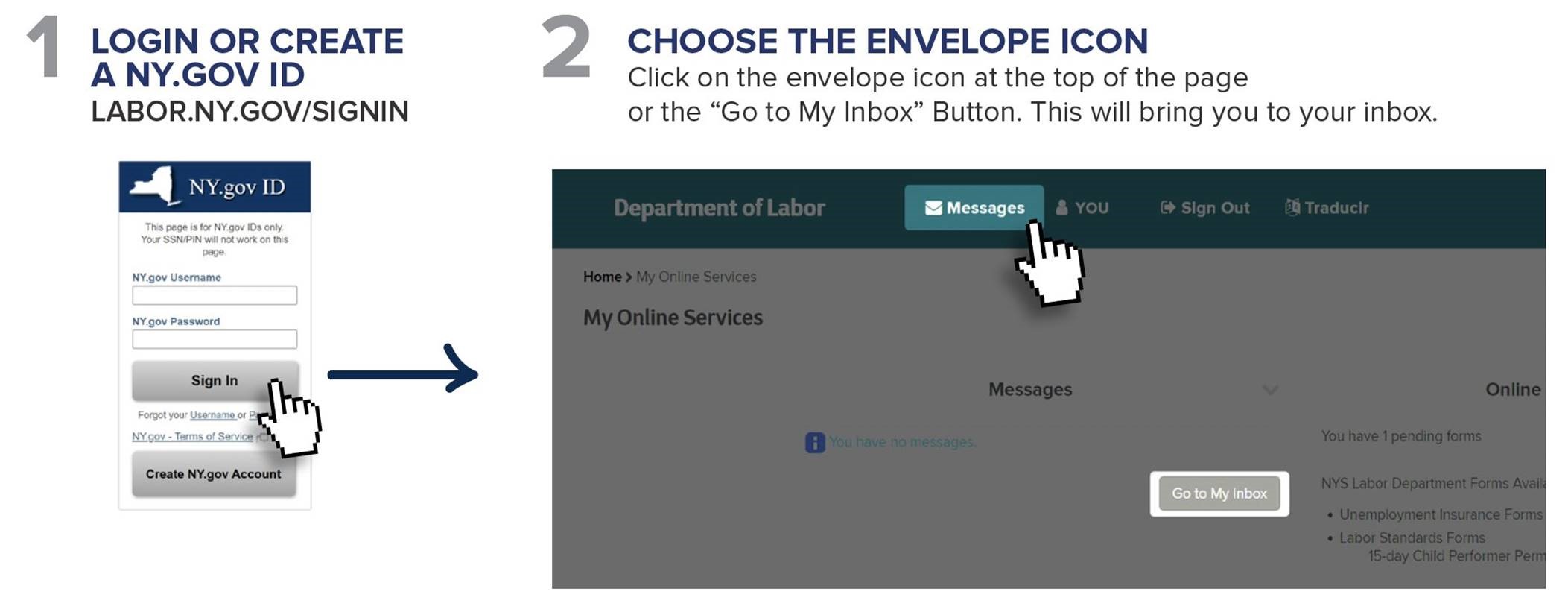

If you are a deaf or hard of hearing individual who is being assisted by another person call the Telephone Claims Center at 888 783-1370. In the event youve been unable to reach a customer care rep at the New York Department of Labor you can write them an email by signing into your account on the website selecting the Messages option and visiting the section that reads How to send a secure message You can also visit New York Unemployment offices for further assistance.

Report Fraud Department Of Labor

How do I talk to a real person at NYS unemployment.

Nys unemployment talk to a person. How do I speak to a live person at NYS unemployment. Go to my online services on the dol website and login with your nygov id. 1 Hudson Square 75 Varick Street New York NY 10013.

Dial 1-888-209-8124 Choose option 1 Choose option 9. Nys unemployment phone number help. New York NY Unemployment Number.

In that case you can call the NY Unemployment Phone Number. Whats the best time to call unemployment. This is a space for people to converse about these issues and ideally to help one another find solutions.

When you call please have ready. Remind me when call center opens. To speak with a live agent you need to press 0 then press pound if you dont know your social security number and stay on the line typical waiting time is about 10-45.

In total there are 5 ways to get in touch with them. New York County Unemployment Office. If you need to speak to a live customer service representative in New York Unemployment customer service you need to dial 1-888-209-8124.

This is the Telephone Claims Center TCC. How do I talk to a live person at NYS unemployment. Thats up from 1900 Central New Yorkers the week.

How do I talk to a live person at NYS unemployment. To speak with a live agent you need to press 0 then press pound if you dont know your social security number and stay on the line typical waiting time is about 10-45 minutes. In that case you can call the NY Unemployment Phone Number.

Answer 1 of 2. Sometimes you just have to talk to a live person to get answers to your questions. Unemployment Insurance Contact Information To contact Telephone Claims Center TCC staff.

See the New York Department of Labor DOL resource page for more information and reader comments. This is a very popular number and you can expect a lengthy delay whatever time of the day you make your call. Fastest way to talk to a real New York Department of Labor -.

If you need to speak to a live customer service representative in New York Unemployment customer service you need to dial 1-888-209-8124. Your Social Security number. If you need to speak to a live customer service representative in New York Unemployment customer service you need to dial 1-888-209-8124.

New York Department of Labor - Unemployment Phone Number. 888-209-8124 Customer Service. Forcing you to talk to a live person gives otherwise unskilled people with government connections jobs.

See the pua weekly certification instructions. However if you use TTYTDD call a relay operator first at 800 662-1220 and ask the operator to call the Telephone Claims Center. I wonder what compelled NY state do have this crazy requirement especially considering the fact that NYC is well in NY.

If you have a partialincomplete claim you do need to speak to an agent to finish it up no other option as some things need to be verified by a person. This is now the old way the pua application will only be accessible once youve applied for regular unemployment insurance ui and been denied. TCC toll-free at 1-888-209-8124 from 800 am to 500 pm Monday through Friday.

Sometimes you just have to talk to a live person to get answers to your questions. You can speak to someone in the New York Unemployment Department by calling the toll free number 1-888-581-5812. If you are calling for someone else please have that person present with you at the time of the call.

Niagara County Unemployment Office. About 2400 were from Central New York. Accessing the pandemic unemployment assistance pua application 42320 update.

N Y Unemployment customer service phone number is 1-888-209-8124. Were getting as many people on the lines as we can as quickly as we can but as you can imagine its pretty much a shitshow since we have to get everyone taken care of while keeping our current staff as safe as possible. Our hours of operation are Monday - Friday 9 am.

How do I talk to a live person at NYS unemployment. June 07 2021 post a comment. O To speak to an agent about your claim.

While New York Department of Labor - Unemployment does not offer live chat they do have a phone number. New York Unemployment Phone Number. Unemployment Division is 888-209-8124.

A list of questions. The main phone number for the New York Department of Labor. Be prepared for long wait times because lots of people are trying to do the same thing that you are.

However if you use TTYTDD call a relay operator first at 1-800- 662-1220 and ask the operator to call the Telephone Claims Center at 1-888-783-1370. The best phone number for New York Department of Labor - Unemployment is their 888-209-8124 customer service phone number and you can get the details and use our free call-back service. Live customer service representatives from NY Unemployment are available from 8am to 5pm EST Monday-Friday.

How do I get a live person for unemployment. Here are the best contact numbers and tips to get in touch a live agent at the NY DOL. Box 15131 Albany NY 12212-5131 or.

If you prefer to speak to an advocate please call 855 528-5618. Live customer service representatives from NY Unemployment are available from 8am to 5pm EST Monday-Friday. Simply dial the nys unemployment phone number to talk to a person and submit an application that way.

New York Unemployment Phone Number. If you live outside of NYS call toll-free at 1-877-358-5306. Not only jobs but coveted jobs with huge overvalued pensions and full benefits.

1001 11th Street Niagara Falls NY 14301. Claims Center at 1-888-783-1370. N Y Unemployment customer service phone number is 1-888-209-8124.

More than 56000 people filed new unemployment claims in New York state in the last week of December. You can speak to someone in the New York Unemployment Department by calling the toll free number 1-888-581-5812.