Unemployment Insurance claimants who have multiple state accounts can now combine them for easier access to state services. The Michigan Web Account Manager MiWAM is the Talent Investment Agencys TIA online system for managing your unemployment account electronically.

Www Michigan Gov Uia Miwam Account Login Money Blogging Make Money Blogging Money Saving Plan

Click on MiWAM for Workers to begin your claim.

Michigan unemployment login miwam. Related Content Unemployment agency sees spike in fraud efforts over the holidays Gov. Whitmer solidifies anti-fraud measures to protect unemployed workers. MiWAM for Claimants Guide-In the state of Michigan Unemployment Insurance or UI is a program that provides its claimants temporary income if they have lost their jobs due to layoffs or plant closuresThe UI program is funded by the unemployment taxes paid by employers and is not deducted from the claimants paychecks.

The Michigan Web Account Manager MiWAM The Michigan Web Account Manager MiWAM is the UIs system for filing and claim and managing your own UI account onlineMiWAM makes doing business with the UI simpler faster and more efficient. Check your claim balance and benefit payment history. Filing online is easy convenient and is available 24 hours a day.

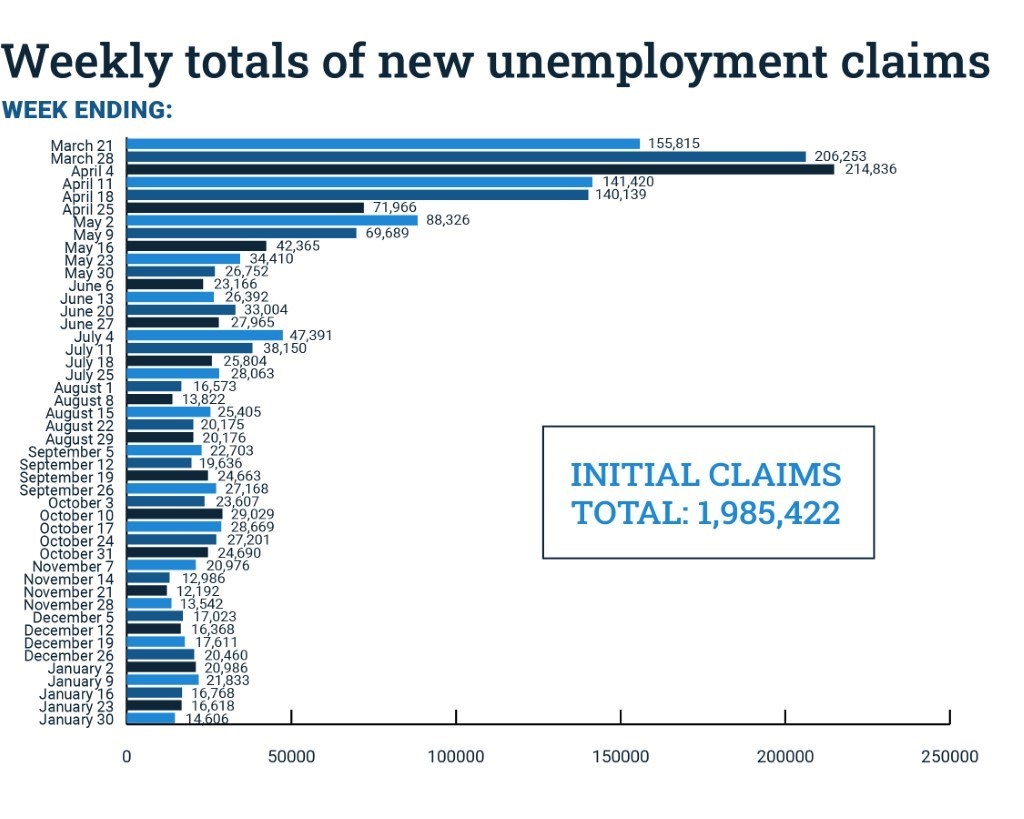

Michigan has been severely struck financially in the last year due to the Covid crisis leading to the fall of many businesses and the Michigan state has been facing unemployment issues. To log back in please click on the links - Pure Michigan Talent Connect or UIA - Michigan Web Account Manager MiWAM. Dec 20 2021 MiWAM is available 24 hours a day seven days a week.

The MILogin User ID Merge initiative launched Dec. Enter your username and password to log in. New Login Process to Access Your MiWAM Account.

Labor and Economic Opportunity - Employers. Get direct access to miwam employer login by following the official links provided below. You must first sign in to MILogin to access or create a MiWAM account.

Online Registration and Seeking Work Waiver. You must create a MILogin account before you can create or access your MiWAM account. To successfully access your MiWAM account you need to have a MILogin.

E-Registration is Unemployment Insurances system for registering for unemployment insurance tax electronically. MDOS eServices CARS MDHHS MI Bridges MDHHS myHealthButton MiPage Michigan Web. MILogin is the state of Michigan Identity Management solution that allows users the ability to access many state services and systems online across multiple departments using a single user ID and password.

Welcome to MILogin which provides you the convenience of using only one set of login credentials to access multiple state of Michigan online services. You have been successfully logged out of all Labor and Economic Opportunity applications. The Michigan Web Account Manager MiWAM is the UIAs updated and enhanced method for online managing your unemployment account by imparting some unemployment benefits for you.

With MiWAM you can. Unfortunately the situation is coming under grasp slowly due to the governments policies that constantly provide unemployment benefits. The Unemployment Insurance Agency UIA has made it faster and easier for employers to request a Registration and Seeking Work Waiver for short term lay off periods.

When you successfully log in the login screen appears. The Employer Web Account Manager EWAM is replaced by MiWAM and simplifies speeds up and improves the efficiency with which you do business with the UIA. MiWAM Login- To help you connect your unemployment account to your Michigan Web Account Manager MiWAM or your jobseeker account to Pure Michigan Talent Connect PMTC The Department of Labour and Economic Opportunity has brought you a new single MILogin account.

MiWAM makes doing business with the agency simpler faster and more efficient. View the MiWAM Toolkit for Claimants for step by step instructions on how create your account. MiWAM allows you to perform routine transactions such as filing claims certifying for benefits viewing.

By performing a User ID Merge claimants will have to remember only one username and password to access services such as Pure Michigan Talent Connect MI Bridges. With MiWAM you can apply for benefits certify for benefits send a message update your account information and more. MILogin is a new single sign on system that connects your unemployment account through the Michigan Web Account Manager MiWAM and your jobseeker account through Pure Michigan Talent Connect PMTC.

The Employer Web Account Manager EWAM is replaced by MiWAM and simplifies speeds up and improves the efficiency with which you do business with the UIA. The fastest and preferred method is to file for unemployment insurance benefits online using the Michigan Web Account Manager MiWAM at michigangovuia. Please do not create a new MILogin account if you already have one to access the following online services.

Due to increased call volumes for faster service file your unemployment claim online through the Michigan Web Account Manager MiWAM. New Login Process to Access Your MiWAM Account MILogin is a new single sign on system that connects your unemployment account through the Michigan Web Account Manager MiWAM and your jobseeker account through Pure Michigan Talent Connect PMTC. Take the following steps.

Beginning December 7th 2020 a valid email address will be required to sign up for a new user id. Claimants may login or sign up for an online account at MichigangovUIA. Labor and Economic Opportunity - The Michigan Web Account Manager MiWAM is the UIAs online system for filing your unemployment insurance claim and managing your unemployment account electronically.

145 gsm fabric solid color t-shirts are 100 cotton heather grey t-shirts are 90. The Michigan Web Account Manager MiWAM is the UIAs updated and enhanced method for online managing your unemployment account by imparting some unemployment benefits for you. Just your everyday smooth comfy tee a wardrobe stapleSlim fit so size up if you prefer a looser fit or check out the Classic T-ShirtMale model shown is 60 183 cm tall and wearing size LargeFemale model shown is 58 173 cm tall and wearing size SmallMidweight 42 oz.

Update your personal information. MiWAM is available 24 hours a day 7. Navigate to the miwam employer login page using the official link provided below.