guide you through MIWAM unfortunately we are unable to file claims or provide customer specific information about your unemployment claim because.

If you meet Michigan unemployment benefits eligibility you will be approved for up to 20 weeks of unemployment compensation. To allow sufficient time for unemployment registration all individuals should arrive at no later than 330 pm. The Michigan unemployment department requires all benefits recipients to file a weekly claim with MARVIN the online reporting system.

To learn more about Michigan unemployment benefits read our guide to MI unemployment here. Were here to help. MILogin is the state of Michigan Identity Management solution that allows users the ability to access many state services and systems online across multiple departments using a single user ID and password.

And verify ther registration with either an in person or virtual appointment. There are two ways to apply for unemployment insurance benefits in Michigan. A screenshot of the Michigan unemployment site login page at 1237 pm.

Telephone by calling our special toll-free telephone number 1-866-500-0017. You may also file by phone at 1-866-500-0017. Michigan unemployment site crashes state develops schedule 04-13.

Additional weeks will appear after. Beginning December 13th 2021 MILogin is releasing a new feature User ID Merge to help users merge multiple MILogin User IDs they own into a single MILogin User ID. The fastest and preferred method is to file for unemployment insurance benefits online using the Michigan Web Account Manager MiWAM at michigangovuia.

Below is a comprehensive list of the Michigan unemployment offices to help you. The Michigan Web Account Supervisor MiWAM is the UIAs online system for filing your unemployment insurance claim and handling your joblessness account digitally. Click here for more information on this new feature.

7 2021 unemployed workers filing a new claim for benefits will be required to register for work with Michigan Works. All unemployment claims can currently be filed online at MichigangovUIA or by calling 1-866-500-0017. MDOS eServices CARS MDHHS MI Bridges MDHHS myHealthButton MiPage Michigan Web.

The executive order is in effect March 16 through. Once you click Submit you have now successfully linked your MiLOGIN username to your record with unemployment insurance. Self-employed 1099-contractors gig workers can apply Monday 03-10-2020.

Please note if you have previously filed a claim you will be asked to submit your drivers license or Michigan ID for verification purposes. Welcome to MILogin which provides you the convenience of using only one set of login credentials to access multiple state of Michigan online services. Michigangov The system appeared to be working again about an hour and 12 after the labor department.

You can file a new claim or reopen an existing claim for benefits by. Whitmer signed an executive order to expand eligibility for unemployment benefits. Everyone already on unemployment or going on it during this crisis is allowed the 13 additional weeks of benefits for a total of up to 39 weeks.