One moment you are living a happy life with two healthy children and the next. Under the Constitution presidential nominations for executive and judicial posts take effect only when confirmed by the Senate and international treaties become effective only when the Senate approves them by a two-thirds vote.

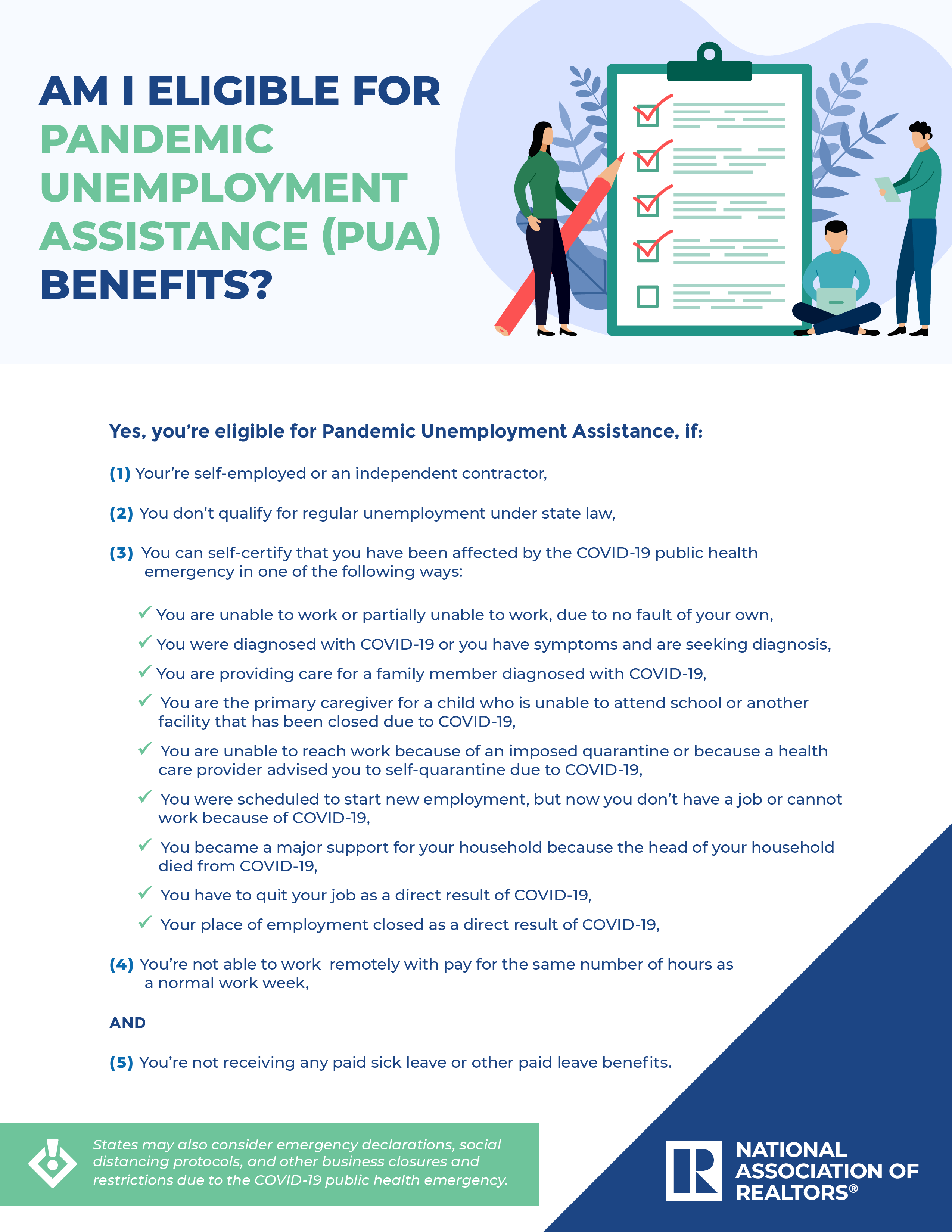

Pandemic Unemployment Assistance Pua Benefits Checklist

Unemployment Temporary Disability and Family Leave Insurance benefits require an application to the New Jersey Department of Labor.

Nj unemployment laws. NJ unemployment law -- make it up as you go along. Applicants must meet the following three eligibility requirements in order to collect unemployment benefits in New Jersey. You cannot receive pay or benefits from more than one programlaw at the same time.

The largest single sector which provides jobs in the state of New Jersey is jobs that are provided by the government. New Jersey employment laws covering wages unemployment in NJ payment of wages and paid leave from employment. A written statement of.

State employer tax laws means the workers compensation law RS3415-1 et seq the unemployment compensation law RS4321-1 et seq the Temporary Disability Benefits Law PL1948 c110 C4321-25 et al PL2008 c17 C4321-391 et al and the New Jersey Gross Income Tax Act NJS54A1-1 et seq. I am April Sirleaf the mother of Andrew Sirleaf. Federal benefits created during the benefit expired September 4 2021.

An incredible 4-year-old boy that was diagnosed with Acute Lymphoblastic Leukemia. STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT NEW JERSEY UNEMPLOYMENT COMPENSATION LAW EXTENDED BENEFITS LAW WORKFORCE DEVELOPMENT PARTNERSHIP ACT SUPPLEMENTARY LEGISLATION JAMES E. Your past earnings must meet certain minimum thresholds.

Employers must post a notice informing employees of reporting and recordkeeping requirements of eight New Jersey statutes. Employees who are discharge for cause are not typically entitled to unemployment benefits. New Jersey does not require employers to provide breaks including lunch breaks for workers eighteen 18 years old or older.

Employers pay NJ Earned Sick Leave and may pay federal sickchildcare leave. An NJ unemployment claim is an attempt to begin to collect New Jersey unemployment insurance for an individual who has not already been collecting unemployment. Unemployment Hearings and Appeals in NJ.

Unemployment Insurance Benefits are payable to workers who lose their jobs or who are working less than full time because of a lack of full-time work and who meet the eligibility requirements of the law. You must be unemployed through no fault of. We need to know why youre out of work and whether your recent earnings meet the minimum required by law.

People who are claiming unemployment insurance benefits are sometimes referred to as claimants You. NJ Statute 342-2117dg4. An unemployment hearing occurs when an employer contests a former employees right to unemployment benefits.

Of the eligibility requirements of New Jersey Unemployment Compensation Law. The New Jersey State Wage and Hour Law authorizes the employment of individuals with disabilities by charitable organizations or institutions at a rate less than the minimum wage and requires the issuing of special permits detailing the duration type of work performed and the payment of commensurate wages. In New Jersey the Department of Labor and Workforce Development handles unemployment benefits and determines eligibility on a case-by-case basis.

Terms Used In New Jersey Statutes Title 43 Chapter 21 - Unemployment Compensation Law. In New Jersey you can earn up to 804 per week in unemployment benefits under state law. Additionally employers must provide all employees hired before November.

I applied for unemployment benefits and was scheduled for a claims examiner interview. A new New Jersey law prohibits employers in the state from publishing job advertisements in print or on the Internet that exclude unemployed individuals from applying. Each state has different rules for filing appeals.

The New Jersey Unemployment Compensation Law acts as a safety net by providing income for workers who have through no fault of their own lost their job. Although additional money 300 extra per week was available under the temporary Pandemic Unemployment Compensation program that program expired on September 6 2021 or earlier in states that cut off these benefits before the program ended. Claimants who exhaust extended benefits will have received up to 88 weeks of unemployment a maximum of 26 weeks of regular state.

MCGREEVEY Governor KEVIN P. Both the employer and employee have the right to appeal any decision regarding unemployment benefits. You will still be able to receive benefits for eligible weeks prior to September 4 2021.

Review the law here. Bureau of Program Services and. December 9 2021.

I was terminated from my job in late December -- unlawfully I might add cost savings by the company -- but thats a topic for another day. MCCABE Commissioner Prepared by. New Jersey 02-15-2009 1208 PM.

Read our FAQs on paid leave job protection and caregiving. Eligibility Requirements for New Jersey Unemployment Benefits. Federal extended unemployment benefits expired September 4 2021.

Generally unemployment laws provide wage replacement payments to employees who have lost their job through no fault of their own. Those who meet the requirements may receive unemployment insurance benefits for up to 26 weeks during a 1-year period. New Jersey labor laws require employers to provide employees under the age of eighteen 18 with a thirty 30 minute break after five 5 consecutive hours of work.

When you first apply for Unemployment Insurance benefits we look at a few different factors to see if you qualify. Your employer is subject to the New Jersey Unemployment Compensation and Temporary Disability Benefits Laws. This makes New Jersey the first state to enact an explicit prohibition against such.

I am writing in hope to change the unemployment laws in NJ that turn their back on families faced with medical emergencies like my family is going through. Unemployment Insurance aka Employment Security is generally established by state-specific laws. TRENTON Approximately 80000 New Jersey workers receiving extended unemployment Insurance UI are due to exhaust these state benefits in coming weeks as they reach the 13-week maximum.

In order to be eligible for NJ unemployment benefits online through the website operated by the New Jersey Department of Labor and Workforce Development the applicant must have worked exclusively within the state of New Jersey must not have worked for the federal government must not have served in the military or worked as a maritime employee at.